The unsustainable monetary system in Lebanon has introduced some Lebanese to crypto. Locals are mining Bitcoin or storing wealth with cryptocurrency and finishing some funds with Tether.

Dire Financial Scenario in Lebanon

In 2019, Lebanon fell right into a monetary disaster after years of pricey wars and poor spending choices. A CNBC floor report outlined the problem and seems to have spurred Michael Syalor, CEO of MicroStrategy to comment on the problem.

A World Financial institution report launched on June 1, 2021, warned that Lebanon would undergo one in every of most extreme financial crises because the mid-Nineteenth century except its “bankrupt financial system benefited just a few for thus lengthy” was reformed.

Consequently, in August 2021, the Lebanon Central Financial institution ended gas subsidies, saying that it could supply credit score strains for gas imports based mostly on market costs for the Lebanese pound. After that, gas costs soared, inflicting an financial disaster within the nation.

Moreover, a number of depositors have been locked out of their financial institution accounts in a single day in September 2022, stopping them from accessing their financial savings. In response, a few of them stormed a number of branches, holding workers hostage and forcing them to withdraw their financial savings.

Digital property option to go

A number of Lebanese locals think about cryptocurrencies a “lifeline for survival,” in line with CNBC.

Supporting the latest development, Microstrategy’s CEO, Michael Saylor, famous that “Bitcoin is hope for Lebanon.”

#Bitcoin is hope for #Lebanon, the place the foreign money has misplaced 96% of its worth vs USD and the banks have failed.https://t.co/DkKrC4zgGY

— Michael Saylor⚡️ (@saylor) November 5, 2022

Let’s take a look at how folks have included digital property into their life:

Alternatives in crypto mining

Mining cryptocurrency requires costly tools, some technical experience, and numerous electrical energy. At scale, miners are compelled emigrate to the world’s most cost-effective energy sources since they compete in a low-margin trade. Southern Lebanon affords low-cost electrical energy enabling miners to earn more money.

Locals like Abu Daher and Salah Al Zaatare, purchased mining tools at hearth sale costs from Chinese language miners and constructed their farms. Moreover, they hosted rigs for folks throughout Lebanon who lacked the technical experience and entry to electrical energy, an important useful resource in a rustic affected by energy outages.

Nonetheless, the native authorities inspected them intently. In January final 12 months, police raided and dismantled a crypto mining farm in Jezzine, a hydro-powered city. Within the eyes of the authorities, “energy-intensive crypto mining” was depleting the nation’s assets and draining electrical energy.

Funds with cryptocurrency

In response to studies, some individuals are incomes cash utilizing digital property like Bitcoin and are buying and selling the cryptocurrency tether for U.S. {dollars} by Telegram teams. Abu Daher, an area informed CNBC,

“We began by promoting and shopping for USDT as a result of the quantity of demand on USDT may be very excessive.”

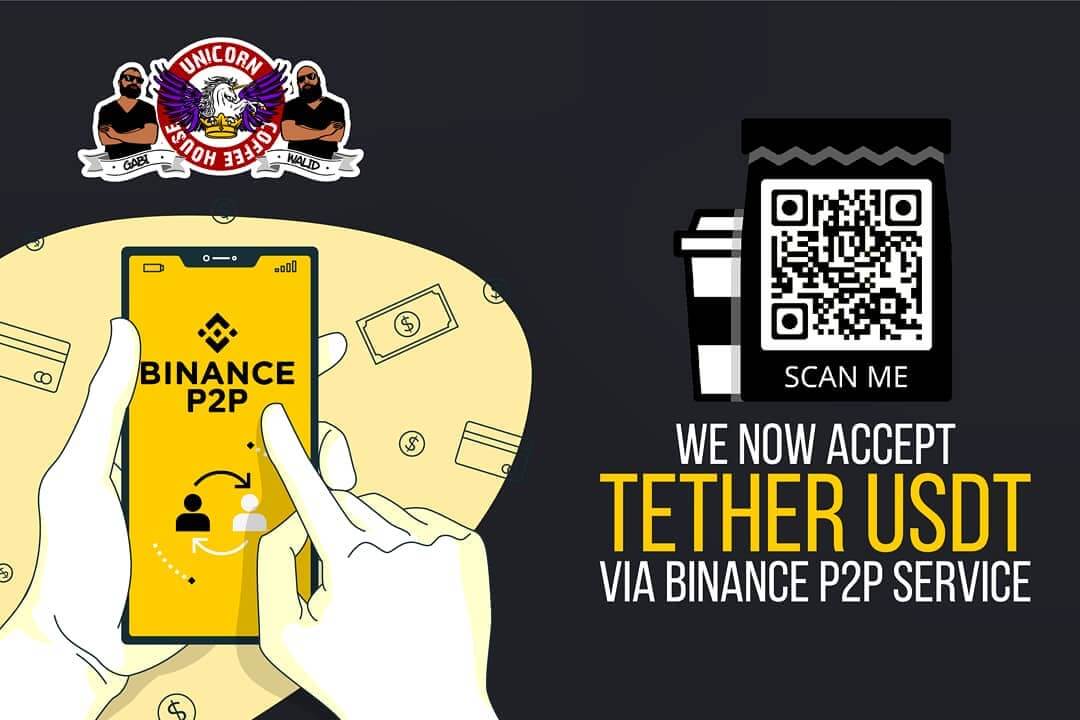

Regardless of Lebanese regulation prohibiting crypto funds, companies are actively promoting on Instagram and different social media platforms that they settle for crypto.

Reportedly, some motels and tourism businesses additionally began accepting Tether.

Storing funds as Bitcoin:

Individuals throughout the nation are afraid of placing their cash in banks or conserving it in money at residence due to the danger of theft, in line with CNBC.

Among the many Center East and North African nations, Lebanon ranks second solely to Turkey by way of the quantity of cryptocurrency obtained, in line with new blockchain knowledge from Chainalysis.