Amid arguably the coldest winter in Bitcoin’s historical past, its price has fallen by greater than 70% from its Nov. 10, 2021, all-time excessive of $69,044.77, whereas its market cap is all the way down to $318.943 billion from the yearly excessive of $902.04 billion — a 64.64% decline.

Let’s check out some metrics that may present extra perception into the present Bitcoin bear market:

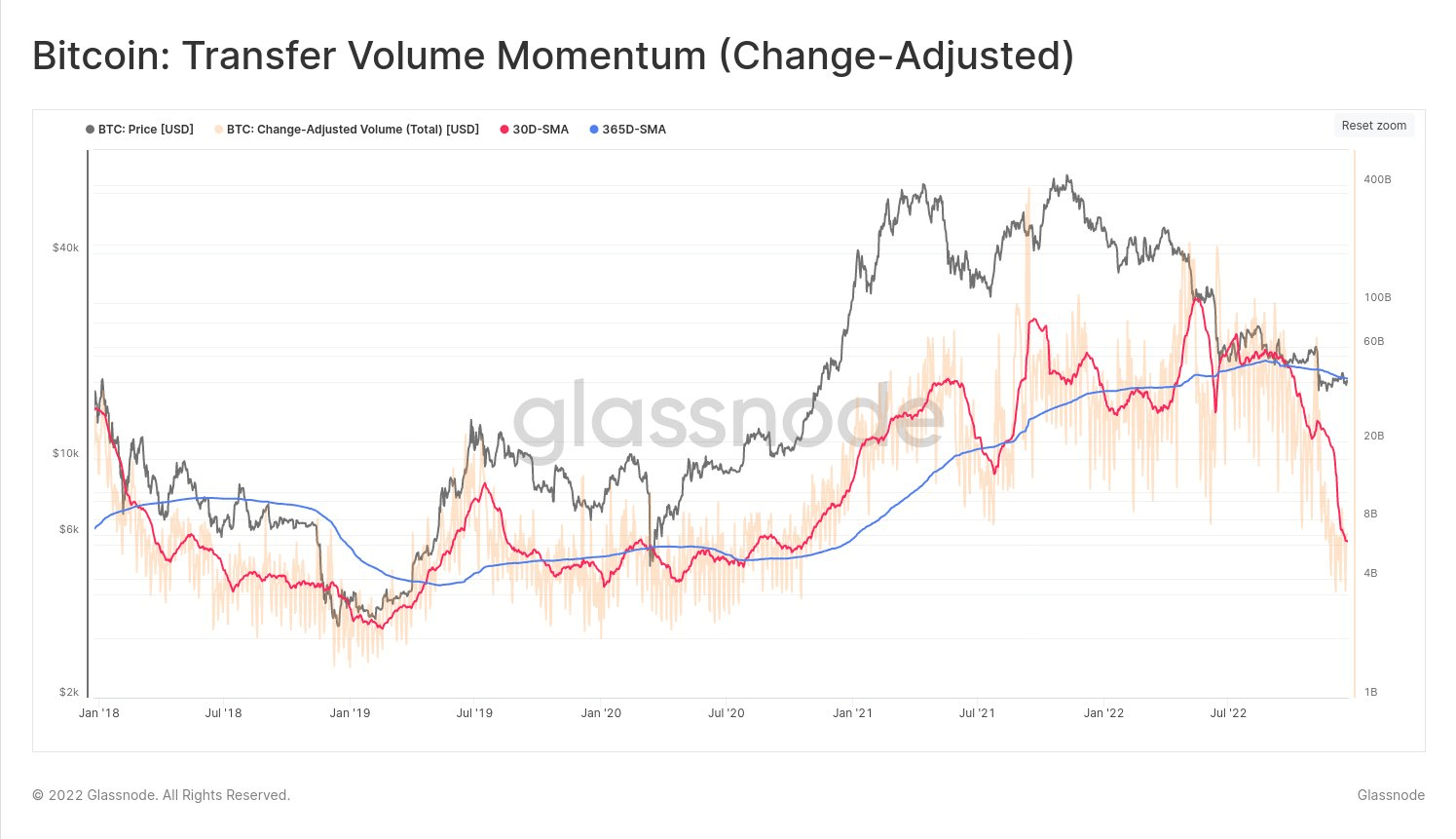

Switch Quantity Momentum

Earlier than June, the 30-day Transferring common (DMA) (crimson line) switch quantity in BTC reached new highs, however after the Luna-Terra crash, it quickly declined and now stands at new lows.

Switch quantity on the Bitcoin community supplies a sign of the present stage of community exercise and the worth that’s being transferred in BTC and USD. This metric compares the month-to-month common (crimson line) switch quantity towards the yearly common (blue line) to underline relative shifts in dominant sentiment and assist establish when the tides are turning for community exercise.

It’s typical for the 30DMA to be beneath the 365 DMA throughout bear markets and vice versa throughout bull markets. At the moment, the 30 DMA has fallen beneath the 365 DMA, indicative of declining community fundamentals and declining community utilization, in line with information analyzed by CryptoSlate.

This means that momentum has evaporated by way of chain switch, which is regarding. Additionally it is the biggest discrepancy between the 30 DMA and the 365 DMA in over the past 5 years.

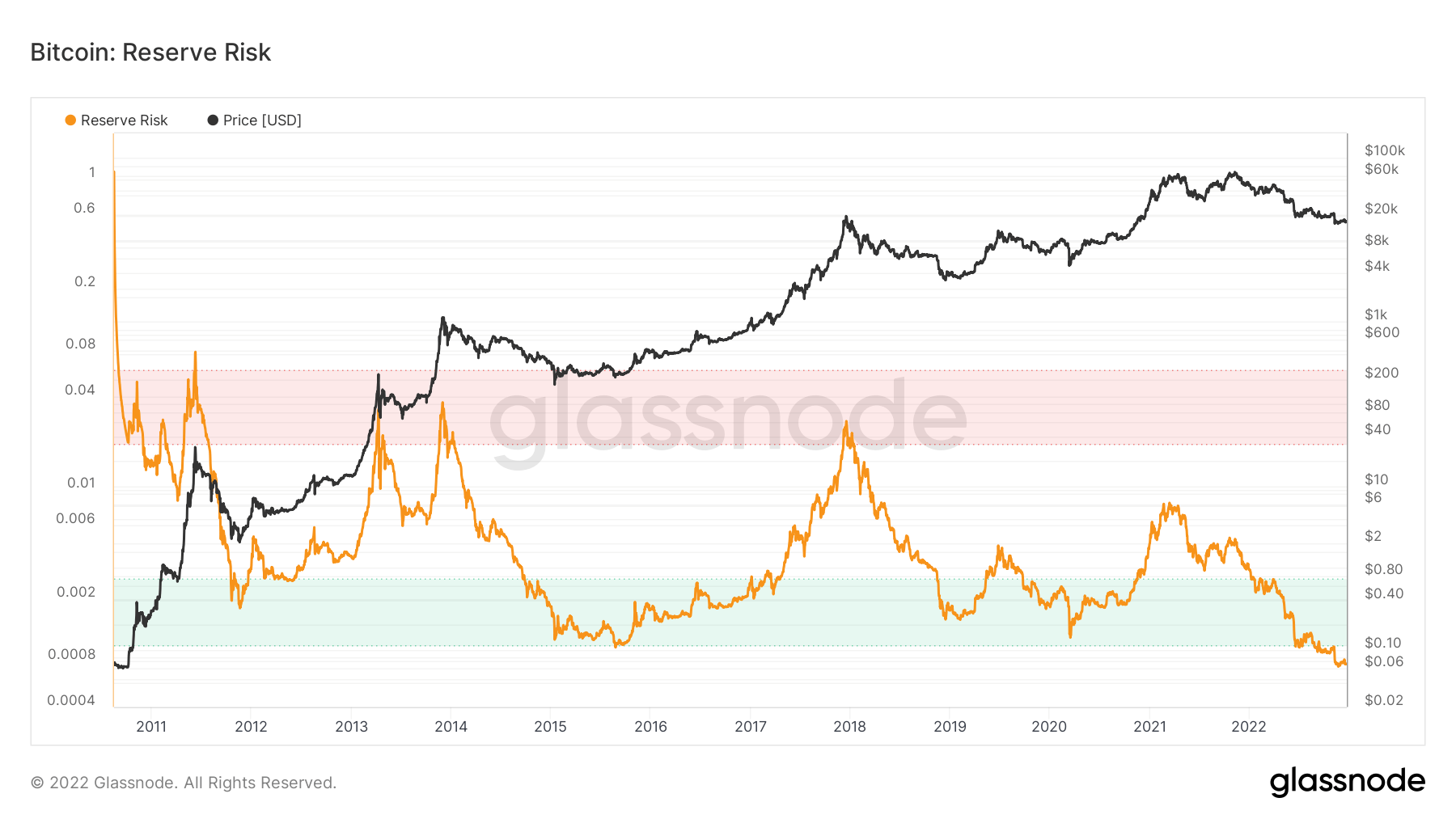

Bitcoin Reserve Threat

CryptoSlate’s on-chain evaluation reveals the Bitcoin Reserve Threat indicator has declined to an all-time low.

The Bitcoin Reserve indicator gauges the boldness stage of long-term holders relative to the present bitcoin worth. Reserve Threat is the ratio between the present worth (incentive to promote) and HODL Financial institution. The HODL Financial institution metric represents the cumulative alternative price of holding the asset.

When Bitcoin costs attain file highs, Reserve Threat (the crimson zone) tends to be larger, reflecting a lower in investor confidence.

Alternatively, a decrease Bitcoin worth and better confidence imply decrease Reserve Threat (the inexperienced zone) or an improved threat/reward ratio.

Nevertheless, at present instances, BTC reserve threat has fallen out of the inexperienced field for the primary time in its historical past, displaying a insecurity amongst traders.

However, low Reserve Threat can sign relative undervaluation, which could be a prolonged and extended course of.

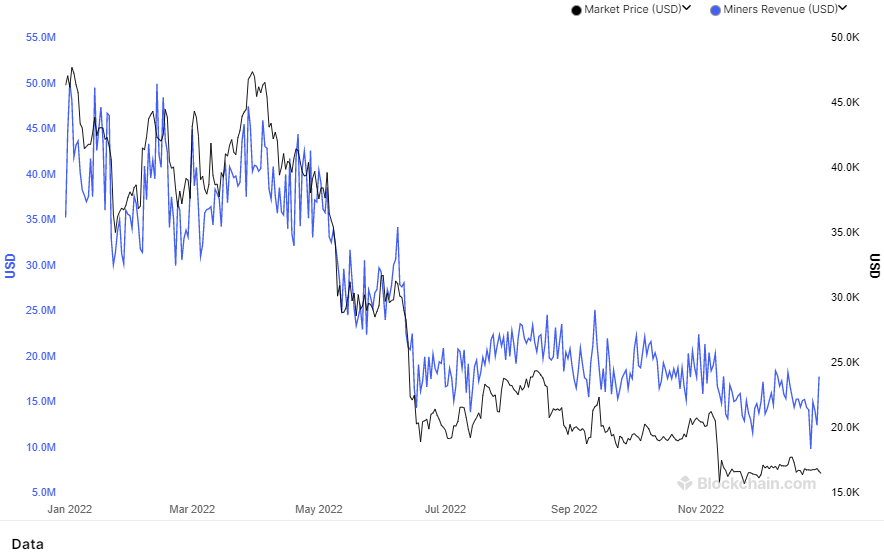

Bitcoin Miner’s Income

Bitcoin miners’ income per day declined over one 12 months and fell to new lows because of a weak market and growing computational calls for.

Consequently, mining companies reminiscent of Core Scientific have filed for chapter, and a number of miners are additionally struggling. As well as, in line with a earlier report by CryptoSlate, miners are promoting their cash on the highest charge within the final two years, leading to problem being adjusted negatively transferring ahead.

In the meantime, BTC miner pockets balances have dropped to ranges seen in January 2022, in line with information analyzed by CryptoSlate.

Mark Mobius, the co-founder of Mobius Capital Companions, who appropriately predicted the drop to $20,000 this 12 months, believes bitcoin shouldn’t be removed from $10,000 having damaged the technical assist ranges of $17,000 and $18,000.

If Mobius’ $10,000 name comes true, it’s going to add extra distress to the cryptocurrency market.

Nevertheless, Bitcoin sentiment shouldn’t be completely bearish in 2022. For example, the variety of long-term Bitcoin holders hit an all-time excessive this 12 months.