Bitcoin (BTC) noticed a big resurgence over the previous few hours after hitting the bottom value since June 21 at $28,641 yesterday. At press time, BTC has skilled a 3.7% hike from its low. In truth, BTC even brushed previous the $30,000 mark, indicating a considerable shift in market sentiment. So, the query begs.

Why Is Bitcoin Up Right now?

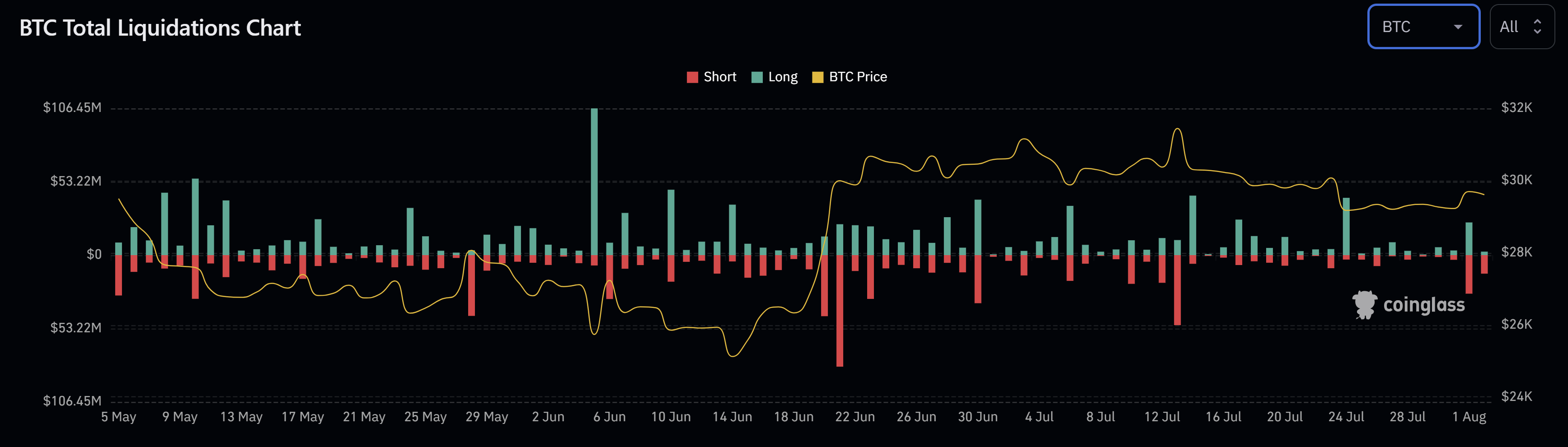

“The whole brief build-up of the previous couple days simply acquired wiped,” tweeted analyst Byzantine Common. Knowledge from Coinglass backs this declare and reveals that BTC brief positions amounting to $27.8 million had been liquidated yesterday, adopted by an extra $13.45 million at the moment. This accounts for essentially the most vital brief liquidation since July 14, undeniably taking part in a big position within the present value motion.

However maybe essentially the most influential cause for the sudden shift in market sentiment was MicroStrategy’s latest announcement. The corporate acknowledged that it’s going to conduct inventory gross sales price $750 million. After the announcement, the Bitcoin neighborhood was abuzz with hypothesis that Michael Saylor would possibly make further, gigantic BTC purchases.

“As with prior packages, we could use the proceeds for normal company functions, which embody the acquisition of Bitcoin in addition to the repurchase or reimbursement of our excellent debt,” mentioned Andrew Kang, MicroStrategy’s CFO throughout a latest earnings name. Whereas it stays unclear if your complete proceeds shall be funneled into Bitcoin, the probability of a considerable chunk is for certain. Immediately after this announcement, Bitcoin surged by 1.6% inside one hour.

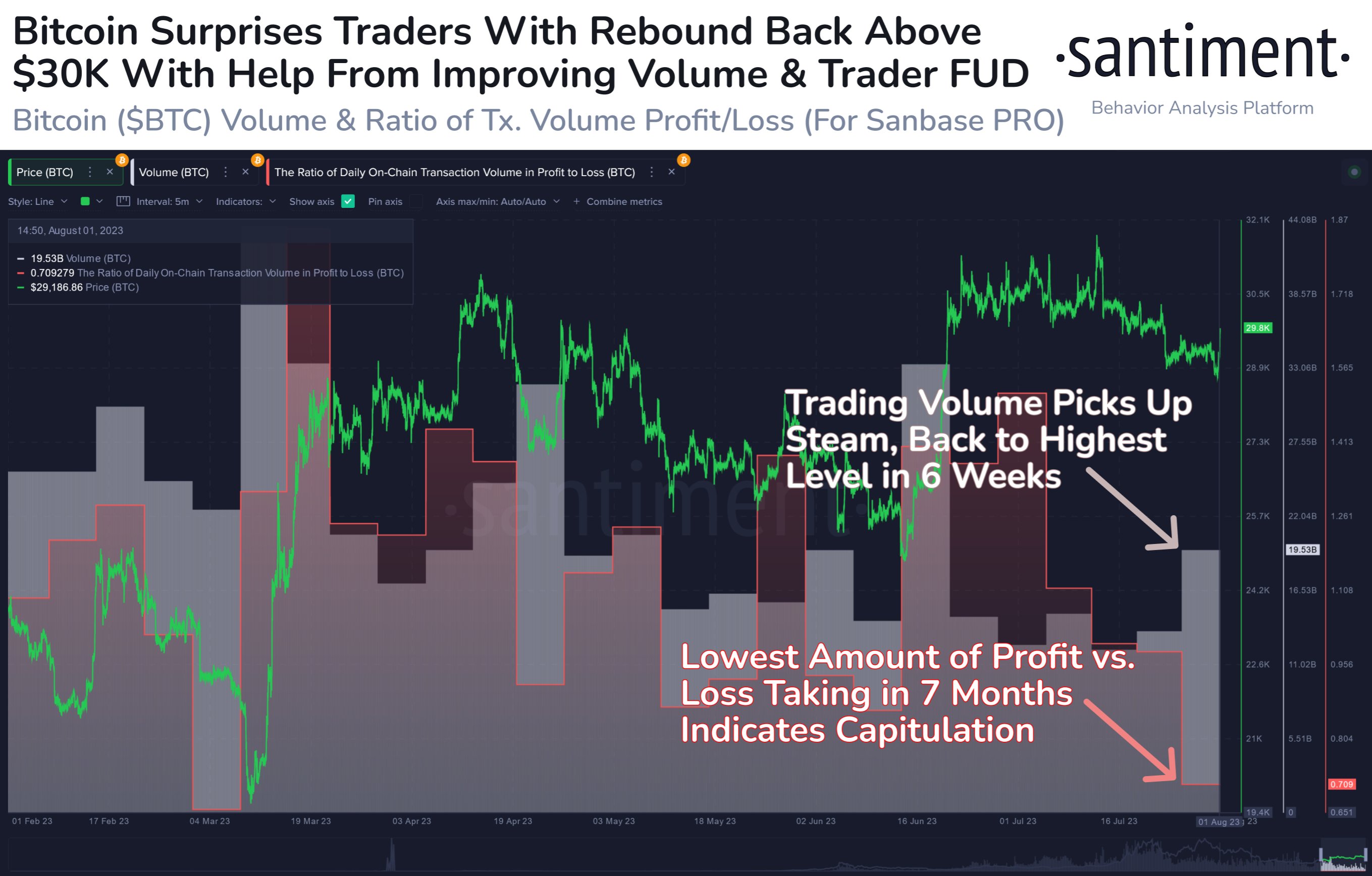

On-chain evaluation agency Santiment tweeted: “Bitcoin has breached again above $30k as soon as once more, with help from the various merchants who capitulated in the course of the previous week of value declines. Quantity is rising to kick off August, & this psychological resistance cross could shift sentiment optimistic.”

The chart shared by the agency reveals that yesterday buying and selling quantity picked up steam once more, rising to the best degree since six weeks. Additionally, the bottom quantity of revenue / loss taking in 7 months signifies a capitulation occasion.

Analyst @52Skew added that the Bitcoin on the Binance spot market skilled a “actual spot demand” which he wished to see for a robust value response. “Observe the restrict bid wall that pushed up value; typical with PvP situations to power restrict chasing. Marked notable liquidity on the orderbook,” the analyst acknowledged.

What’s Subsequent?

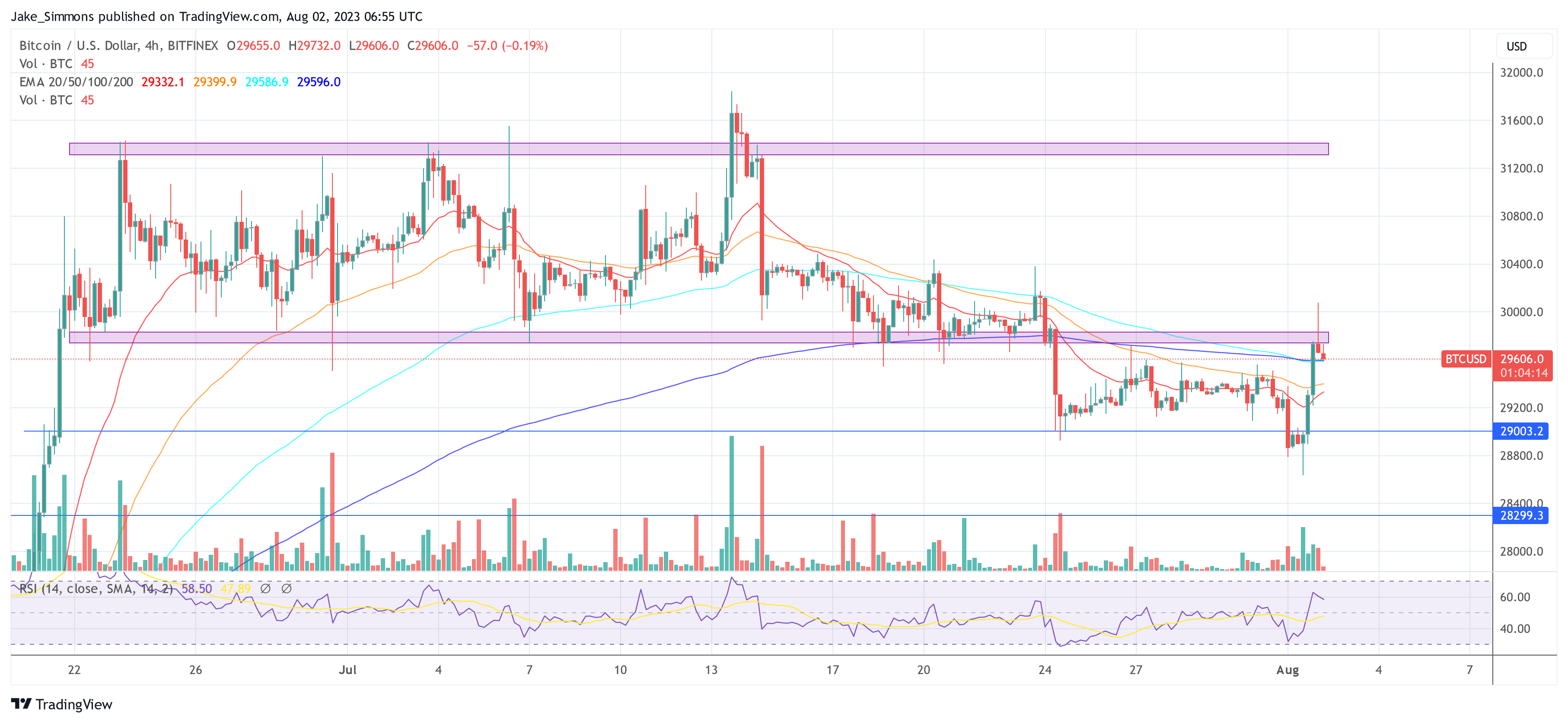

Nonetheless, he additionally cautioned that the 4-hour chart is to this point trying like a basic Swing Failure Sample (SFP) into the next time frame help / resistance. The Swing Failure Sample, or SFP, is a sort of reversal sample the place merchants goal stop-losses above a key swing low or beneath a key swing excessive to govern the worth course by producing sufficient liquidity.

However, the market seems to be brimming with anticipation. As per @DaanCrypto: “If value begins ranging right here I’d search for one other sweep of the lows and consolidation there. $28.5 & 29.5K are the areas of curiosity.” In the meantime, a break above the resistance zone on the month-to-month and weekly open between $29,236 and $29,300 would validate a bullish situation the place the worth targets $30,000.

At press time, BTC wasn’t in a position to reclaim the crimson resistance zone and was buying and selling at $29,606.

Featured picture from Kanchanara /Unsplash, chart from TradingView.com