Choices are monetary derivatives wherein two events contractually conform to transact an asset at a acknowledged worth earlier than a future date.

Glassnode knowledge analyzed by CryptoSlate suggests choices merchants expect Bitcoin and Ethereum to maneuver greater in This fall.

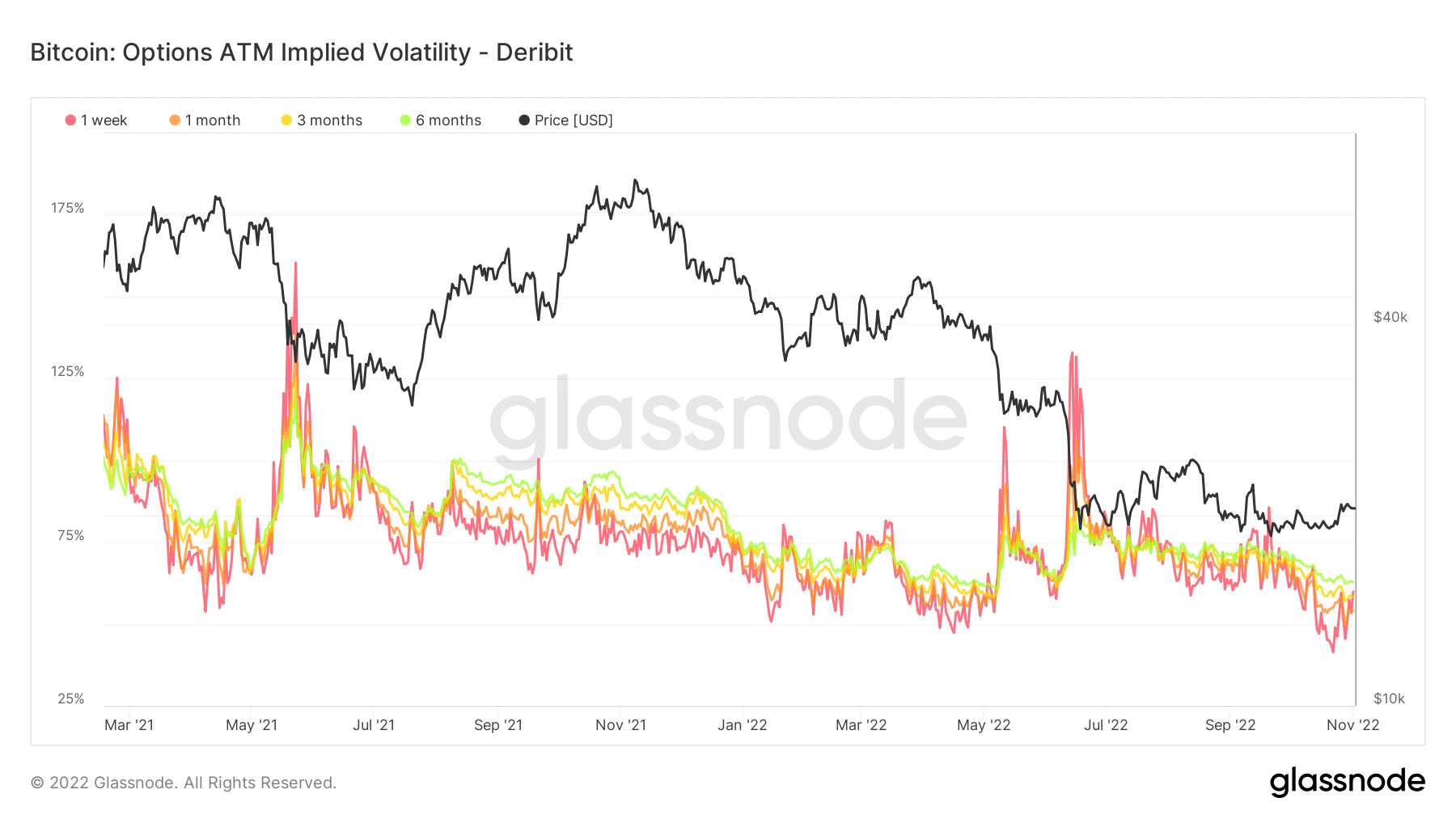

Bitcoin Implied Volatility

Implied Volatility (IV) is a metric that gauges market sentiment towards the chance of modifications in a selected asset’s worth – usually used to cost choices contracts. IV normally will increase throughout market downturns and reduces underneath bullish market circumstances.

It may be thought of a proxy of market danger and is normally expressed in share phrases and normal deviations over a selected timeframe.

An ordinary deviation (SD) measures how scattered, or distributed knowledge is relative to the imply common. For instance, inside a standard distribution, 68% of information falls inside one normal deviation of the imply, 95% inside two SDs, and 97.7% inside three SDs.

IV follows anticipated worth actions inside one SD over a 12 months. The metric is additional supplemented by delineating IV for choices contracts expiring in 1 week, 1 month, 3 months, and 6 months from the current.

The chart under reveals that Bitcoin IV has since fallen from summer season highs to stabilize and turn into much less risky within the 12 months’s second half. Primarily based on previous cases of falling IV, this can be a precursor to bullish circumstances brewing in This fall.

Open Curiosity

Open Curiosity (OI) refers back to the whole variety of excellent derivatives contracts, on this case, choices, which have but to be settled.

Places are the proper to promote a contract at a selected worth by an expiration date. As compared, calls are the proper to purchase a contract at a selected worth by an expiration date.

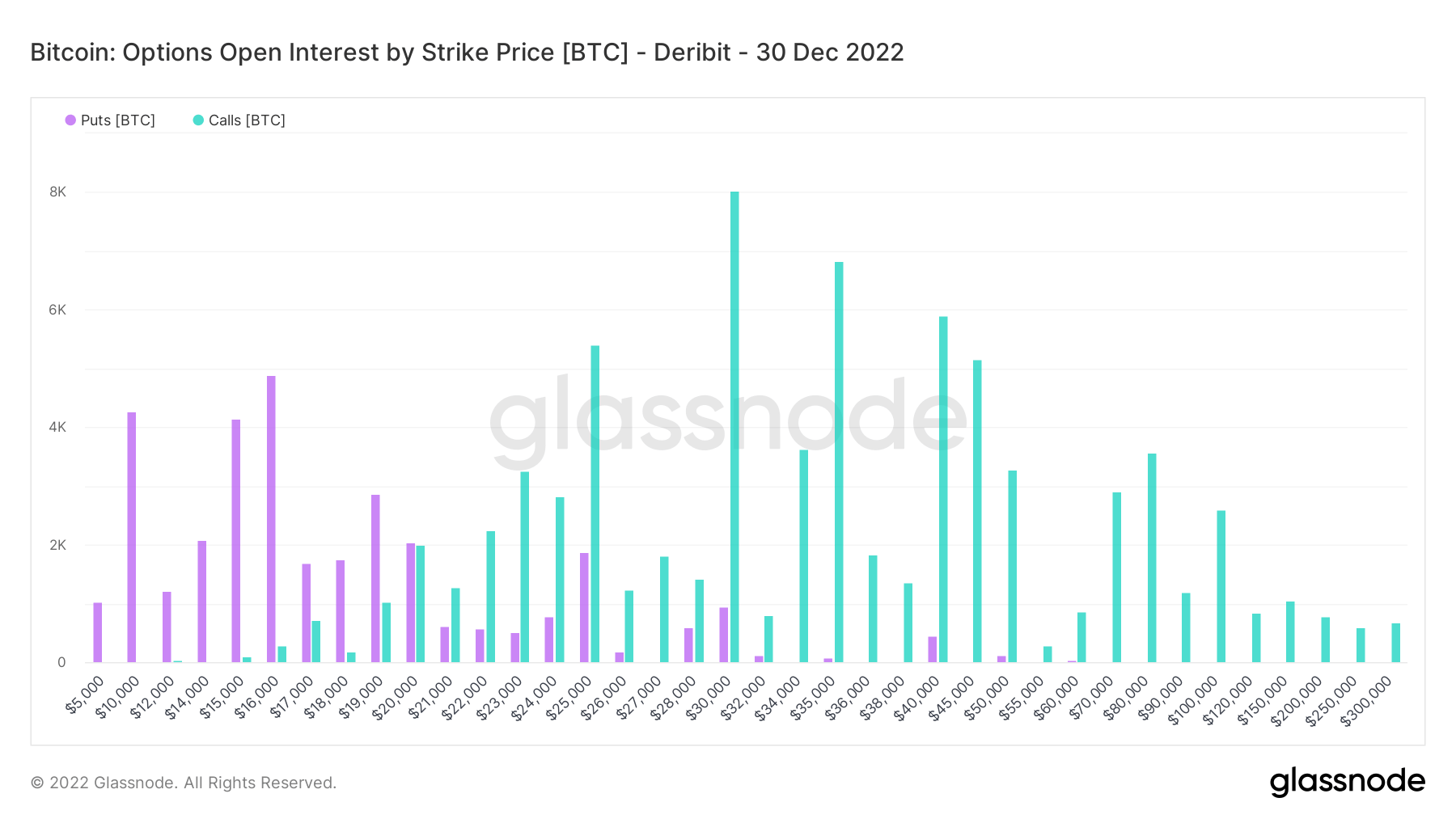

The Bitcoin OI chart under reveals robust places at $10,000, $15,000, and $16,000. Whereas merchants have signaled an amazing quantity of calls, amounting to over $1 billion in worth, for BTC above 30,000.

The ratio of places to calls suggests merchants count on Bitcoin to maneuver greater, with $30,000 being the mode worth goal.

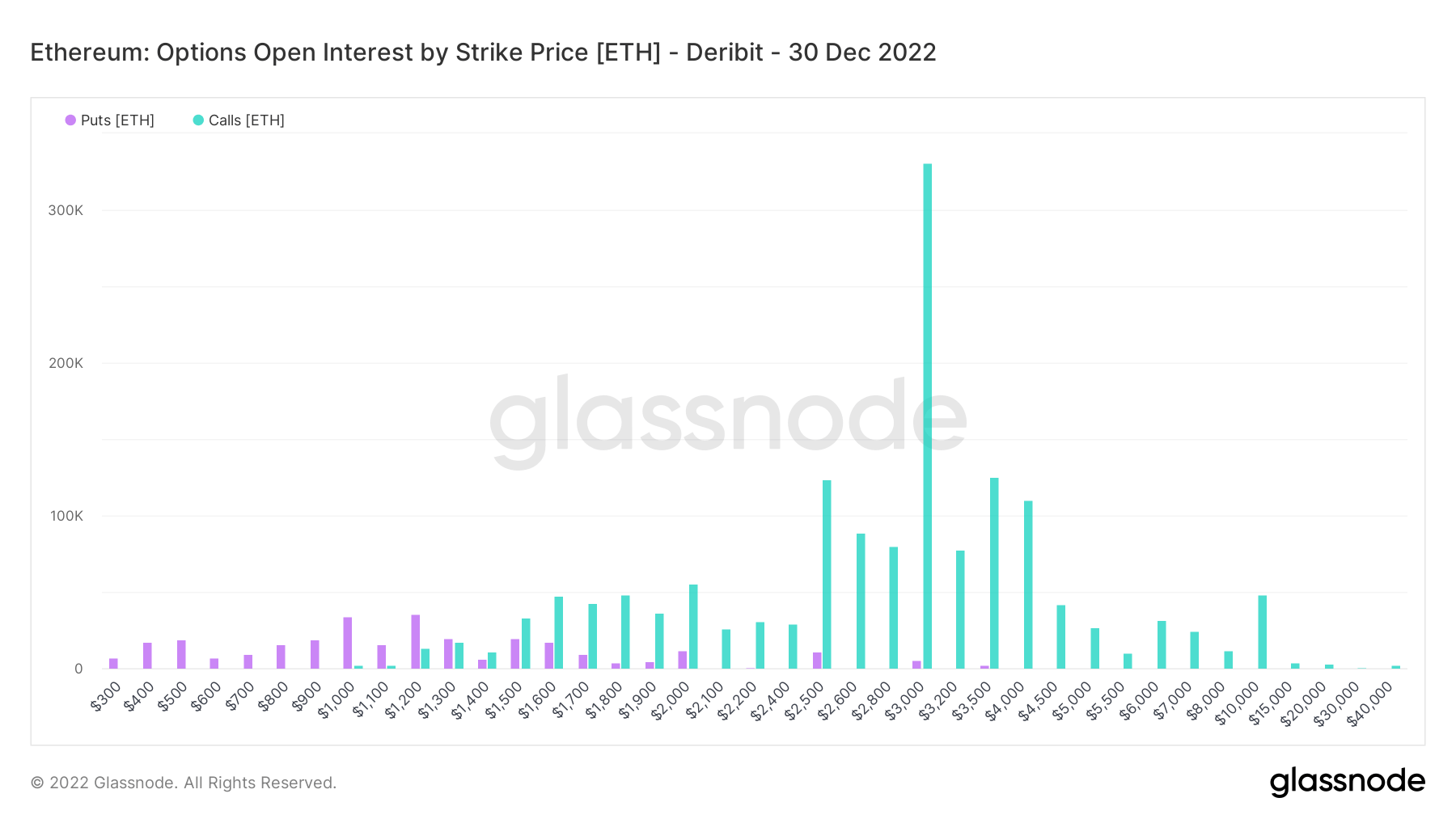

In the meantime, Ethereum OI reveals an analogous sample to Bitcoin as calls dominate. Calls at $3,000 dwarf all different costs, each places and calls.