The most important information within the cryptoverse for Dec. 9 features a Twitter sparring between Binance CEO Changpeng Zhao and former FTX CEO Sam Bankman-Fried, and Hut8, Riot, and Marathon are rising as the one public miners that elevated their BTC holdings in November.

CryptoSlate Prime Tales

The Synthetic Intelligence (AI) cryptocurrency sector grew 12.3% during the last 24 hours, making it the second greatest gaining sector after hashish.

Notable prime 10 AI cryptocurrency performers have been Cortex, which develops machine studying fashions on blockchain, up 93.7%, and Fetch, which leverages AI and automation for dApp and peer-to-peer purposes, gaining 33.7%.

The drama surrounding FTX and Binance continues to unfold as new textual content messages emerge that present what went on behind the scenes because the alternate crumbled.

The New York Occasions obtained textual content messages from a gaggle chat with Sam Bankman-Fried, Changpeng Zhao, and varied different cryptocurrency executives that have been exchanged on Nov. 10 — the day earlier than FTX filed for chapter.

The sequence of round a dozen texts confirmed that every one crypto executives feared the scenario may worsen. Furthermore, the nervous exchanges reportedly grew to become more and more tense as CZ accused SBF of making an attempt to govern the worth of Tether (USDT).

Within the texts, CZ stated that SBF used Alameda Analysis to depeg the stablecoin. Binance’s CEO identified a $250,000 commerce and stated Alameda particularly positioned it to destabilize USDT.

Sam Bankman-Fried (SBF) has spoken out following Binance founder Changpeng Zhao’s (CZ) public thread referring to Kevin O’Leary’s protection of FTX and referring to SBF as “a fraudster.”

The feud continued following CZ’s current allegations that CZ accused SBF of making an attempt to depeg USDT by Alameda.

CZ alleged that SBF “launched a sequence of offensive tirades at a number of Binance group members” in his Twitter thread.

In rebuttal, SBF introduced that CZ had “received” and alleged that CZ had lied relating to the small print surrounding Binance’s buyout of FTX.

FTX former CEO Sam Bankman-Fried helps restarting the bankrupt alternate by issuing new FTT tokens to collectors and giving 100% income to token holders.

Crypto Dealer host Ran Neuner first proposed the thought on Dec. 9, including that it will make the brand new alternate the “greatest alternate on the planet.”

In response, SBF tweeted that he thinks “that this could be a productive path for events to discover.”

Analysis Spotlight

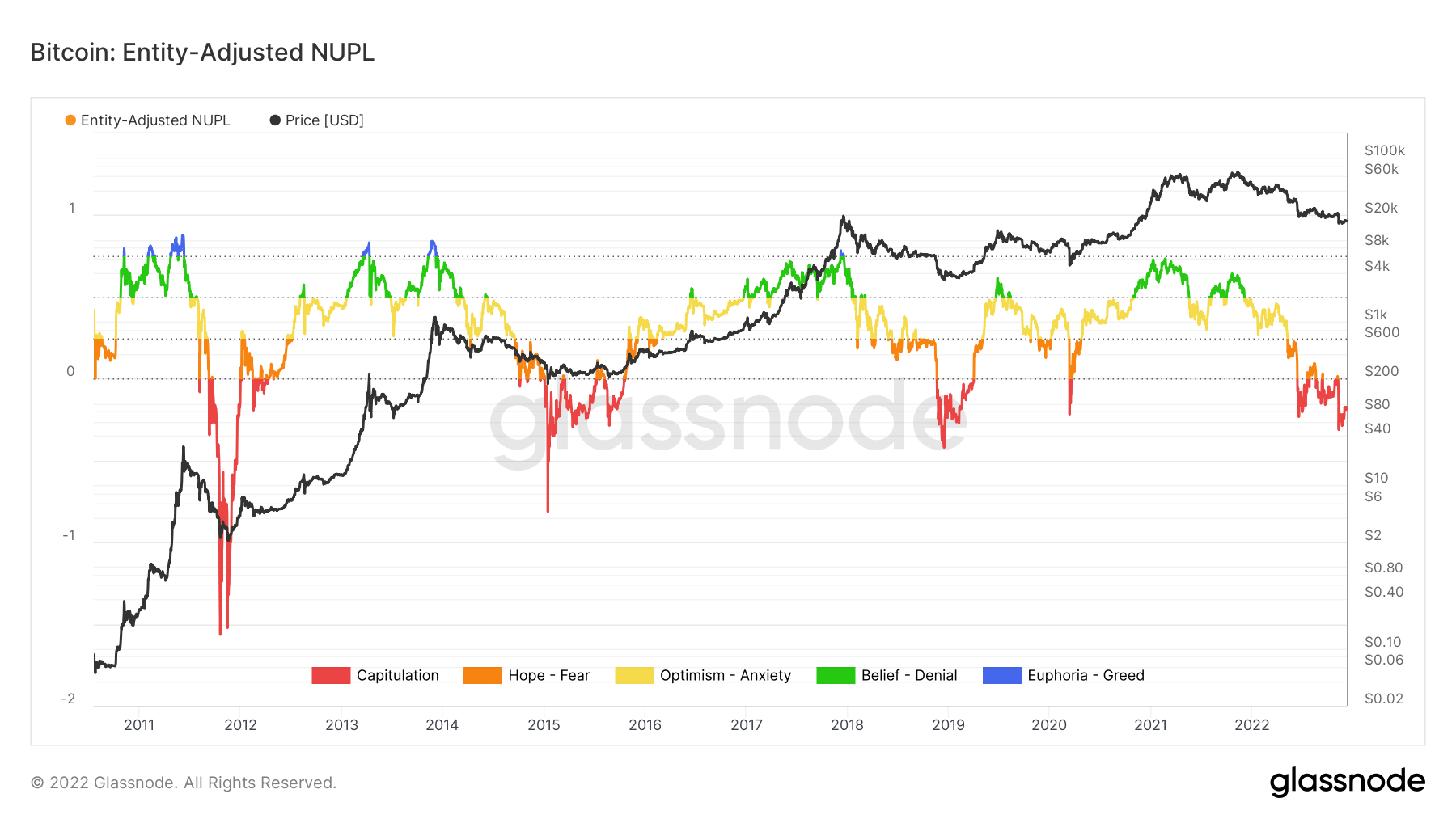

Since June, Bitcoin (BTC) – and the overall market subsequently – has been in capitulation, aside from a handful of rallies seen in the summertime of this ongoing bear market, in response to on-chain information offered by Glassnode and analyzed by CryptoSlate.

Each bull and bear markets reveal on-chain sentiment information, starting from ‘Capitulation’ to ‘Euphoria – Greed. Within the peak of a bull market, the highest is traditionally indicated when Euphoria grips tightly. However, capitulation often alerts the underside.

The chart beneath reveals that BTC has firmly sunk into the Capitulation sentiment because the Web Unrealized Revenue/Loss (NUPL) on-chain information shows a descent into pink territory seen beforehand solely in 2012, 2015, and 2019.

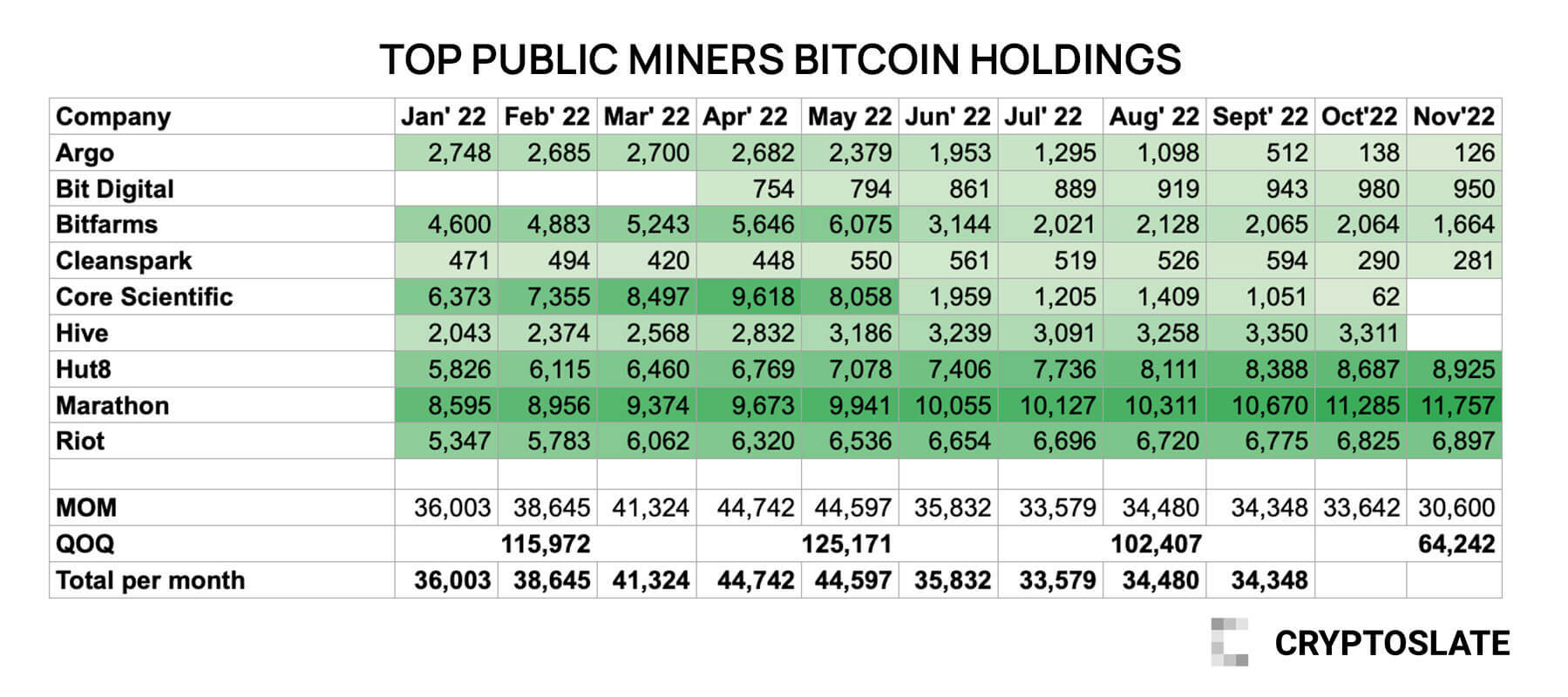

Mining firms have been releasing their November manufacturing charges all through the week. CryptoSlate analysts introduced the numbers collectively and revealed that Hut8, Riot, and Marathon are the one ones who elevated their BTC holdings in November.

The chart above contains the highest 9 BTC miners’ month-to-month reserves ranging from January 2022. The numbers present that Hut 8, Riot, and Marathon added 238, 472, and 72 BTC to their reserves in November, respectively.

However, Argo, Bit Digital, Bitfarms, and Cleanspark shrank by shedding 12, 30, 400, and 9 BTC in the identical month.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by 0.75% to commerce at $17,147.91, whereas Ethereum (ETH) elevated by 1.16% to commerce at $1,270.72.

Greatest Gainers (24h)

- Mass Car Ledger (MVL): +30.26%

- Ampleforth (AMPL): +26.01%

- Fetch (FET): +21.52%

Greatest Losers (24h)

- Radix (XRD): -10.64%

- Neutrino USD (USDN): -7.14%

- Celsius (CEL): -6.73%