Asia’s Bitcoin (BTC) provide reached its all-time excessive (ATH) and at the moment accounts for 7.3% of all Bitcoin provide, whereas the U.S. and E.U. Bitcoin reserves are in destructive year-over-year provide.

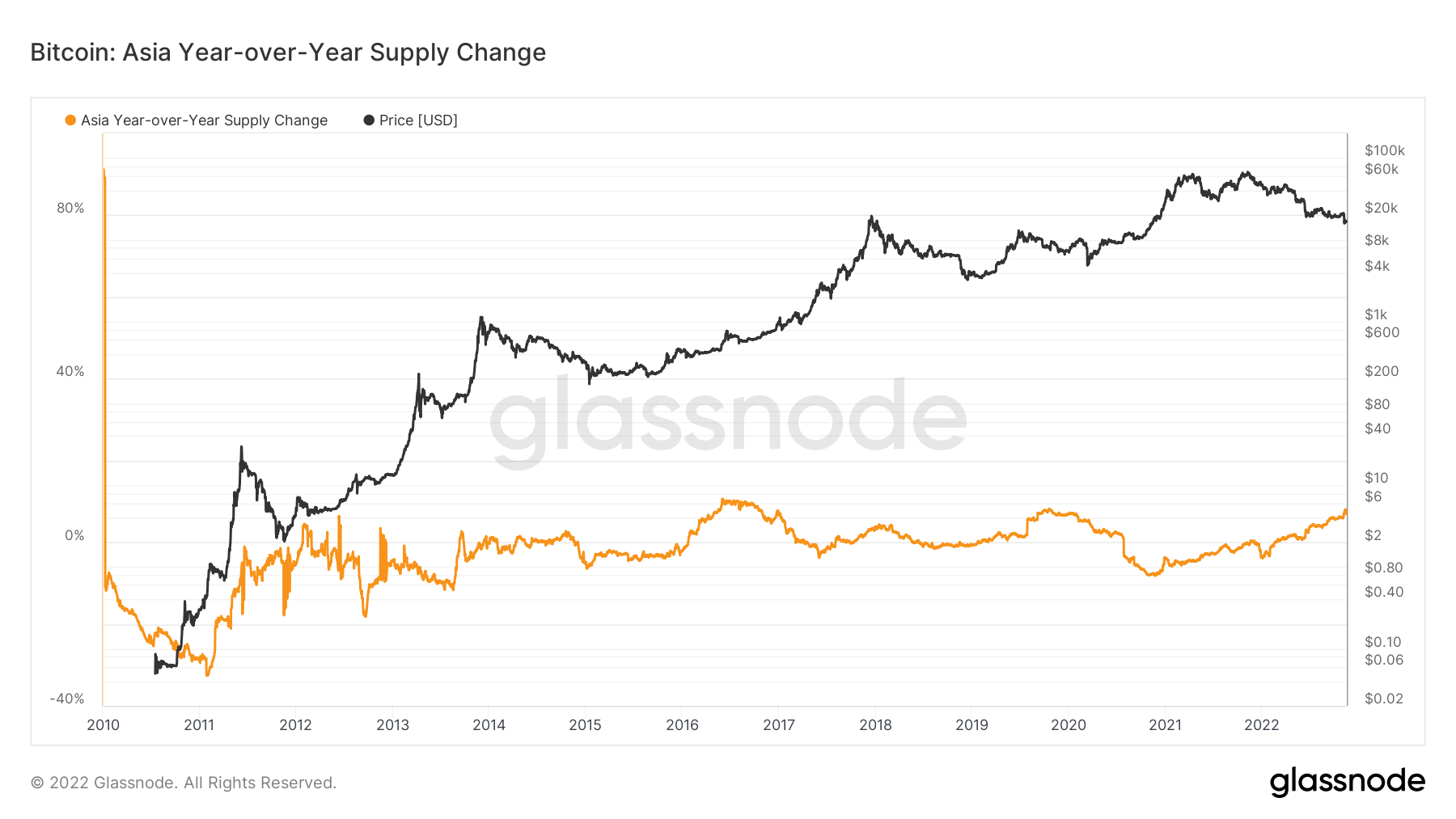

Asia Markets

The chart beneath demonstrates the scale of Asia’s Bitcoin provide since 2010. Aside from transient durations in 2016-2017 and 2020, the area has been scuffling with destructive provide ranges.

Asia’s Bitcoin reserves began to rise above zero firstly of the yr and reached its ATH as of November. The area at the moment holds 7.3% of the full Bitcoin provide, which equates to 1,402,330 Bitcoins.

The U.S. and the E.U.

Whereas Asia has been accumulating, the E.U. and the U.S. saved dropping Bitcoins.

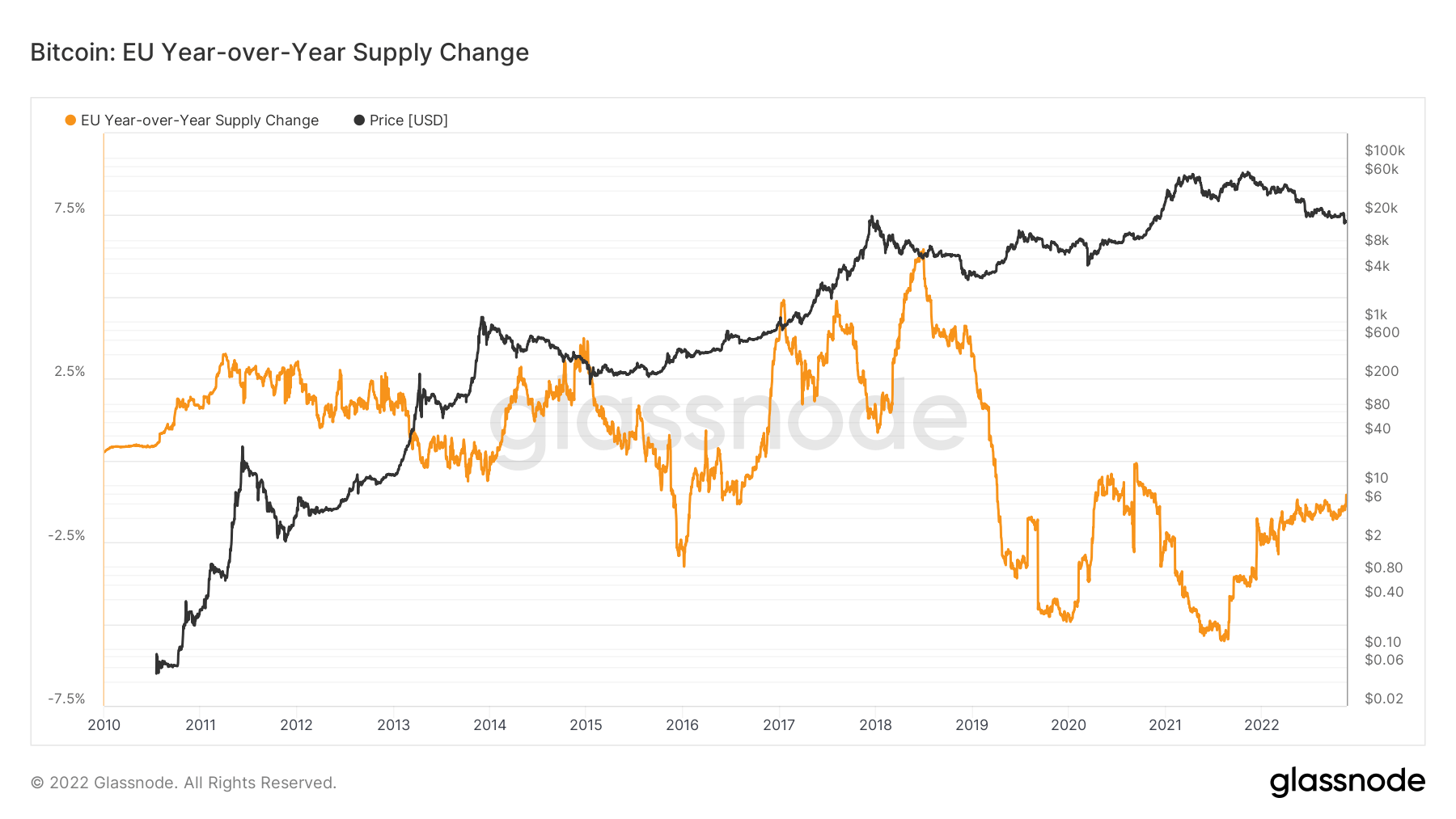

The E.U.

The chart beneath reveals the expansion of E.U.’s Bitcoin reserves because the starting of 2010. Whereas the area additionally struggled with below-zero provide ranges like Asia, it did comparatively higher till late 2019.

The E.U.’s Bitcoin reserves recorded its ATH in late 2018, accounting for almost 6.25% of the full provide. Nevertheless, this proportion fell to destructive 2.5% in mid-2019 and destructive 5% in 2020.

The E.U. reserves recovered to achieve zero in mid-2020 earlier than falling again to destructive 5% by mid-2021. At present, it’s on a restoration trajectory however stays at round destructive 1,25%.

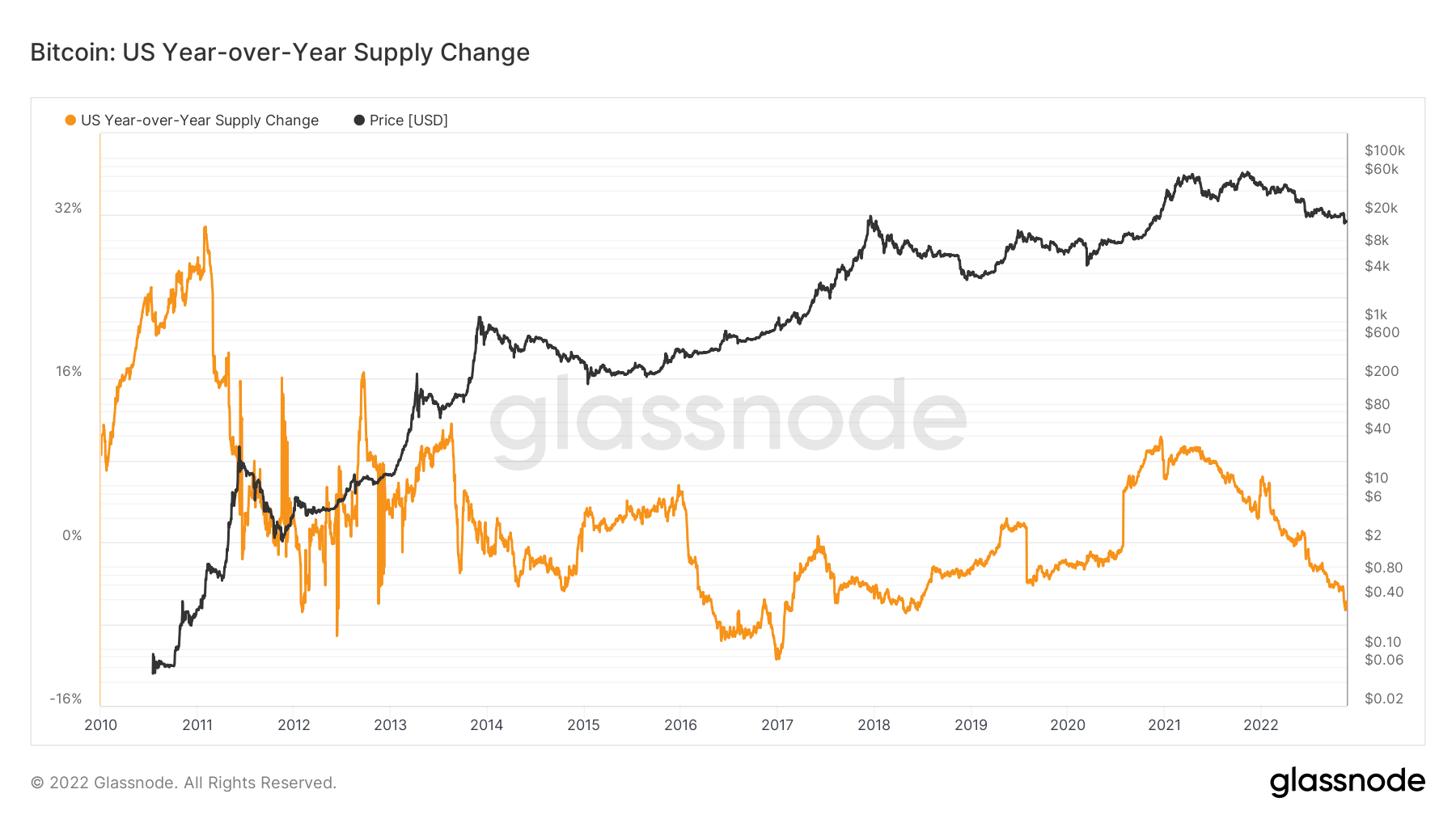

The U.S.

Not like Asia and the E.U., the U.S. recorded a worsening state of affairs with its Bitcoin reserves. As can be seen from the chart beneath, the U.S. Bitcoin reserves have been above zero for essentially the most half between 2010 and 2016.

After it fell beneath zero in early 2016, it struggled to extend to the constructive facet till the top of 2020. Nevertheless, although it recovered above zero in 2021, the U.S. Bitcoin provide has been shrinking.

The U.S. Bitcoin provide ATH was recorded in 2011, accounting for almost 30% of the entire provide. Nevertheless, the U.S. failed to keep up the constructive provide stage it recovered to in 2021 and fell beneath zero in early 2022. At present, the U.S. Bitcoin reserves account for nearly destructive 8% of all Bitcoin provide.

Asia on crypto

Current research turned the eyes on Asia concerning rising crypto adoption within the area. A examine by HSBC and KPMG revealed {that a} quarter of 6472 start-ups working within the area are crypto-related companies. One other report from July 2022 additionally concluded that mass crypto adoption is anticipated in Asia Pacific.

Main nations within the area additionally assist these findings by taking vital steps to extend crypto adoption additional.

Japan has been making selections to additional improve adoption by softening regulatory obligations and tax burdens and composing higher KYC guidelines and Cash Laundering precautions to create a wholesome surroundings for buyers. As well as, the nation has been practising with Central Financial institution Digital Currencies (CBDC) and the Metaverse to push adoption larger.

China, however, might stay averse to crypto, however Hong Kong’s latest initiatives made the group query if China will make the most of Hong Kong to catalyze the crypto market.

In July 2022, Hong Kong Financial Authority mentioned that crypto would probably combine with conventional finance quickly. Hong Kong has additionally been getting ready for that future by experimenting with CBDCs and issuing coverage statements to manage crypto utilization.

Singapore comes ahead as one other crypto-hub of the area. The nation has been crypto-friendly for years and has established a powerful base of crypto firms and lovers. Despite the fact that it determined to tighten its crypto-related guidelines following the collapse of Three Arrows Capital, the nation stays one of many largest crypto hubs on the earth. Much like Japan and Hong Kong, Singapore additionally participates in CBDC and Metaverse tasks whereas enhancing laws to advertise crypto adoption.

Along with these nations, Vietnam, Philippines, India, Pakistan, and Thailand are among the many prime ten nations with the very best crypto adoption, in keeping with Chainalysis‘ most up-to-date adoption report. Moreover, Vietnam and the Philippines emerged because the world’s first and second most crypto-adaptive nations.