Key Takeaways

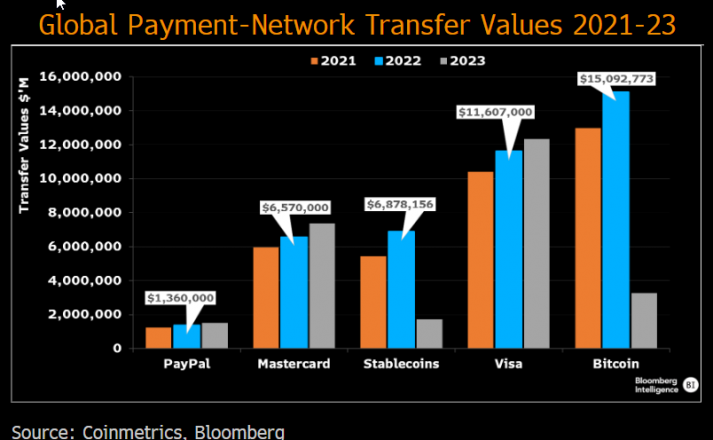

- In 2022, stablecoins on layer 1’s reached a $6.87T transaction quantity.

- Stablecoins have achieved increased adoption charges than Ethereum.

Share this text

In 2022, stablecoins on numerous layer 1 networks reached a transaction quantity of $6.87 trillion, overtaking conventional cost giants like Mastercard and PayPal. Comparative information from 2022 confirmed that Mastercard settled transactions value $6.57T, whereas PayPal settled transactions value $1.3T, based on information from Coinmetrics and Bloomberg.

Regardless of the challenges confronted by the broader crypto market in 2023, reminiscent of strict laws in the USA and persevering with bear market circumstances, the adoption charge of stablecoins like USDT and USDC is even increased than that of Ethereum. Since 2021, the variety of stablecoin addresses holding greater than $1 has grown seven occasions sooner than Ethereum addresses with the identical stability.

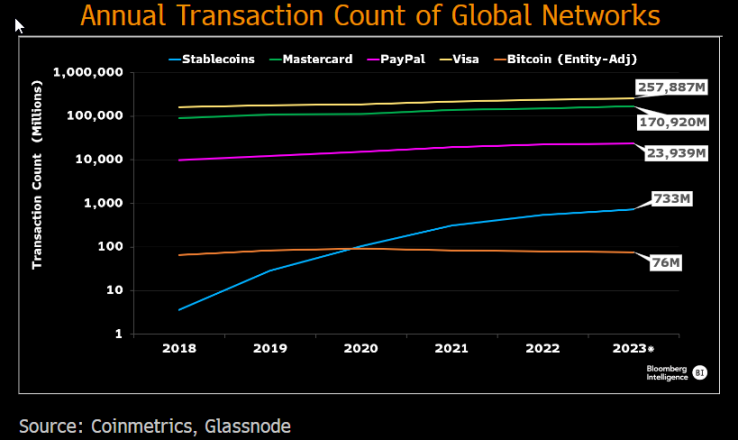

Whereas stablecoins have seen a substantial rise in adoption, their annual transaction rely stands at merely 0.5-3% of conventional cost networks, as per Coinmetrics and Glassnode statistics. One motive decentralized networks won’t be as extensively adopted may very well be the excessive transaction charges and throughput limitations of platforms like Ethereum.

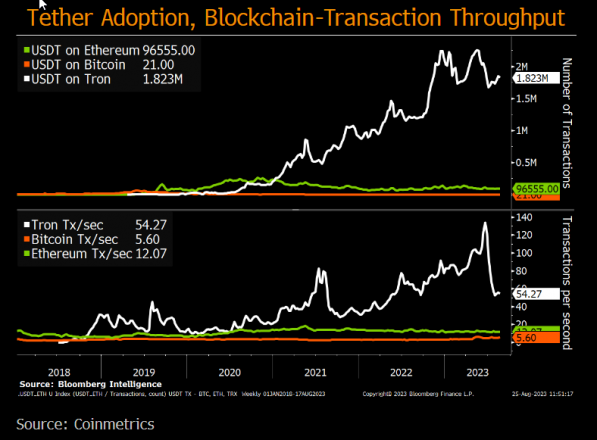

But, whereas Ethereum’s limitations might need been a bottleneck for stablecoin adoption, centralized networks like Tron counsel a unique narrative. By mid-2023, Tron’s reached 130 transactions per second (TPS), outperforming Ethereum’s present 30 TPS and facilitating practically 20 occasions extra USDT transactions, based on Coinmetrics.

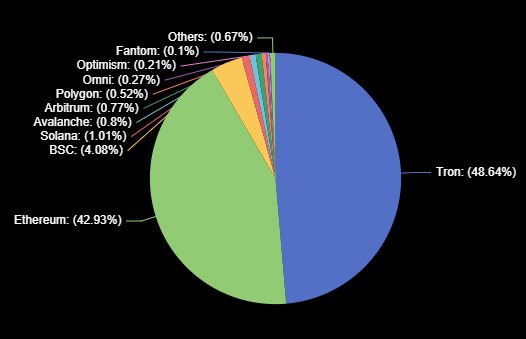

Nevertheless, whereas transaction pace is necessary, it’s not the one issue that markets contemplate. Whereas Tron may provide extra transactions per second, its centralization raises safety issues, stopping it from dominating the USDT market cap. Tether’s market cap in Tron is 48%, whereas the slower, costlier, however decentralized Ethereum has roughly 43% of the pie, based on Bloomberg Market Analyst, Jamie Coutts.