The Bitcoin value at the moment stays in a weak place. In the meantime, current on-chain information means that Bitcoin whales are accumulating, however opposite to common rumors, BlackRock isn’t amongst them. In the meantime, analysts are divided on whether or not the worst is behind for Bitcoin’s value.

Whales Accumulate Bitcoin, However It’s Not BlackRock

On-chain analyst James V. Straten not too long ago highlighted a pattern within the accumulation rating by cohort chart. He remarked, “Looks as if peak Bitcoin distribution is behind us, as we will see a slight tick-up in accumulation. That is probably the most aggressive accumulation since June/July for whales which have over 10k BTC.”

Nonetheless, the waters are muddied by rumors surrounding BlackRock’s involvement. Hypothesis has been rife that BlackRock has been suppressing Bitcoin costs to purchase low cost. However these claims are unfounded. “Many people don’t understand that BlackRock would require precise Bitcoin to again their Spot ETF. They could have already bought their Bitcoin months in the past when costs have been decrease,” is an announcement that’s been debunked.

The fact is that BlackRock, being a monetary behemoth managing individuals’s cash, undergoes audits each three months. This implies they will’t disguise Bitcoin purchases from auditors. In the event that they have been to spend money on Bitcoin, it might be by means of an exchange-traded fund.

In actual fact, BlackRock has already proven curiosity within the area by investing in Bitcoin mining shares and MicroStrategy as a proxy. Remarkably, BlackRock is a serious shareholder in 4 out of the 5 largest Bitcoin mining corporations.

Is The Worst Behind For BTC Worth?

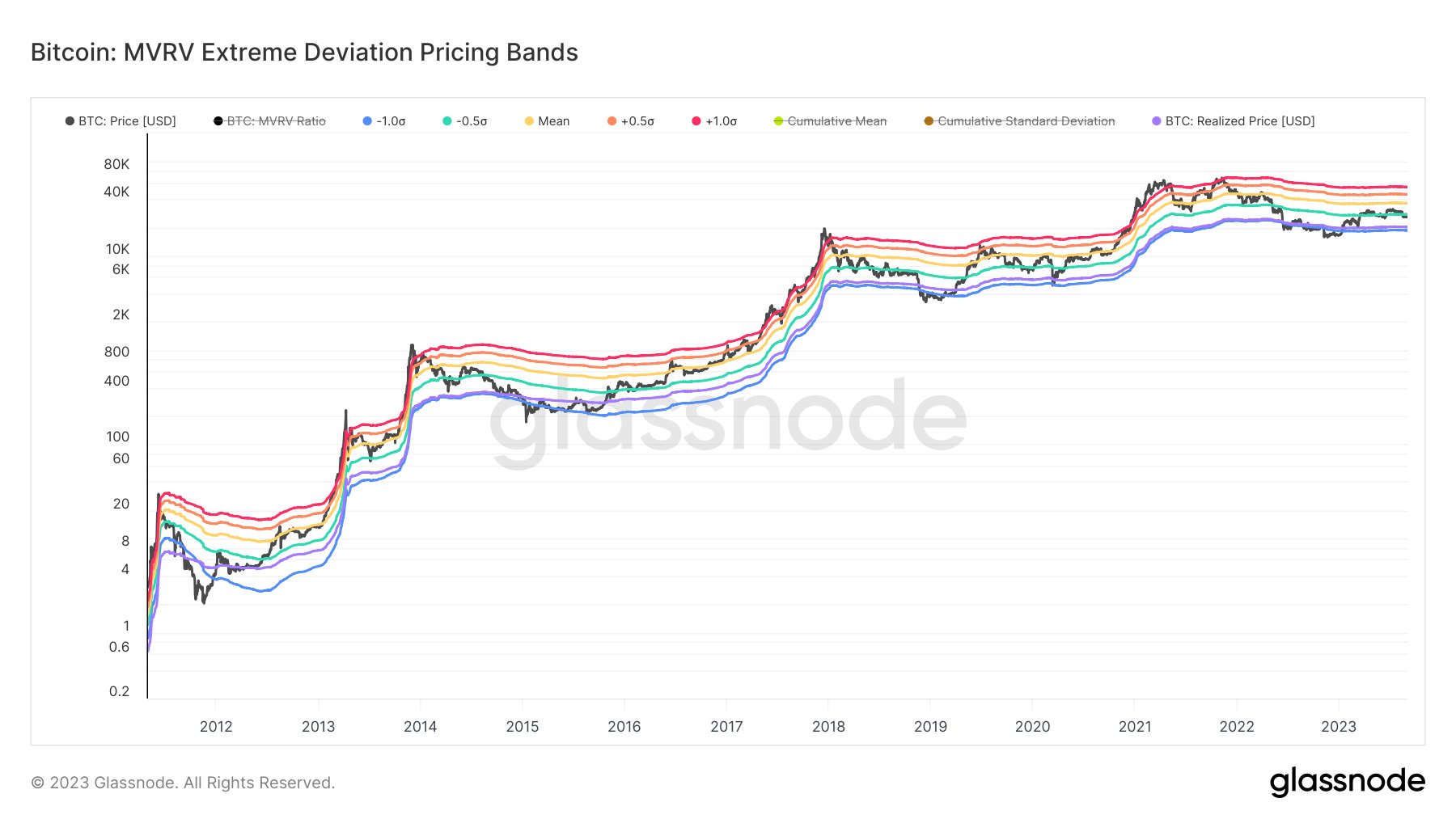

The Bitcoin value trajectory stays a subject of intense debate amongst analysts. Will Clemente, a outstanding determine within the area, shared the chart under and commented, “From a high-time-frame valuation perspective, Bitcoin’s place is intricate. Whereas it’s not overheated relative to historic values, there’s a tangible threat of retesting the lows akin to Q1 2020.”

He additional emphasised the prevailing market apathy, pointing to the bottom aggregated buying and selling quantity since 2020, the dwindling Google search traits for Bitcoin at multi 12 months lows and realized volatility, implied volatility, weekly Bollinger Bands all close to report lows.

Joe Burnett of Blockware Options chimed in with a compelling observation, “A staggering 94.6% of all Bitcoin remained stationary within the final 30 days. We set a report excessive at August’s finish, and this would possibly quickly be surpassed. Traditionally, bear markets conclude when provide dries up. A mere spark of demand may ignite the subsequent explosive bull market.”

Crypto merchants, too, are carefully monitoring key ranges. @DaanCrypto remarked the importance of the $26K-26.1K vary because it marks the day by day, weekly and month-to-month open, excessive quantity node and weekly VWAP. Subsequently, for bulls, it’s the road of motion, and for bears, it’s the fortress to defend.

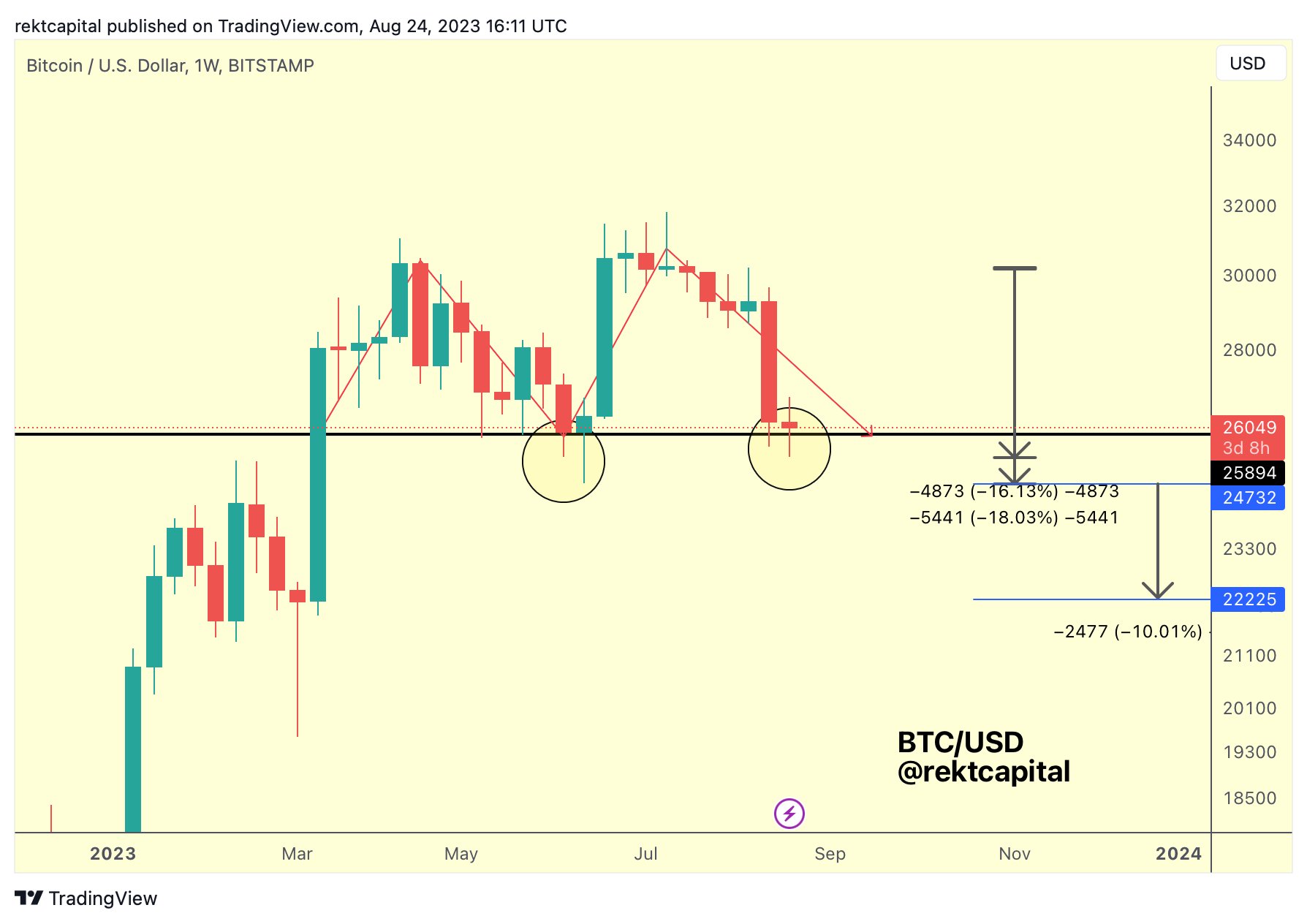

Rekt Capital, a well-regarded crypto analyst, has been carefully monitoring Bitcoin’s value motion, particularly in relation to its quantity dynamics. He additionally highlights the importance of the $26,000 assist stage on the weekly chart, declaring that Bitcoin’s value has been hovering round this mark even after retracing most of its features from the earlier Grayscale rally.

Nonetheless, the simultaneous decline in each buy-side and sell-side volumes is a trigger for concern, suggesting a market that’s at the moment directionless. “The declining sell-side quantity coupled with a lackluster purchaser quantity is regarding. And not using a quantity breakout, neither from sellers nor patrons, the market lacks momentum,” the analyst states.

On the subject of the double prime, a historically bearish sample, Rekt Capital indicated {that a} breach under the $26,000 mark on the weekly chart may doubtlessly ship BTC tumbling in the direction of $22,000. Nonetheless, he additionally hinted at a silver lining: an inverse head and shoulders sample noticed earlier this 12 months. If Bitcoin approaches the $24,000 mark, which serves because the neckline for this sample, it may act as a strong assist and probably sign a bullish turnaround.

At press time, BTC traded at $25,734.

Featured picture from Mike Doherty / Unsplash, chart from TradingView.com