Solely 7% of customers who first work together with Ethereum will proceed to take action even after a yr, newest Token Terminal data on October 9 reveals. This statistic signifies that roughly 93% of customers will cease utilizing the platform to switch tokens or deploy sensible contracts inside a yr. This implies that the platform (or its underlying know-how) remains to be perceived to be advanced, or customers won’t be too keen to interact and work together.

Ethereum Is Struggling With Consumer Retention

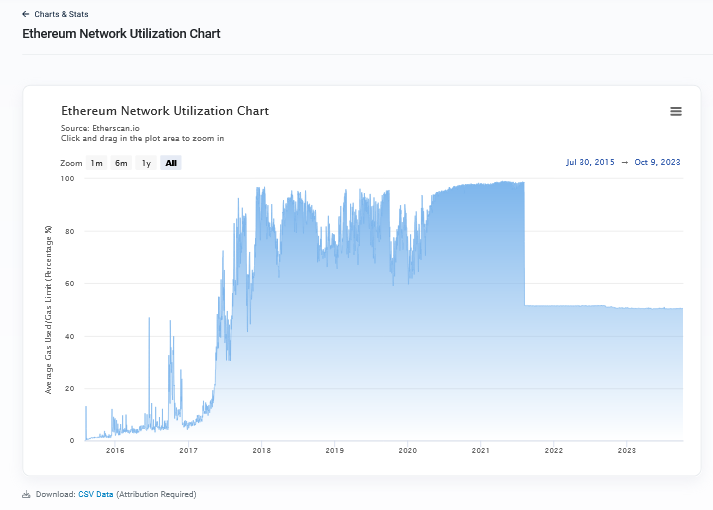

Regardless of its clear lead and recognition, what might disincentivize customers from utilizing Ethereum shouldn’t be instantly clear. Token Terminal, an analytics platform, posted a graph exhibiting fast-falling curiosity over time based mostly on information collected between August 2015 and October 2023.

Ethereum first launched in July 2015. Nevertheless, its builders have repeatedly enhanced the platform, making it extra performant, particularly emphasizing bettering scalability.

The ledger is the primary to permit customers to launch decentralized functions (dapps). These protocols are immutable and powered by sensible contracts in a typically safe surroundings guided by globally distributed validators.

The distribution and decentralization of validators imply protocols launching on Ethereum, akin to Uniswap, are censorship-resistant. Ethereum is widespread due to Ether (ETH), its native foreign money, now the second most precious coin after Bitcoin. Past this, the chain anchors decentralized finance (DeFi), non-fungible token (NFT) actions, and others.

Scalability, Safety, And Complicated Consumer Interfaces Can Discourage Interplay

Whereas the prominence of Ethereum is clear, and billions of transactions are moved by the platform yearly, the community struggles with on-chain scalability. At peak, the blockchain can solely course of 15 transactions each second.

Subsequently, transaction charges are comparatively greater because the demand for block house can also be excessive. As of October 10, the community utilization charge stood above 50%, which means extra customers demand a slot in each block house added to the Ethereum blockchain. The excessive demand interprets to extra charges than these noticed in competing networks like Solana or TRON, that are extra scalable.

The potential of excessive fuel charges dampening engagement will be one issue. A stage deeper, challenges associated to consumer interfaces, hacks of protocols deploying on Ethereum, and rising competitors, even from conventional functions, would possibly clarify why customers are giving up or contemplating alternate options.

Customers depend on non-custodial wallets like MetaMask to straight interact with the community. The necessity to obtain and set up a third-party utility earlier than posting transactions or swapping can discourage some from continuing.

Characteristic picture from Canva, chart from TradingView