Glassnode knowledge analyzed by CryptoSlate reveals that Bitcoin miners are starting to take pleasure in some respite within the present yr after struggling in 2022.

Bitcoin miner’s holdings decline 12.1% YoY

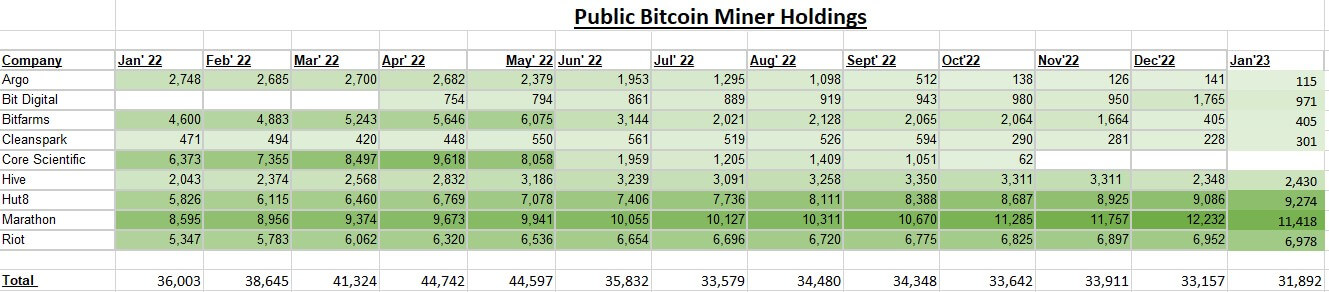

As of Jan. 2022, Bitcoin miners held 36,003 BTC, with mining corporations like Core Scientific, Riot, Hut8, Marathon, and Bitfarms holding over 30,000 cash.

Nonetheless, the panorama seems to have modified within the present yr as Hut 8, Marathon, and Riot are actually the dominant miners, holding 87% — 27,760 BTC — of the miners’ BTC holdings, in line with CryptoSlate’s analysis.

Bitfarms and Core Scientific fell off as they struggled in 2022 — the latter filed for chapter whereas the previous handled debt obligations.

In the meantime, the market has seen a little bit BTC distribution from miners in January 2023 in comparison with the earlier yr.

Apart from that, the shares of a number of miners have risen by three figures on the year-to-date (YTD) metric. Miners like Hut8, Riot, Iris, Marathon, and many others., have all seen their shares enhance by over 100% YTD.

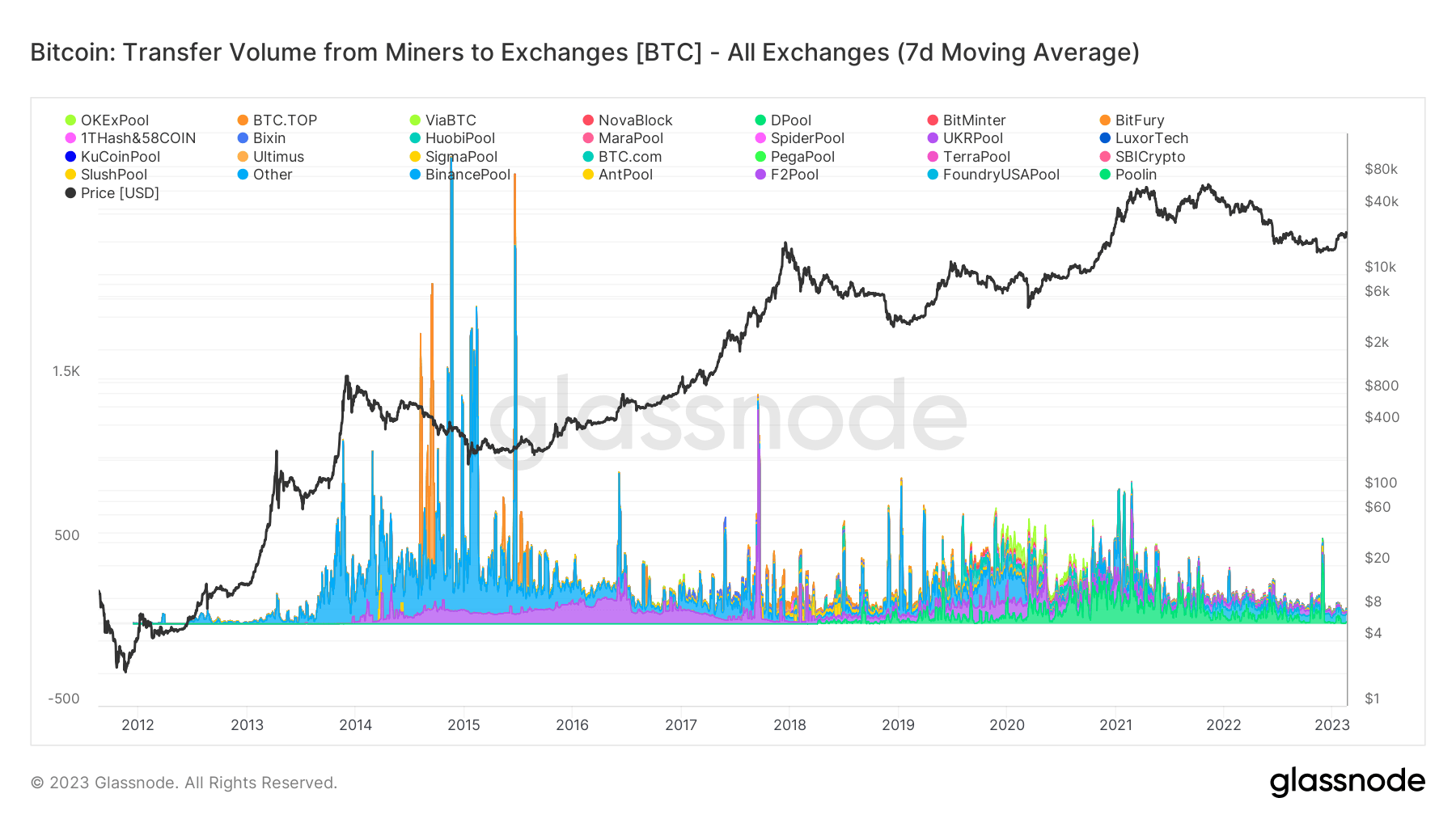

Miners are promoting their BTC to exchanges at “extraordinarily low ranges”

CryptoSlate’s evaluation confirmed that miners look like in a more healthy place in comparison with the earlier yr.

In line with Glassnode’s knowledge, as analyzed by CryptoSlate, miners are promoting their BTC to exchanges at extraordinarily low ranges in comparison with earlier years.

It is because profitability is starting to return to the mining trade as BTC’s worth has risen by round 50% in 2023 — the flagship digital asset briefly traded above $25,000 for the primary time since August 2022 on Feb. 16.

In the meantime, Bitcoin hash price rose 34% on the year-on-year metric and hit a brand new all-time excessive of 300 TH/s. This reveals the community’s present consistency and power.

Mining BTC is at the moment cheaper

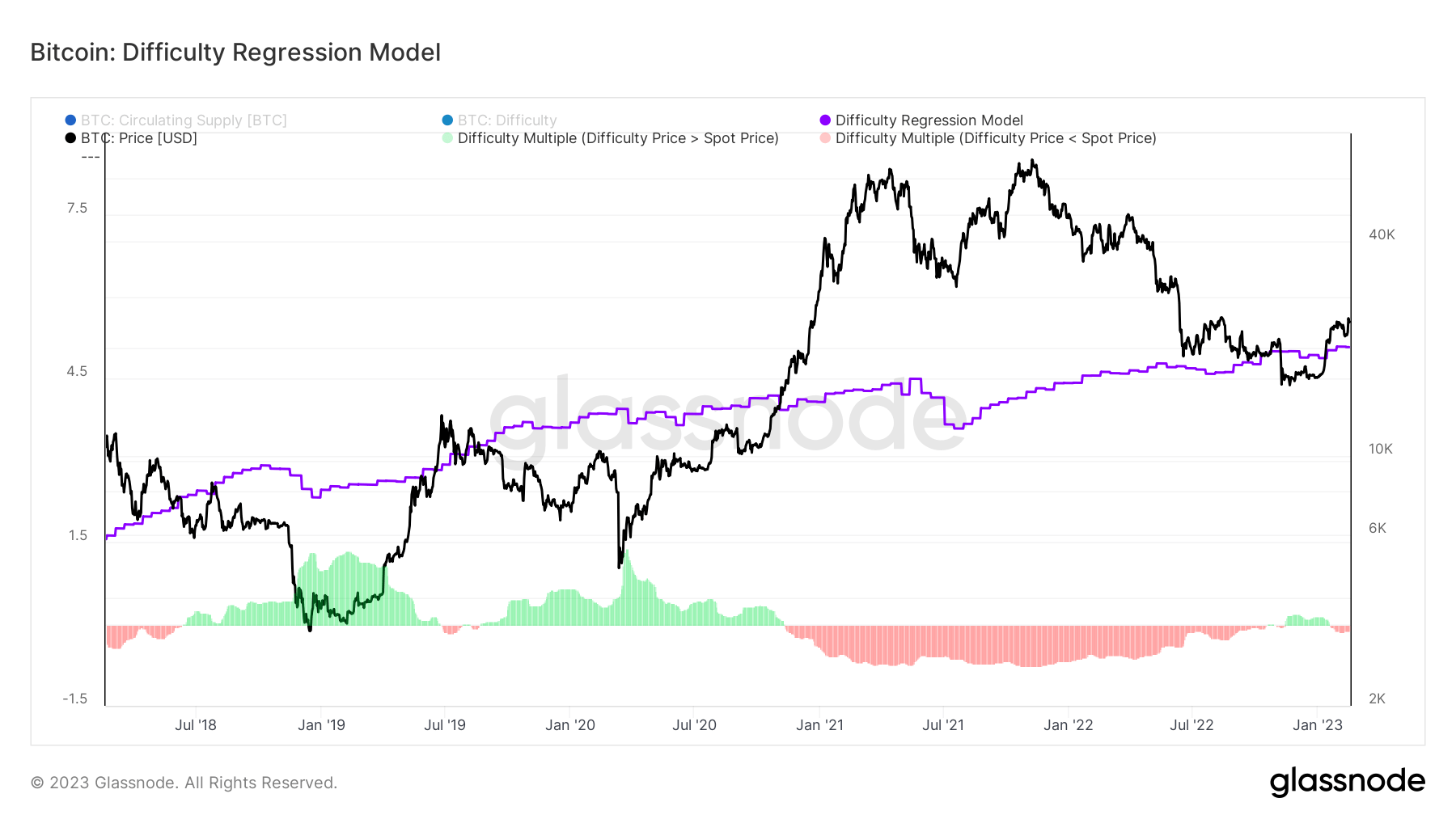

The Problem Regression Mannequin, a metric used to measure the price of mining Bitcoin, is at the moment below the asset’s spot worth.

In line with the chart above, the DRM is at $20,000, greater than $4000 under BTC’s present spot worth on the time of writing.

The present DRM stage is crucial for the miners to carry because it ensures that they’re in a wonderful monetary place even when the hash charges proceed to soar and the mining issue rises.

In the meantime, the DRM is also used to gauge bear markets sentiments when BTC’s worth falls below the DRM.