Bitcoin (BTC) whales accumulate extra of the asset as spot buying and selling dominance sees a latest large surge.

Whereas some traders see Bitcoin’s present underperformance as a purpose to be cautious, others imagine the asset’s present value actions are a possibility to amass extra tokens, as they reckon it’s at present undervalued. Whales, whose actions are main determinants of an asset’s value actions, seem to have proven extra curiosity in Bitcoin

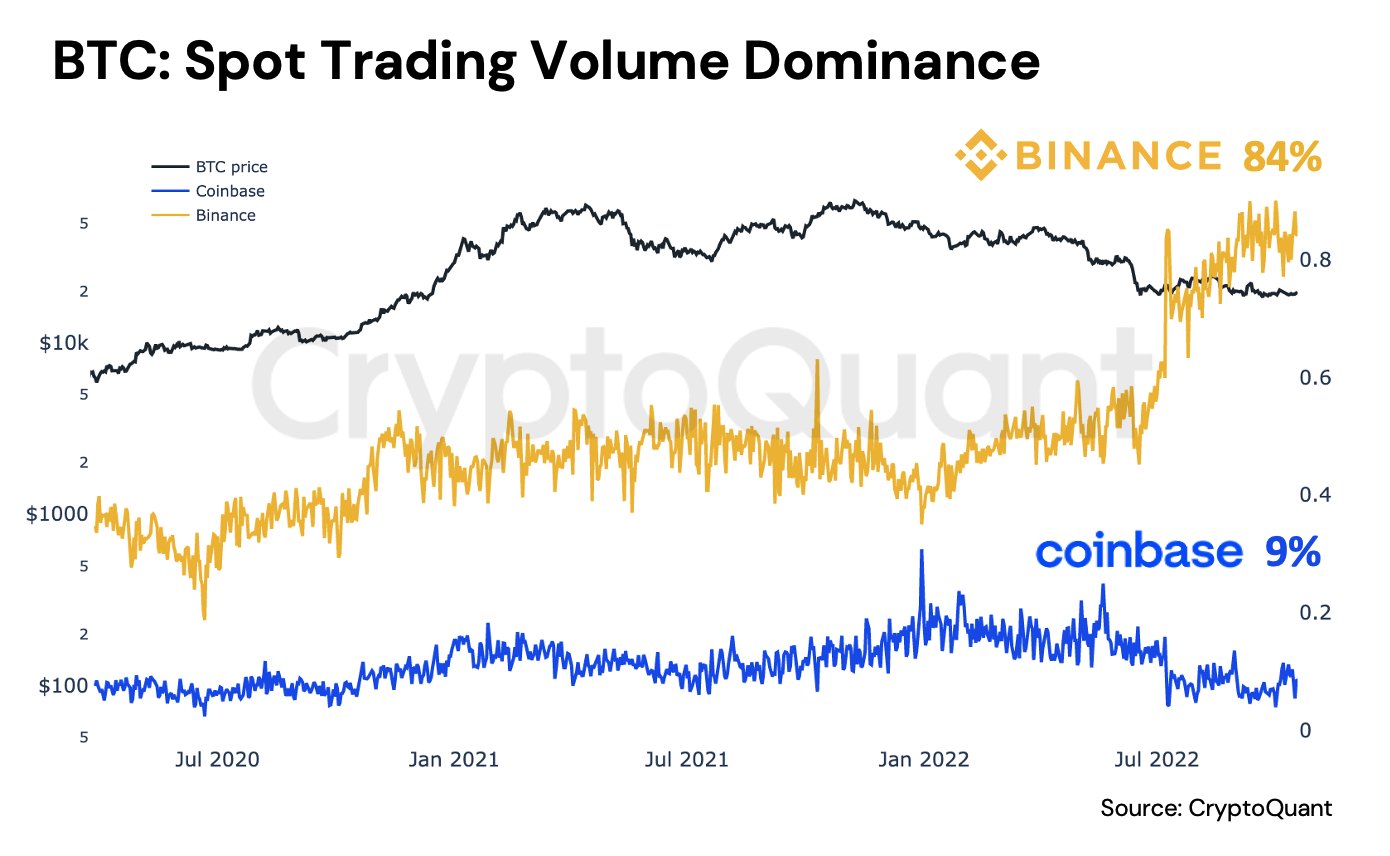

Following Bitcoin’s journey to the $20k zone, Bitcoin’s spot buying and selling quantity on the world’s largest alternate, Binance, noticed an enormous dominance, as revealed by CryptoQuant’s CEO Ki Younger Ju in a latest evaluation.

Because the asset plummeted to the $20k degree in July, spot buying and selling instantly noticed a surge in response, hitting a dominance fee of 84% on Binance – ranges that hadn’t been witnessed for over two years. Moreover, BTC spot buying and selling on America’s largest alternate, Coinbase, skyrocketed, hitting a dominance fee of 9% as of press time.

“Since Bitcoin value hit the $20k degree, Binance spot buying and selling quantity dominance skyrocketed, and it’s now 84%. The second greatest is Coinbase, 9%,” Ki highlighted in a tweet, as he shared a chart to corroborate his evaluation.

Ki admitted that he’s unsure of the traders behind this large surge. Nonetheless, he restricted his choices to establishments using prime brokers and enormous crypto traders seeking to leverage Bitcoin’s undervalued value situation.

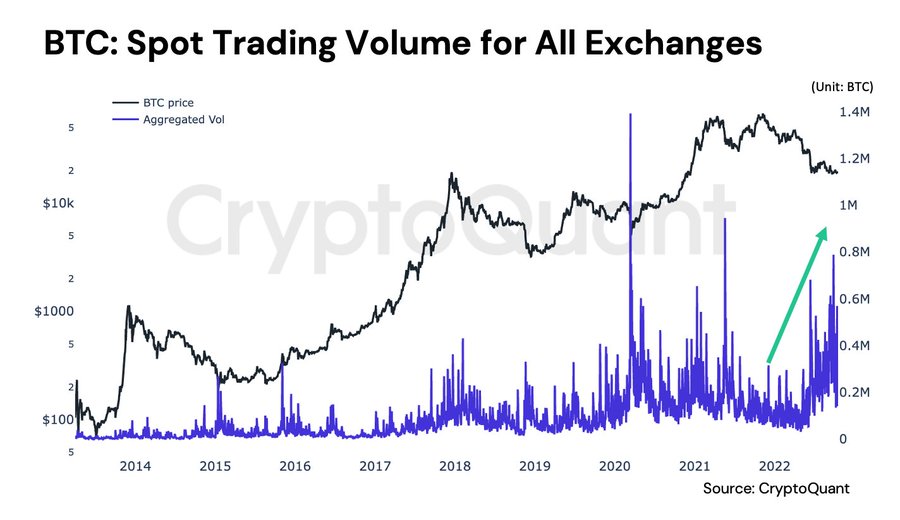

Moreover, Ki identified that BTC alternate volumes on spot buying and selling have elevated by over 2,000% up to now six months, as they see a 20x rise.

“BTC spot buying and selling quantity for all exchanges elevated 20x over the previous six months. The amount renewed a year-high final month, however not a lot change within the each day closed value, indicating somebody(s) is shopping for all of the sell-side liquidity,” Ki famous in a separate tweet.

This improve in spot buying and selling quantity might both have been contributed by a rising pattern of whale accumulation, or it may very well be the results of wash buying and selling on account of Binance’s recently-introduced zero-fee buying and selling coverage. Ki admitted that both or each of the talked about may very well be the case, however he highlights that Binance, the world’s prime alternate, doesn’t want any type of wash buying and selling to spice up its buying and selling quantity stats.

A pattern that factors to whale accumulation is the latest motion of enormous bulks of BTC tokens which were witnessed of late. The Crypto Fundamental just lately reported the motion of about 48,000 BTC tokens from Coinbase Professional.

Moreover, Ki Younger Ju identified that Bitcoin has reached the zone at which it tends to draw a lot curiosity from institutional traders.

– Commercial –