Lengthy Bitcoin (BTC) positions have been rather more dominant in 2022 than quick ones, in line with CryptoSlate’s evaluation of glassnode knowledge.

Since Jan. 25, there have been 270,000 lengthy and 159,000 quick BTC liquidations this 12 months.

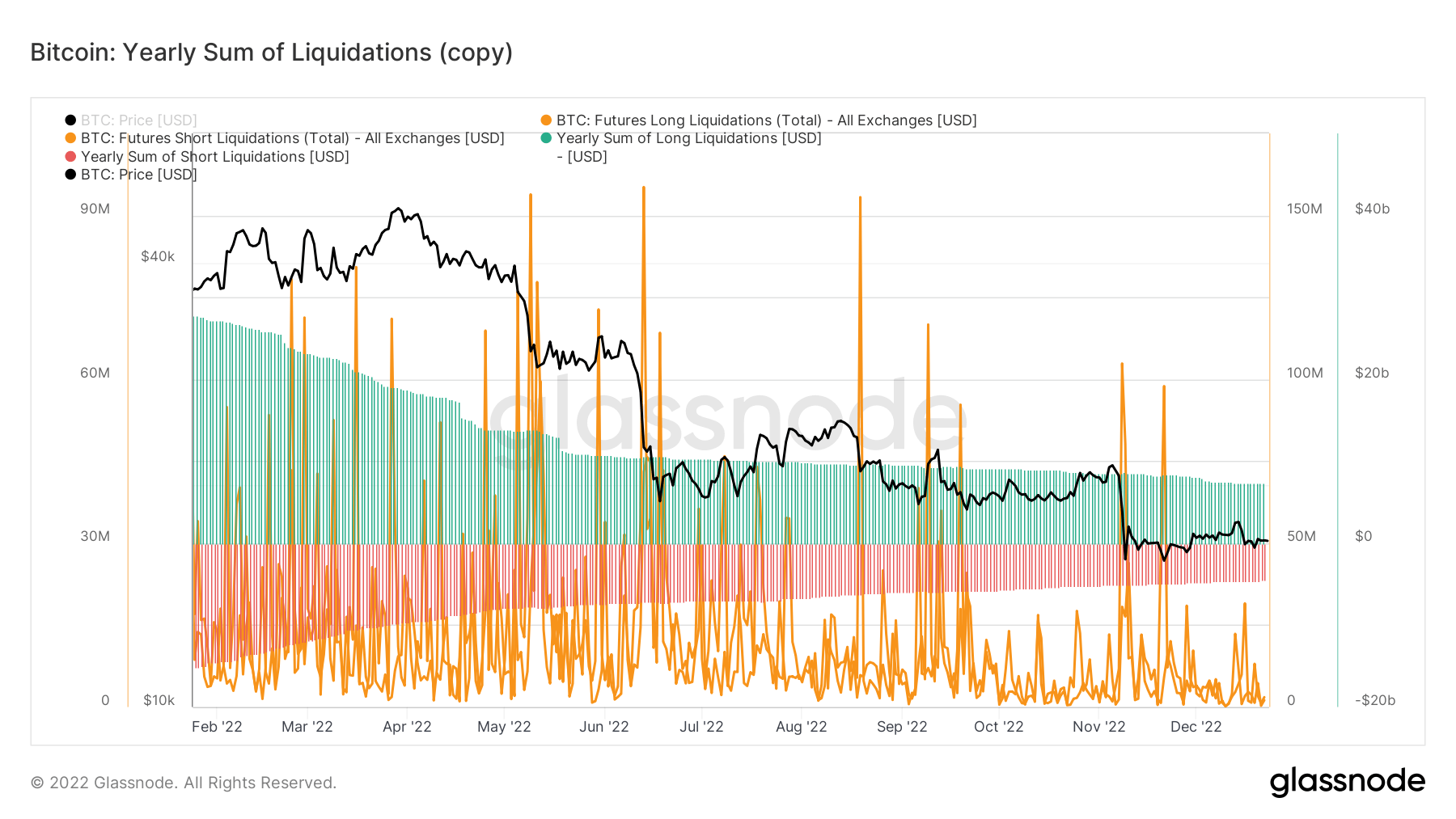

The chart above demonstrates the sum of all BTC liquidations throughout all exchanges. The inexperienced areas signify the yearly sum of lengthy liquidations, whereas the purple ones stand for the full variety of quick liquidations. Traders confirmed an inclination to spend money on long-term positions and saved liquidating all year long.

It may be stated that this 12 months’s catastrophic occasions, just like the collapse of Terra and FTX — in addition to macro occasions just like the Russia-Ukraine conflict — have performed a task within the conduct of buyers.

CryptoSlate’s evaluation revealed that the lengthy BTC positions grew exponentially after the Terra collapse — which began the bear market. Numbers from October present that long-term BTC holders began to liquidate in direction of the top of the month.

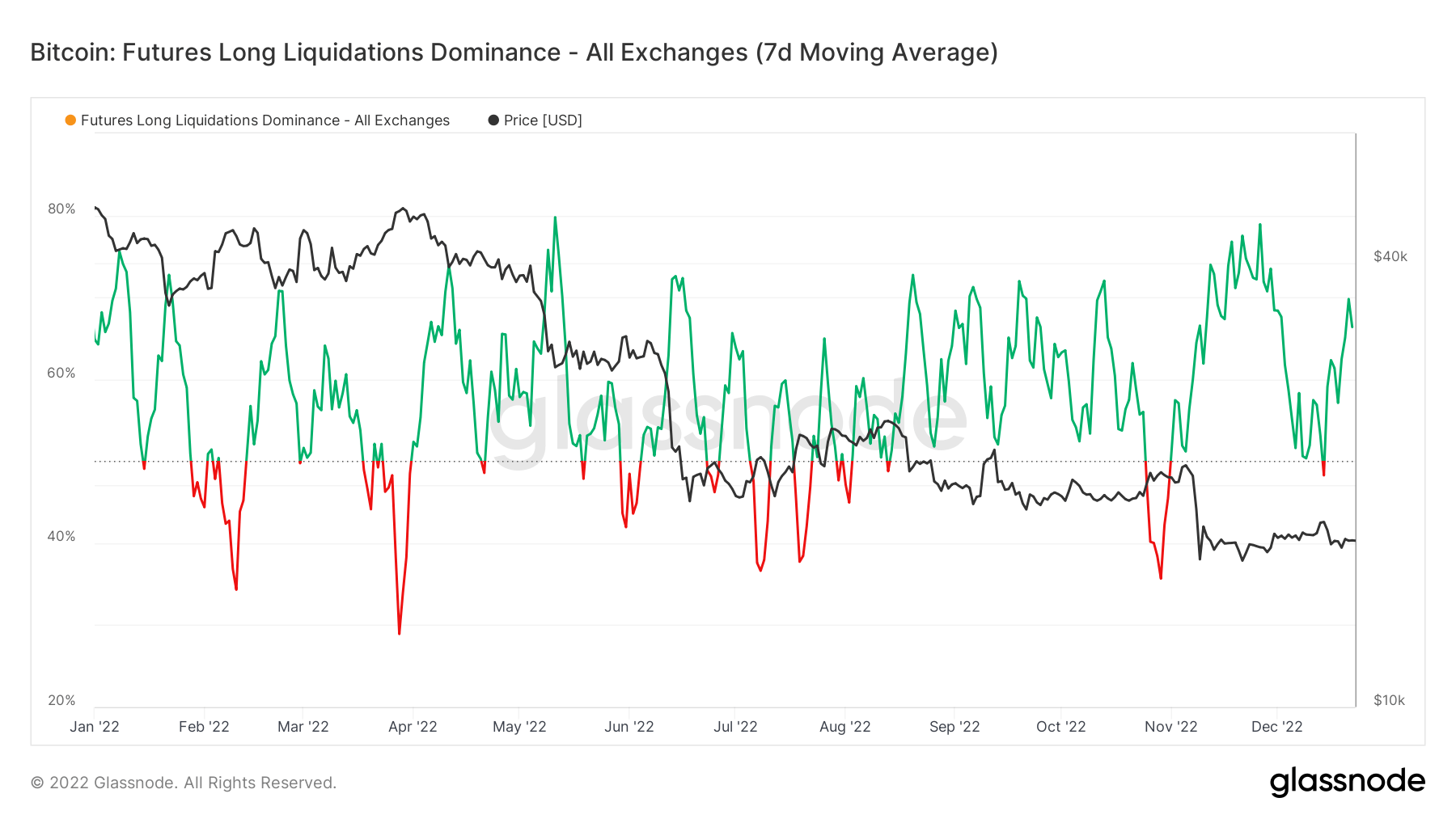

Lengthy liquidations dominance

The lengthy liquidations dominance additionally helps the findings above. The chart under reveals the share of lengthy liquidations since Jan. 25.

The share of quick liquidations is calculated by dividing the variety of lengthy liquidations by the sum of each lengthy and quick liquidations. If the metric is at 50%, this means that there have been an equal quantity of lengthy and quick liquidations. If it seems under 50%, because of this extra shorts have been liquidated.

If the metric is above 50%, like nearly all of the chart is, it signifies dominance in long-term liquidations. In response to the chart, long-term liquidations have been dominant all year long besides for brief durations in February, April, July, and November.