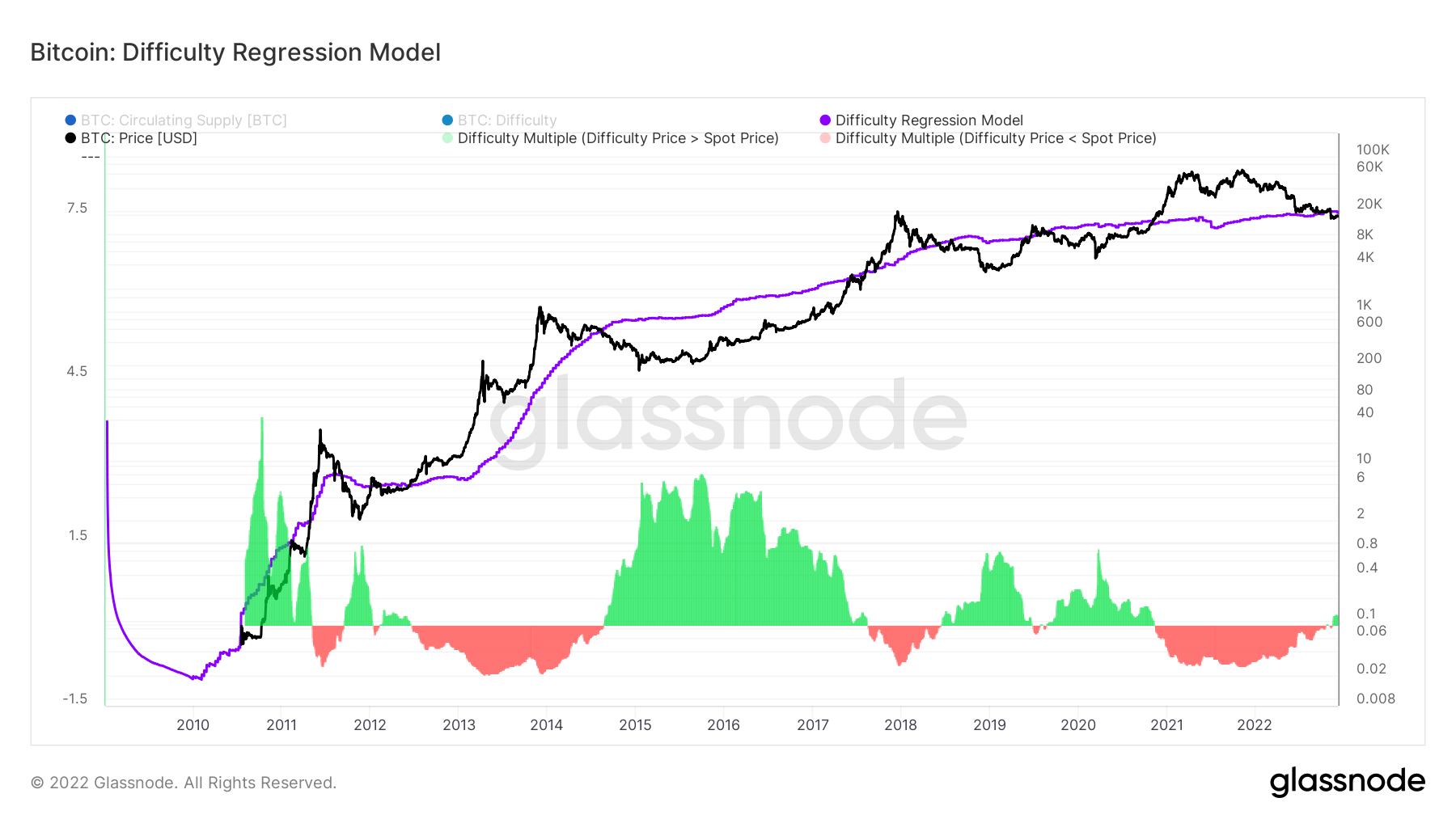

The price of Bitcoin (BTC) is now cheaper than the price of mining one Bitcoin, in response to the Problem Regression Mannequin.

As per information obtained from Glassnode, the present value of mining one Bitcoin is $18.8k, whereas the price of one Bitcoin is $16,5771.8.

The Problem Regression Mannequin is taken into account the last word distillation of mining ‘value’, because it represents all of the mining variables in a single quantity, representing a mining business’s common manufacturing value for Bitcoin with out requiring an in depth breakdown of mining gear, energy prices, and logistical considerations.

A couple of days after FTX filed for chapter, Bitcoin’s value went beneath the issue regression mannequin and has remained there since.

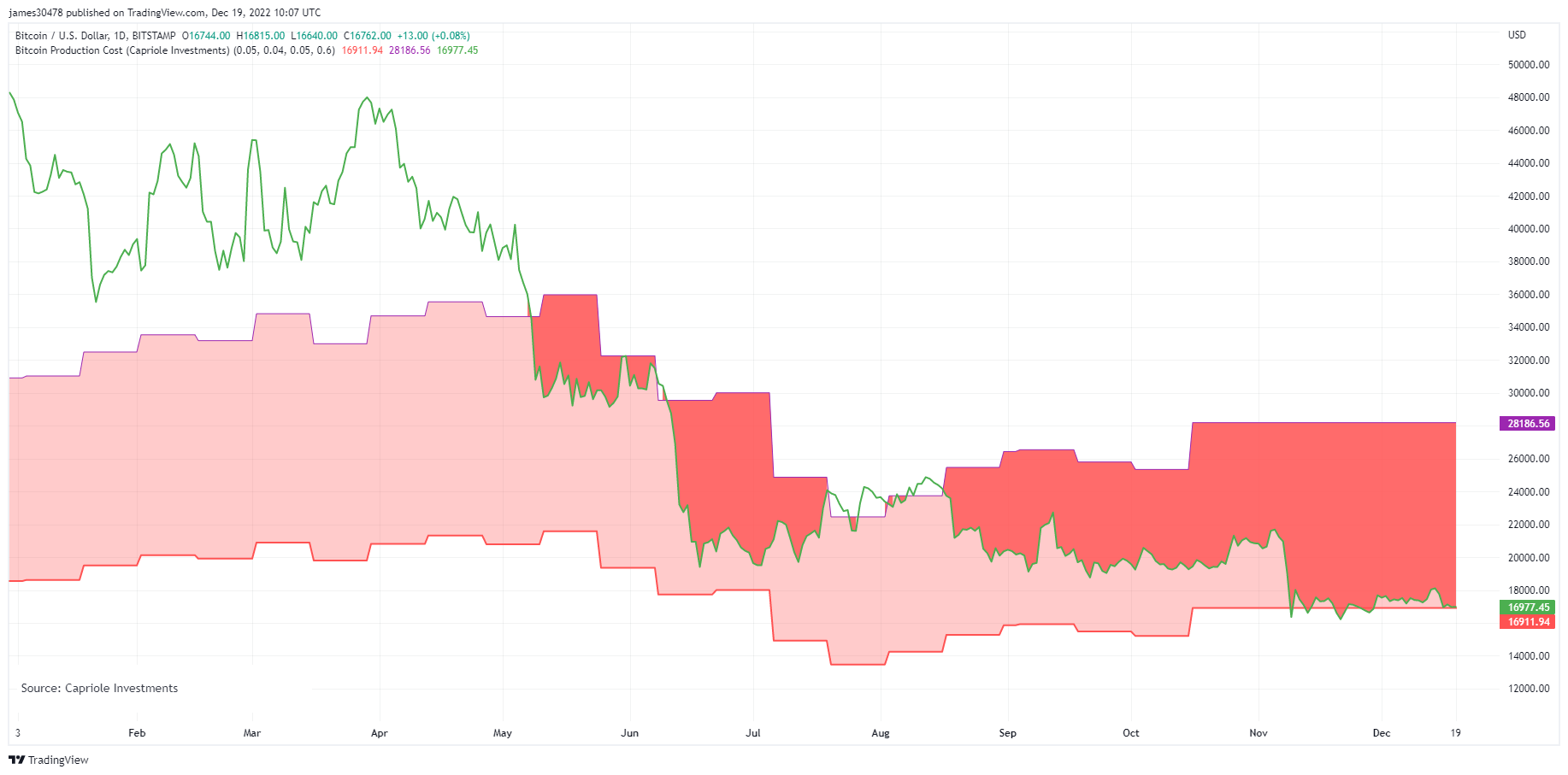

As well as, Tradingview’s information signifies that Bitcoin’s value is now decrease than its electrical energy value. Bitcoin’s Value is at the moment buying and selling at round a 60% low cost to Bitcoin Power Worth, based mostly on the watts of power used within the community. It’s the largest low cost because the value hit $4K on 13 March 2020 and $160 on 14 January 2015.

There have solely been three situations the place the market value has fallen beneath the common mining value – from 2016 to 2017, on the finish of 2018 to Might 2019, and early 2020. In every case, Bitcoin rallied strongly, rising to a brief peak the place the market value was a number of occasions the mining prices.

If historical past repeats itself, the smaller the hole between Bitcoin’s market worth and mining value, the extra enticing Bitcoin will probably be as an funding. Nonetheless, traders and merchants needs to be cautious about investing in Bitcoin or altcoins resulting from present bearish market situations and the macro setting.

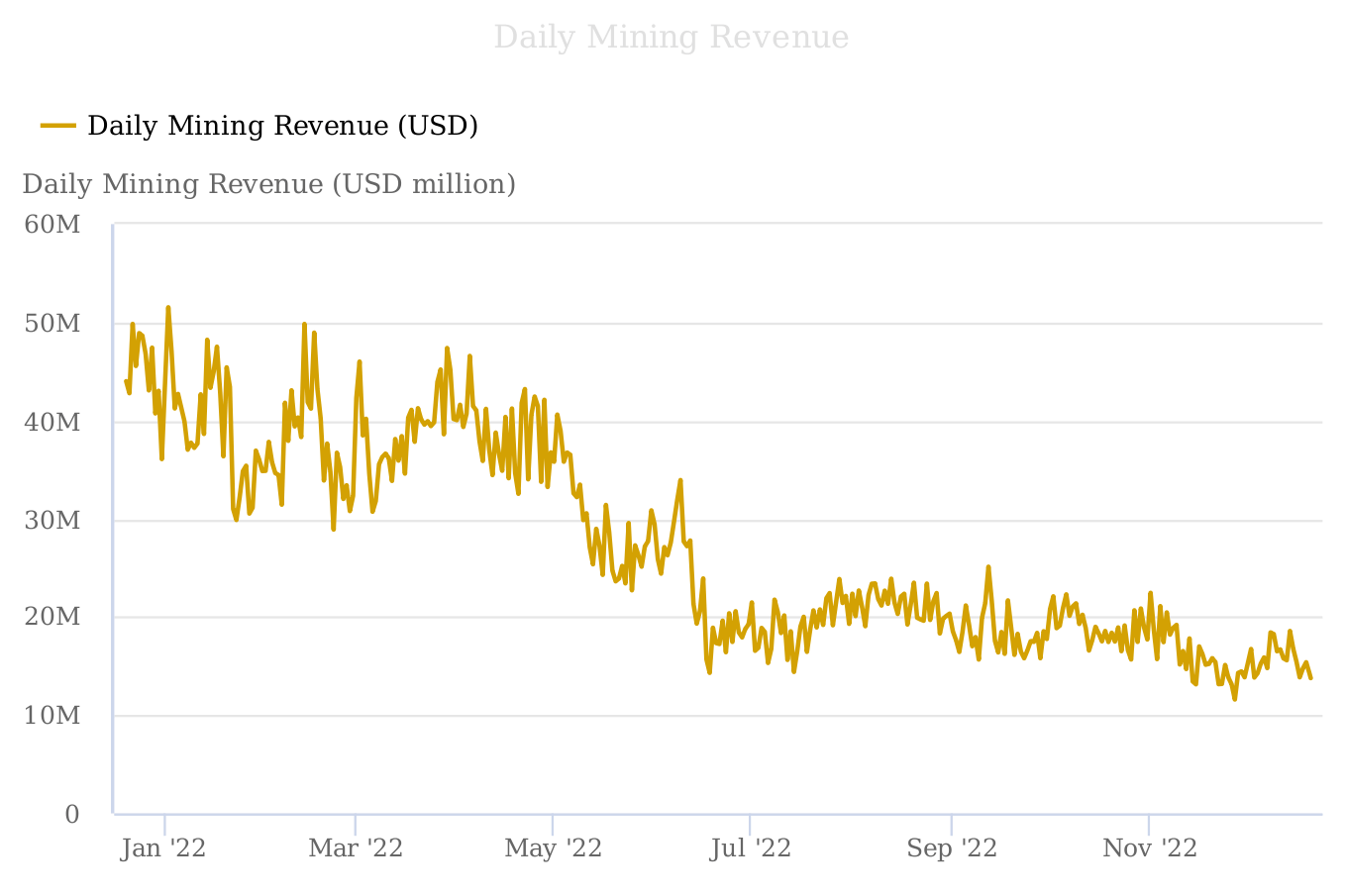

The present market put miners below stress

When mining prices are decrease than Bitcoin’s market worth, a mining operation stays worthwhile extra miners will be a part of. Nevertheless, the present market has put miners below stress as mining prices are rising.

Within the final 12 months, miner income has decreased by 72.34 %, in response to information obtained from Braiins.com.

Moreover, CryptoSlate’s earlier report revealed that the Hash Value representing the income earned per Exahash per day had hit an all-time low of $583,000.

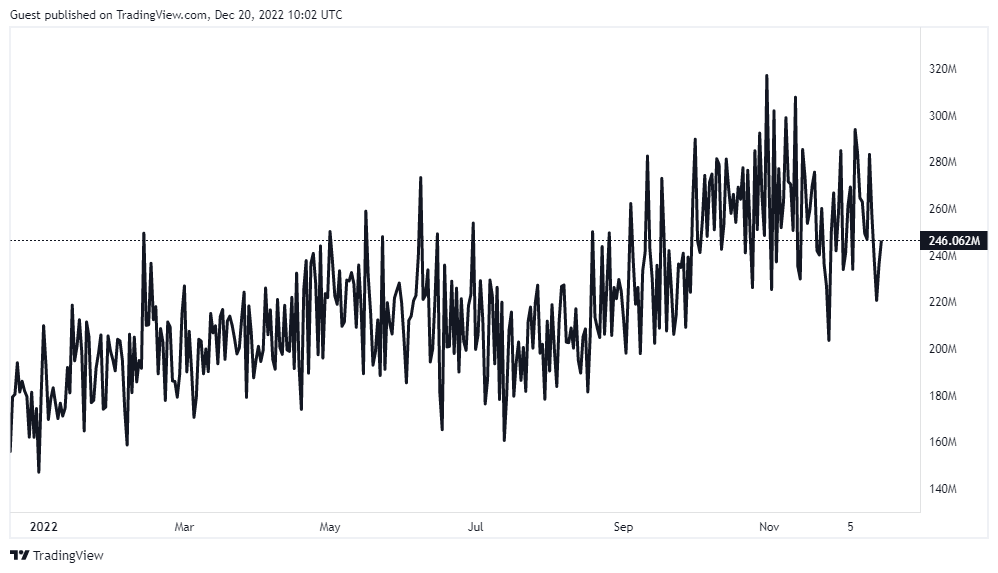

As well as, Bitcoin’s hash fee additionally means that it’s getting dearer to provide and that it’s being offered at a reduction.

Bitcoin Hashrate measures the quantity of processing and computing energy given to the Bitcoin community by miners. The Bitcoin hash fee at the moment stands at 246.062 EH/s, in response to Buying and selling View.

There’s a chance that plenty of Bitcoin mining operations will probably be compelled out of enterprise if bitcoin costs don’t rise or fall decrease.