Because the extremely anticipated US Shopper Worth Index (CPI) information for June is about to be launched right this moment at 8:30 am EST, the Bitcoin (BTC) market finds itself at an important crossroads. With inflation considerations lingering and the Federal Reserve’s subsequent strikes underneath scrutiny, market contributors eagerly await the influence of the CPI figures on BTC’s value trajectory. The expectations are as follows:

- Headline y/y at 3.1% (final 4.0%)

- Headline m/m at 0.3% (final 0.1%)

- Core CPI y/y of 5.0% (final 5.3%)

- Core CPI m/m of 0.3% (final 0.4%)

The Fed’s Battle Towards Inflation

In latest months, inflationary pressures have been a trigger for concern, capturing the eye of buyers and economists alike. Whereas headline inflation is cooling off quick and anticipated to fall additional to three.1% (from 4.0% in Could), it’s the core CPI, which excludes risky meals and vitality costs, that has change into more and more necessary.

In latest public appearances, members of the Federal Reserve (Fed) have maintained a hawkish stance and expressed considerations a few potential resurgence of inflation concerning the elevated core inflation. The underlying concern stems from the truth that inflation has primarily declined as a result of resolving provide chain issues, whereas core inflation stays elevated.

The rise in wages might contribute to a cycle of accelerating sticky core inflation. Though core CPI was at 5.3% in Could, consultants now anticipate a gradual decline to five.0% in June. Whereas that is progress, it exhibits how sticky core inflation presently stays. An unexpectedly sharp drop would due to this fact be extraordinarily bullish.

Any quantity under expectation might result in a rally within the Bitcoin and cryptocurrency markets, as Christopher Inks, famend dealer and psychology coach, tweeted:

CPI can be launched with a big anticipated drop from 4% final time to three.1% anticipated this time round for the headline quantity. If core CPI is available in under 5%, that will be large, and also you higher maintain onto your britches. Will used automobile gross sales ship core down a lot better than anticipated?

A shock in core inflation might have a big influence on the subsequent charge hike resolution by the Fed. The subsequent FOMC assembly is on July 26. For the time being, the CME FedWatch instrument predicts with 92.4% a 25 bps charge hike which is holding again the markets. This likelihood is more likely to drop massively if the core CPI surprises to the draw back.

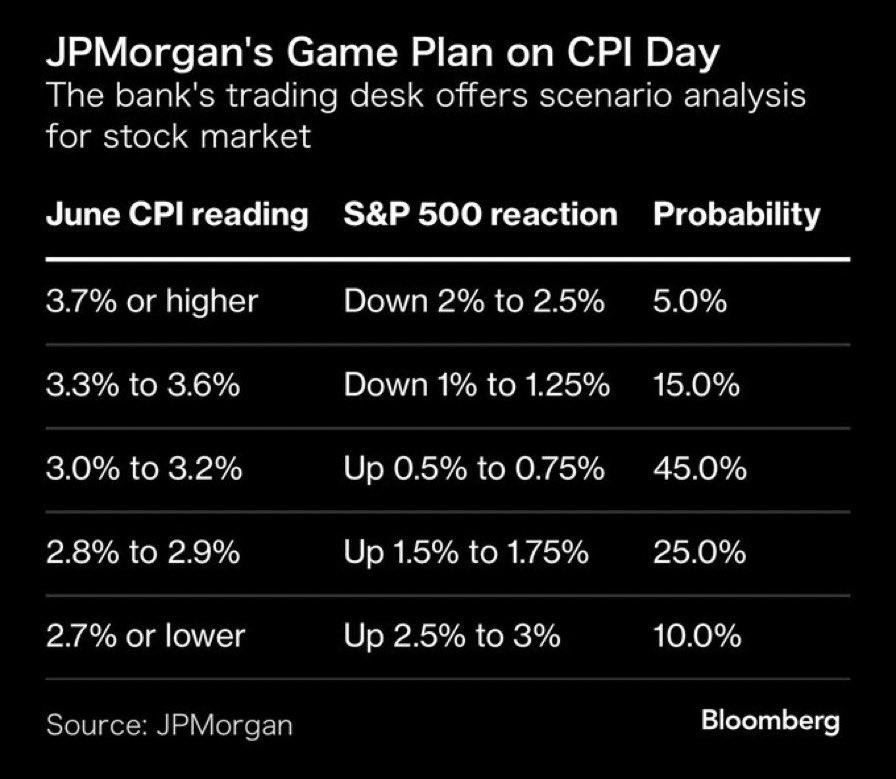

As ordinary, JP Morgan has drawn up a recreation plan for the S&P 500 in view of right this moment’s launch of the Shopper Worth Index. In line with the banking large, a drop within the CPI to three%-3.2% has the very best likelihood at 45%. The S&P 500 might then achieve between 0.5-0.75%.

The second-highest likelihood is given by JP Morgan to a drop within the headline CPI to 2.8% to 2.9% (25%). On this case, the S&P 500 might rise by 1.5-1.75%. Furthermore, the banking large provides a ten% probability to a fall of the CPI to 2.7% or decrease, whereas a surpassing of the forecasted studying (above 3.3%) is simply at 20%.

Potential Situations For Bitcoin

If the CPI figures are available greater than anticipated, signaling elevated inflationary pressures, BTC might face a short lived retreat. Within the case of CPI falling inside the predicted vary, BTC’s response could also be average. Buyers will intently monitor the information for indicators of sustained inflation, doubtlessly leading to a slight dip in Bitcoin’s value.

A lower-than-anticipated CPI determine, suggesting easing inflationary pressures, might ignite a bullish rally in BTC. Buyers could understand this as a optimistic sign which is signaling a continued charge pause by the Fed. A lower-than-expected core CPI studying has the potential to offer a much-needed enhance for Bitcoin.

At press time, the Bitcoin value has managed to interrupt above the mid-range resistance, buying and selling at $30,767.

Featured picture from iStock, chart from TradingView.com