The Bitcoin and crypto market eagerly noticed the expiry of the quarterly BTC and ETH choices as we speak (at 8:00 am UTC / 4:00 am EST). It was the second largest in historical past with a quantity of 159,000 BTC choices and 1.25 million ETH choices with a complete worth of just about $7 billion.

The market was anticipating a pointy enhance in volatility, but it surely didn’t materialize. Within the run-up, the BTC value briefly spiked as excessive as $31,300 earlier than seeing a pullback in the direction of $30,700. The occasion has thus just about turn into a nothing burger.

Choices analysts at Greeks.Dwell confirmed a couple of minutes in the past that the quarterly expiration has been accomplished, with extra BTC block calls being traded in the previous couple of days, primarily to shut and roll positions on the finish of the quarter, with ETH being primarily within the order ebook, adding:

With the quarterly expiry, the market has seen a launch of positions which have constructed up in current months, and choices may see a bigger shift if the market helps it in July.

Though volatility ranges have risen this month and market makers are completely satisfied to actively purchase positions, the downward development in main time period IV may be very a lot in proof amidst the robust promoting stress from quarterly supply.

What’s Subsequent For Bitcoin?

At the moment’s each day shut may turn into extraordinarily vital for the Bitcoin value. At the moment is month-end, quarter-end and the Private Consumption Expenditure (PCE) value index, the US Federal Reserve’s most well-liked inflation gauge, shall be launched at 8:30 am EST (12:30 pm CET). On Tuesday, the U.S. market is closed for the Fourth of July, Independence Day.

The Private Consumption Expenditure (PCE) value index is most well-liked by the Fed as a result of it gives broader protection of shopper spending, consists of chain weighting to precisely observe behavioral modifications, accounts for the substitution impact, and makes use of complete information sources. The PCE is due to this fact thought-about a extra versatile and consultant indicator of inflation in comparison with different indexes such because the Shopper Worth Index (CPI).

Whereas headline CPI information have regarded extraordinarily good in current months, core inflation has been proven to be very sticky. Loads of focus as we speak will due to this fact be on core PCE. The expectation for PCE inflation is 3.9% and for core PCE 4.7% year-over-year. A shock to the draw back has the potential to offer a bullish enhance to each the normal monetary market in addition to the Bitcoin and crypto markets.

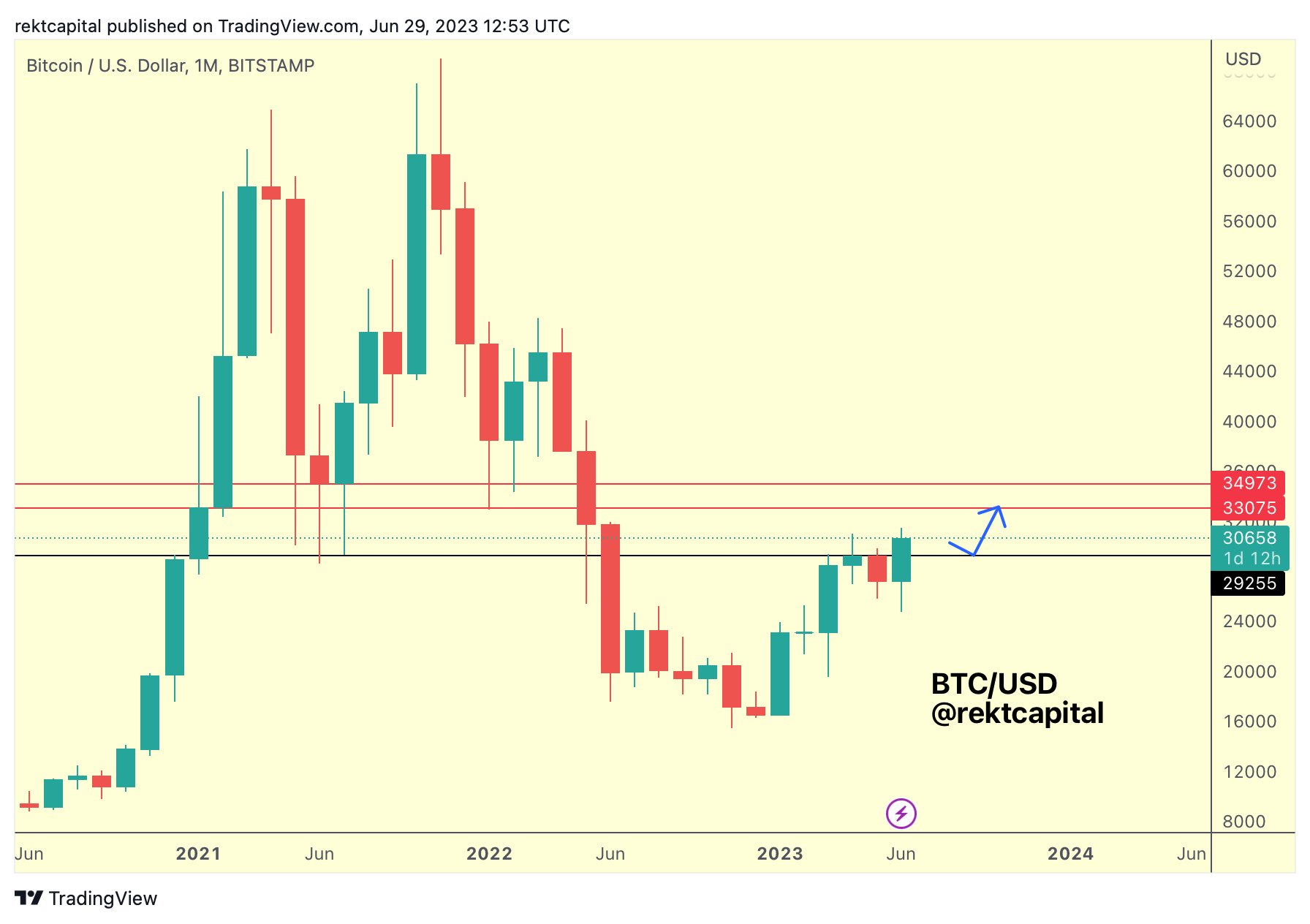

As famend analyst @rektcapital writes by way of Twitter, BTC is positioning itself for a month-to-month shut above a resistance that had rejected the worth for the previous three months. At present, BTC is holding above the identical degree (black). Thus, the month-to-month in addition to the quarterly shut could possibly be an especially bullish harbinger for July.

Is The Greatest Time To Purchase Subsequent Monday?

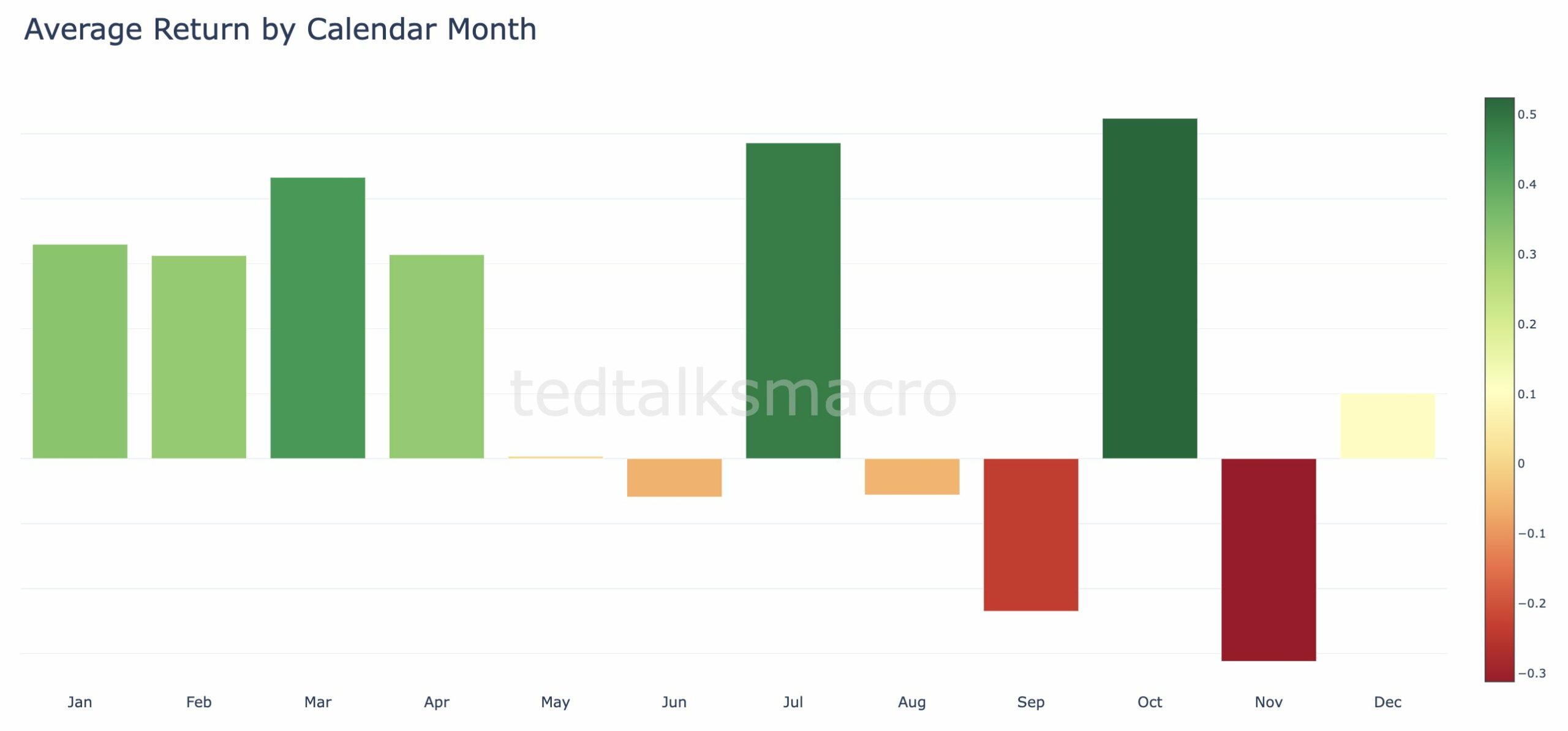

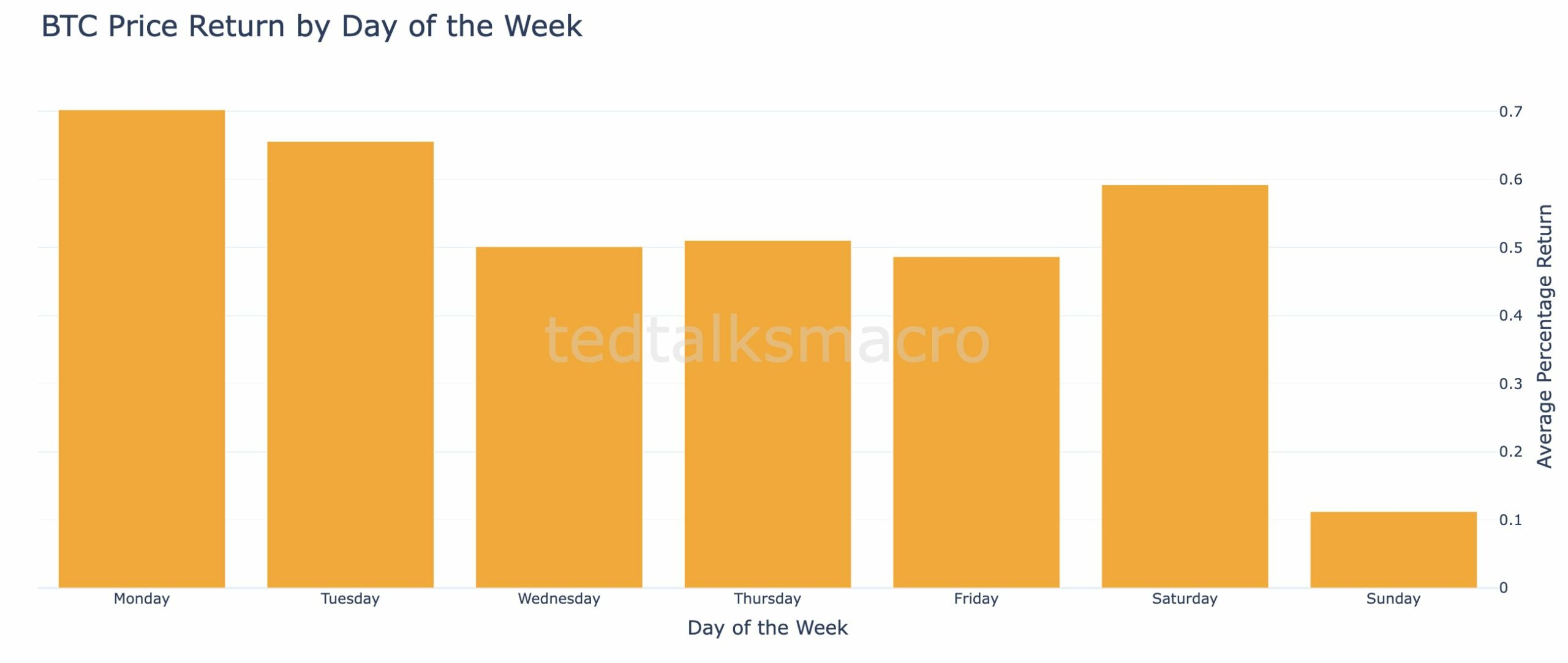

Analyst @tedtalksmacro lately published an evaluation about Bitcoin’s historic efficiency by way of Twitter. The consequence might counsel that the upcoming Monday, July 3, is the most suitable choice for a Bitcoin purchase, at the very least traditionally.

Because the analyst famous, July has been the very best performing month since October 2009. Nevertheless, the information is skewed because of a 10x in July 2010. Taking solely the final 5 years of information, the very best performing month is October, carefully adopted by July.

On a weekly foundation, Mondays are the very best day to purchase and maintain BTC. This assumes that consumers don’t maintain BTC on any day aside from the nominated one, because the analyst evaluated.

At press time, the Bitcoin value hovered under the $31,000 resistance zone, buying and selling at $30,856.

Featured picture from iStock, chart from TradingView.com