After the FTX collapse, traders are shifting massive quantities of Bitcoin (BTC) to their self-custody wallets and exiting Ethereum (ETH) to spend money on stablecoins, in line with information analyzed by CryptoSlate.

Bitcoin retreats to self custody

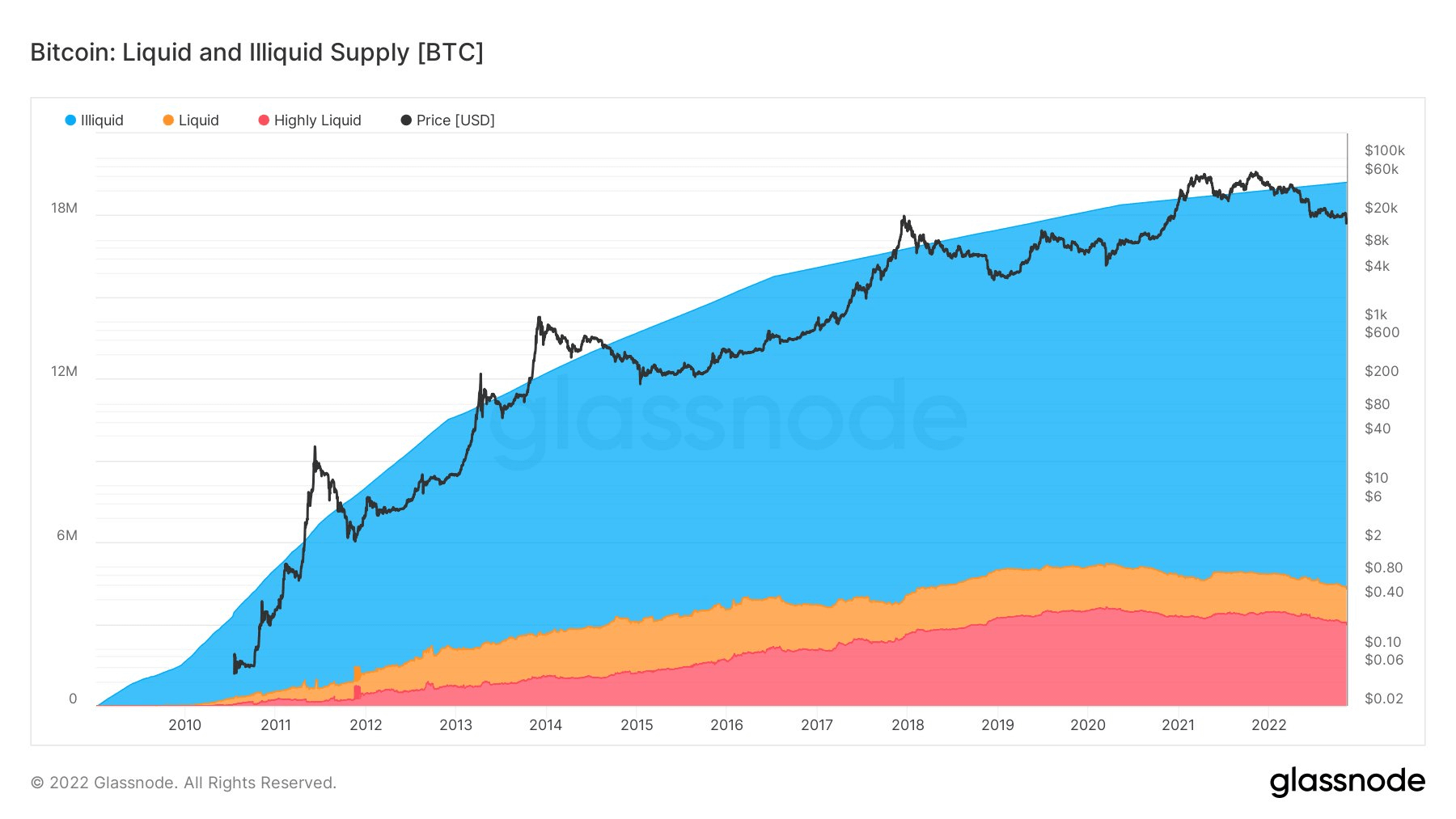

The chart beneath demonstrates the quantity of liquid, illiquid, and extremely liquid Bitcoins since 2008.

As of November 2022, the quantity of Bitcoins held in self-custody wallets virtually reached 15 million. Out of the present circulating provide of 19,204,000, this quantity exhibits that 78% of all Bitcoin is held in self-custody.

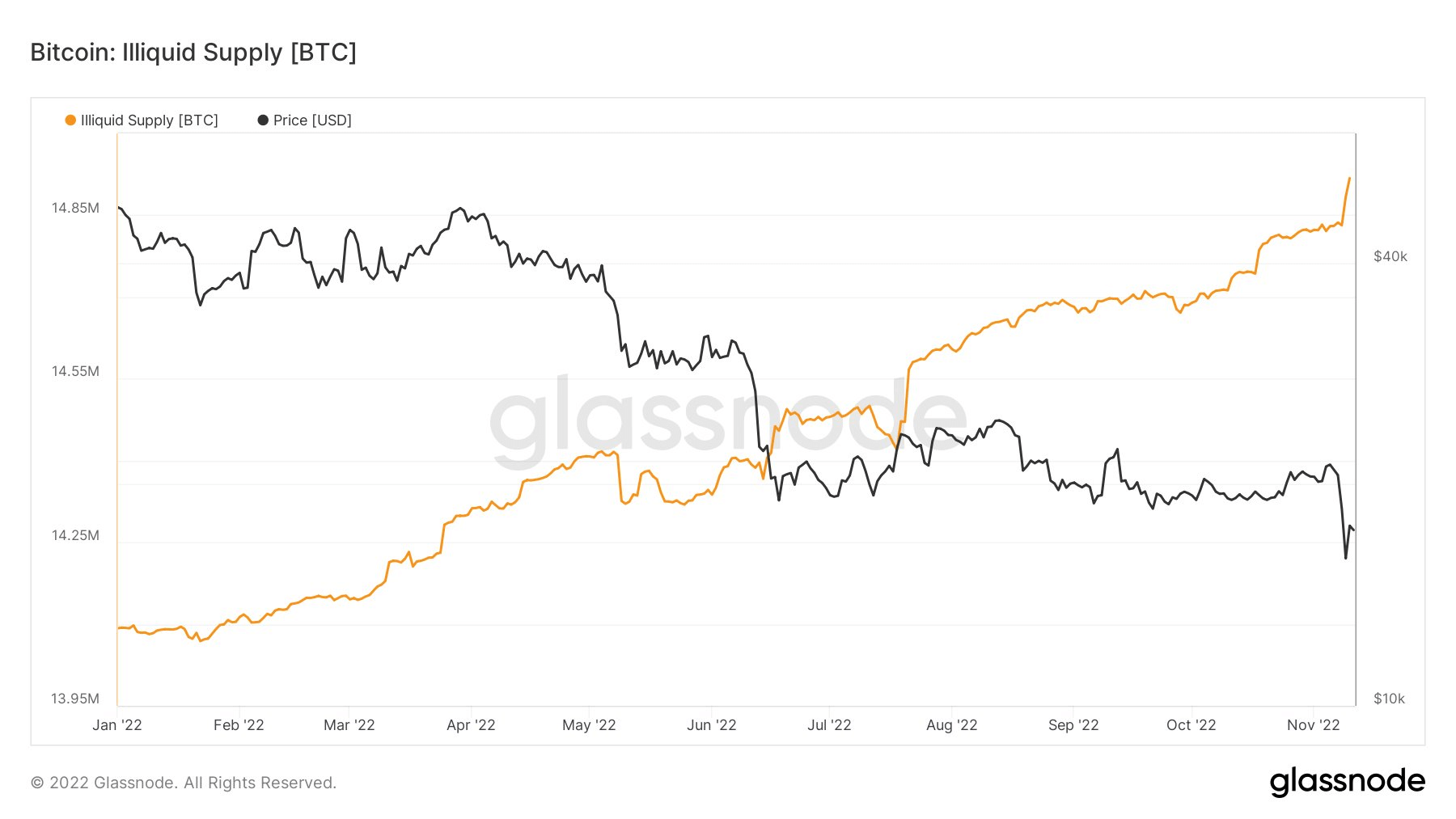

The chart beneath exhibits the illiquid Bitcoin provide in additional element for the reason that starting of the 12 months, and it exhibits {that a} sharp enhance was recorded this week.

This sharp enhance may be the results of the precious classes the group discovered from the latest occasions with regard to FTX’s liquidity disaster. Though FTX just lately dedicated to doing every part it may to supply liquidity, it nonetheless abstained from making any guarantees.

Stablecoins over Ethereum

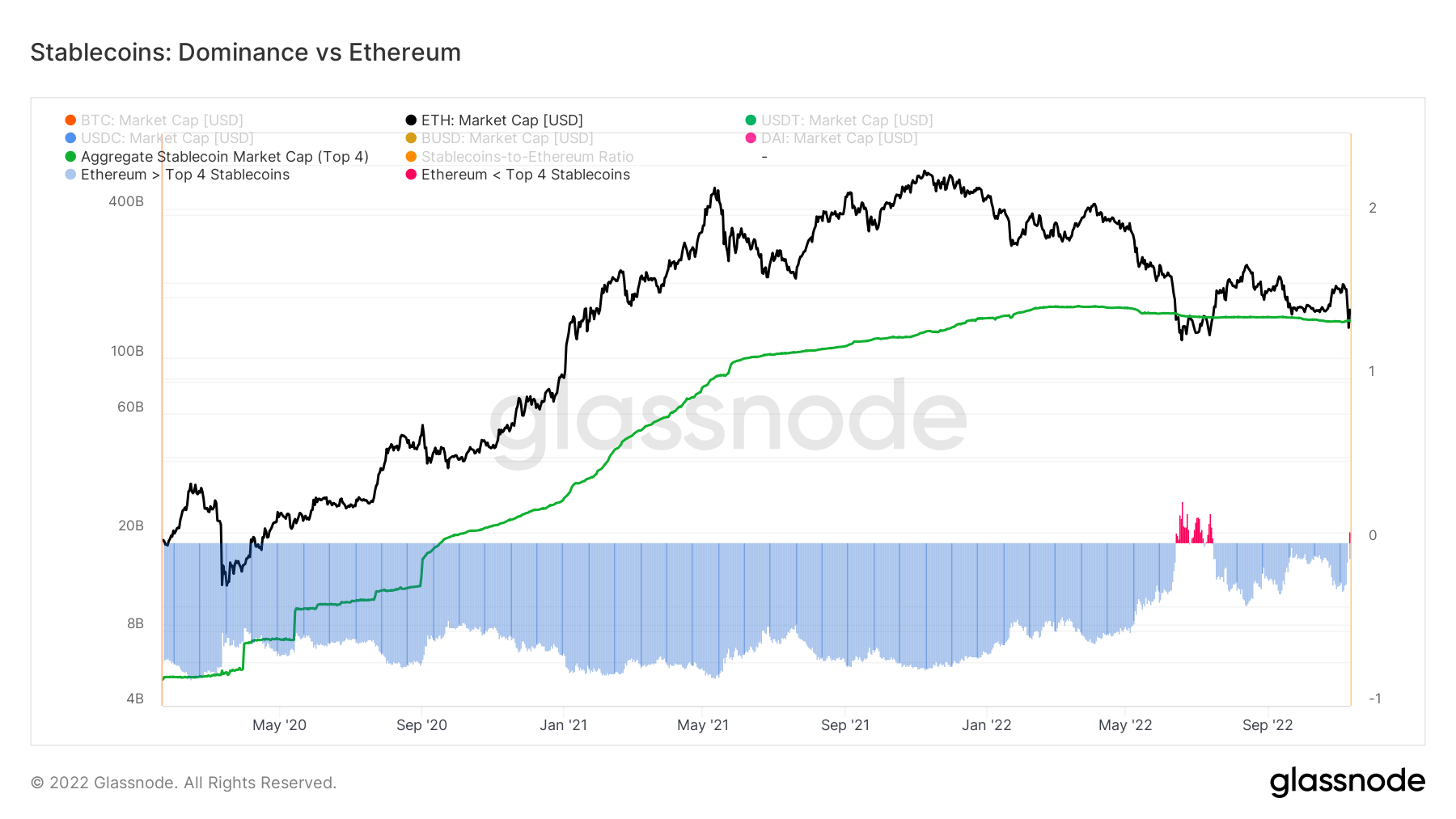

The chart beneath collects the provides of the highest 4 stablecoins – Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI)- which might be on completely different blockchains and compares them with the Ethereum Market Cap.

The info exhibits that stablecoin dominance triumphed over Ethereum dominance as of Nov. 11. This solely occurred as soon as earlier than within the historical past of crypto throughout June 2022, and is a robust indicator displaying that traders are shifting massive funds into stablecoins as Ethereum market cap drops.