Outstanding crypto asset supervisor CoinShares has launched a current report detailing the weekly motion of funds by funding merchandise associated to crypto, comparable to Bitcoin (BTC).

Particularly, the report revealed important inflows of $1.115 billion into digital asset funding merchandise up to now week. It famous that the determine has contributed to year-to-date inflows amounting to $2.7 billion.

Per the disclosure, this surge in inflows, mixed with current worth will increase, has propelled whole belongings underneath administration (AuM) to their highest stage since early 2022, reaching $59 billion.

U.S. ETFs Lead

Moreover, the report highlighted that regionally, consideration remained on the lately authorized spot-based Bitcoin exchange-traded funds (ETFs) in the USA.

It prompt that U.S. Bitcoin spot ETFs skilled a internet influx of $1.1 billion final week, totaling inflows of $2.8 billion because the January 11 approvals.

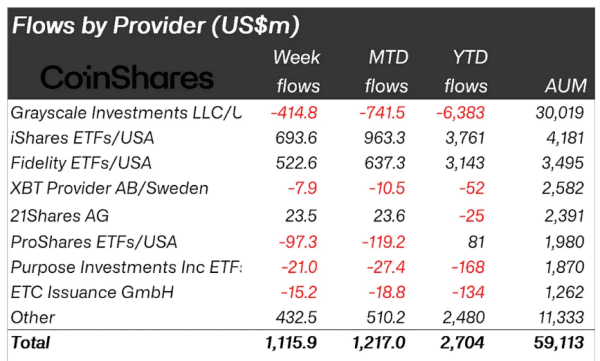

Among the many U.S.-listed ETFs main this cost are BlackRock’s iShares with 693.6 million optimistic stream and Constancy ETFs with $522.6 million. Others, comparable to Grayscale and ProShares, witnessed detrimental flows.

In the meantime, CoinShares prompt that outflows from established entities have diminished notably in comparison with earlier weeks.

– Commercial –

But, it famous that the doubtless sale of the Genesis holdings, amounting to $1.6 billion, may set off further outflows within the forthcoming months.

Moreover, CoinShares revealed that outflows from different non-U.S. funds have equally subsided. Nonetheless, minor outflows from Canada and Germany have been noticed. This amounted to $17 million and $10 million, respectively.

Conversely, Switzerland skilled notable inflows of $35 million final week, with Australia and Brazil registering $800k and $100k respectively. Total, the week-over-week influx to crypto-based funds was at a optimistic $1.116 billion.

Bitcoin Leads Influx Pattern

Moreover, the report highlighted that Bitcoin captured almost 98% of the inflows with $1.089 billion.

In the meantime, Bitcoin’s worth surge bolstered sentiment for Ethereum and Cardano, which witnessed inflows of $16 million and $6 million, respectively.

CoinShares noticed minor inflows to Avalanche (AVAX), Polygon (MATIC), and Tron (TRX). These belongings collectively recorded about $1.3 million.

Observe Us on Twitter and Fb.

Disclaimer: This content material is informational and shouldn’t be thought of monetary recommendation. The views expressed on this article could embrace the writer’s private opinions and don’t mirror The Crypto Fundamental’s opinion. Readers are inspired to do thorough analysis earlier than making any funding selections. The Crypto Fundamental isn’t accountable for any monetary losses.

-Commercial-