The Bitcoin worth has rallied quick previously few days because of the BlackRock information. The massive query is whether or not the bulls can proceed to push the value upwards, or whether or not they’re slowly operating out of steam. With this in thoughts, there’s at the moment a putting similarity within the 1-day chart of BTC to the rally in mid-March 2023.

Again then, the BTC worth skilled a setback of over 22% after reaching a one-year excessive at $25,200. Information from the macro and crypto setting have been extraordinarily bearish after USDC misplaced its peg to the US greenback and a renewed banking disaster loomed. Nevertheless, because of rumors of a Silicon Valley Financial institution (SVB) bailout, BTC kicked off a 46% surge. Remarkably, this occurred in a double-pump with a one-day breather.

Quick-forward to at the moment, Bitcoin could also be in that place once more. Because the Bitcoin worth dipped beneath $25,000 on June 14, the information have been extremely bearish (Tether FUD, SEC lawsuits, and extra). As soon as once more, nevertheless, BTC was saved by bullish information: BlackRock’s submitting for a Bitcoin spot ETF.

Because the information, BTC has risen by over 20%. Yesterday, the value took a breather. The million-dollar query: Will the second a part of the pump come at the moment, as in March, or has Bitcoin already skilled the double pump (see yellow circles). On this case, June 18 may have been the equal to the one-day breather of the March rally.

Information Helps Bitcoin Bulls, However Warning Is Warranted

In accordance with the analysts at Greeks.dwell, BTC choices could turn out to be essential at the moment. A complete of 31,000 BTC choices expire at the moment with a put-call ratio of 0.73, a most ache level of $27,000 and a notional worth of $930 million. Stimulated by the rise of BTC, the worth of BTC choices positions elevated by virtually 50% this week.

“The present BTC and ETH every main time period IV inversion is apparent, now cross-currency IV arbitrage may be very cost-effective, BTC IV long-term increased than the ETH will not be sustainable,” the analysts note.

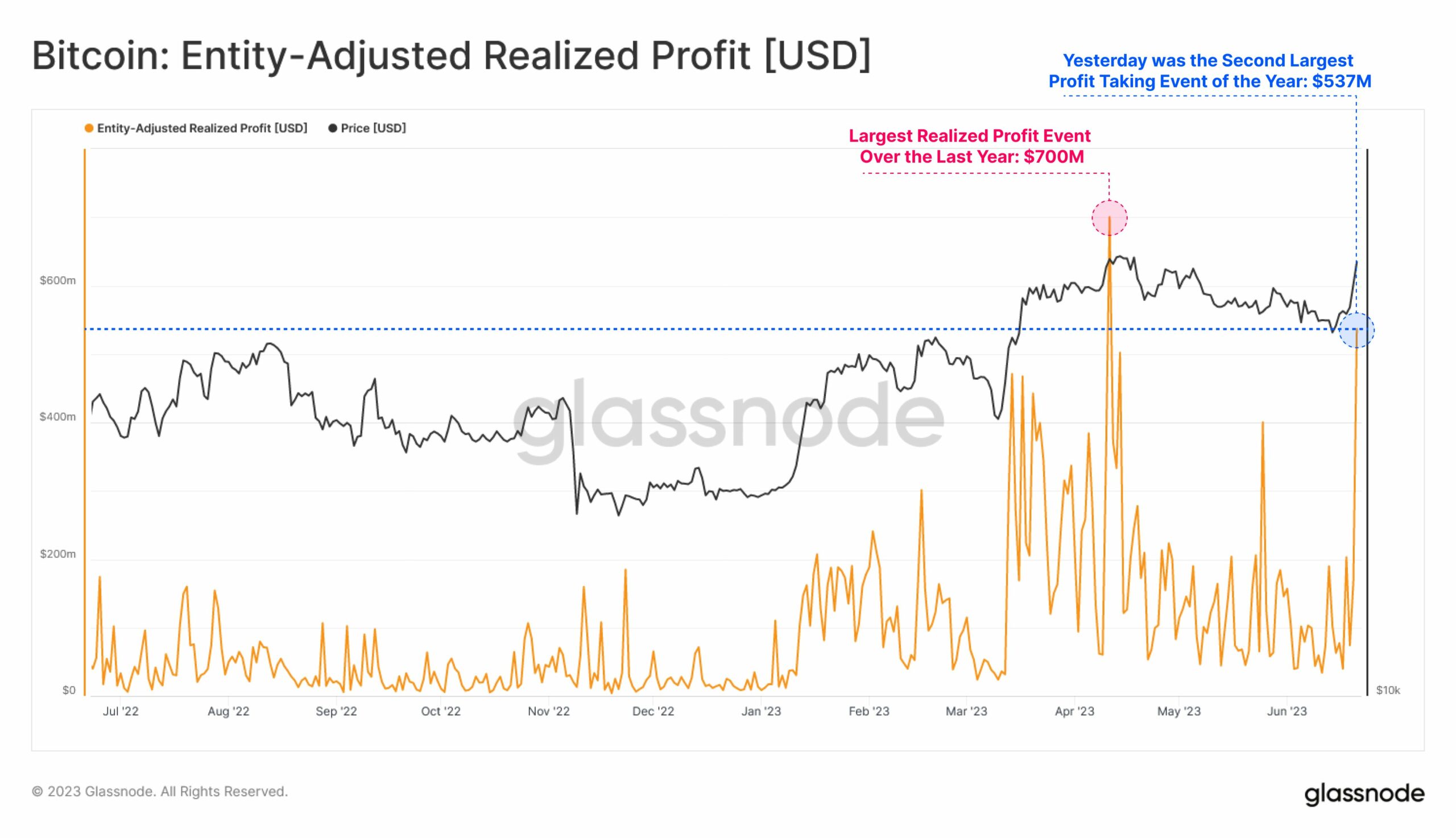

In the meantime, the on-chain consultants from Glassnode stated yesterday that after the latest rally within the Bitcoin worth, market contributors took a non-trivial revenue of $537 million, the second-largest profit-taking previously yr.

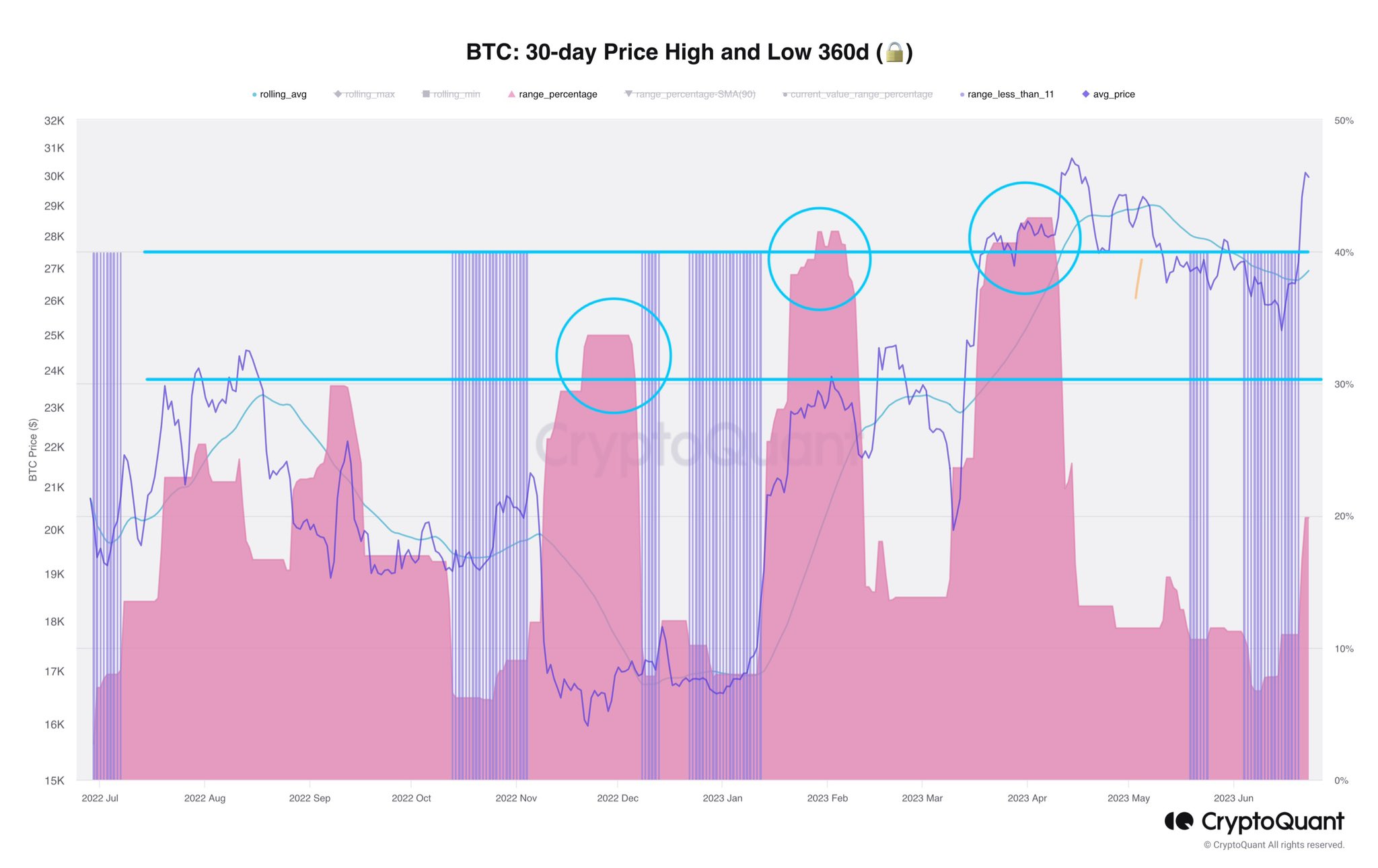

Nevertheless, different on-chain knowledge introduced by analyst Axel Adler Jr reveals that there’s nonetheless potential for a second leg up. As Adler writes, durations of low volatility (blue peaks) have traditionally been adopted by speedy worth actions (pink). These rallies have been larger than the one BTC skilled over the previous few days. Adler remarked:

Over the past yr, such fluctuations have reached as much as 30-40%. We’re at the moment experiencing one other pink spike!

[UPDATE: 10:40 am EST]: The BTC choices expiry is out of the best way and had no main influence on worth.

Featured picture from iStock, chart from TradingView.com