Bitcoin (BTC) has been locked in a decent buying and selling vary, fluctuating between $30,000 and $31,000. Whereas some on-chain metrics present that this ongoing sideways motion has been noticed earlier than Bitcoin’s earlier bull runs, there’s little to point {that a} vital shift might occur quickly.

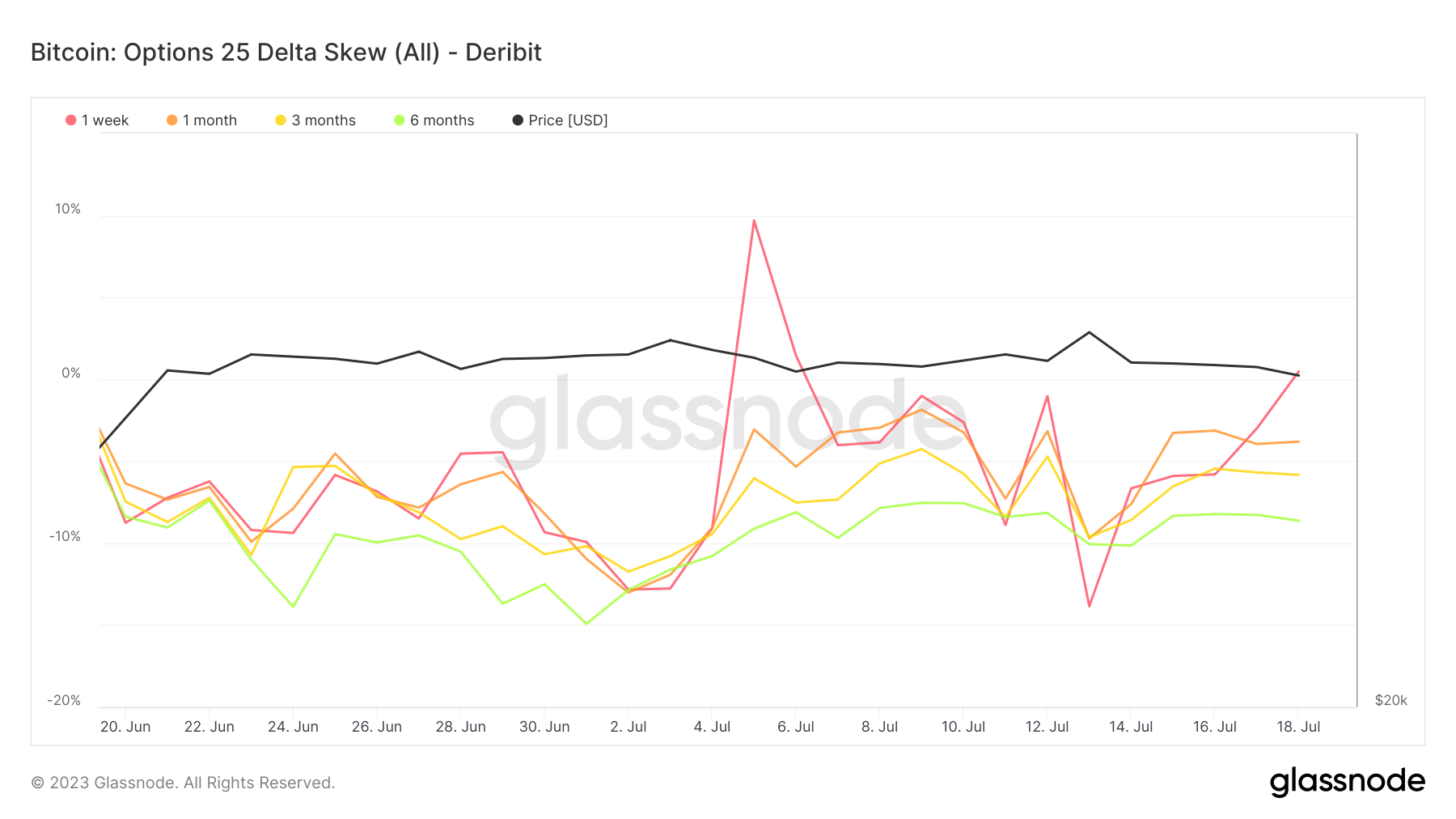

The derivatives market, significantly the choices market, reveals a divided sentiment about Bitcoin’s efficiency. This division is clear when analyzing Bitcoin choices delta skew. The delta skew for choices contracts expiring one week, one month, three months, and 6 months from now’s 0.48%, -3.8%, -5.83%, and -8.62%, respectively.

Delta skew, also referred to as the “skew” or “threat reversal,” is a measure of market sentiment usually used within the choices market. It measures the distinction in implied volatility between out-of-the-money (OTM) places and OTM calls.

If the market is bullish, OTM name choices (choices to purchase above the present value) could have increased implied volatility than OTM put choices (choices to promote beneath the present value) as a result of merchants are keen to pay extra for the prospect to purchase the asset at the next value sooner or later, anticipating the worth to rise. This case ends in a optimistic delta skew.

Conversely, if the market is bearish, OTM put choices could have the next implied volatility than OTM name choices, leading to a unfavorable delta skew. On this case, merchants are keen to pay extra for the prospect to promote the asset at the next value sooner or later, as they anticipate the worth to fall.

The 0.48% delta skew for Bitcoin choices expiring in a single week is barely optimistic, indicating considerably bullish to flat sentiment for BTC within the brief time period. Nonetheless, the delta skew for choices expiring in a single month, three months, and 6 months is unfavorable (-3.8%, -5.83%, and -8.62%, respectively), suggesting that the market sentiment turns into more and more bearish over the long term. Merchants are keen to pay extra for the prospect to promote Bitcoin at the next value sooner or later, anticipating the worth to fall.

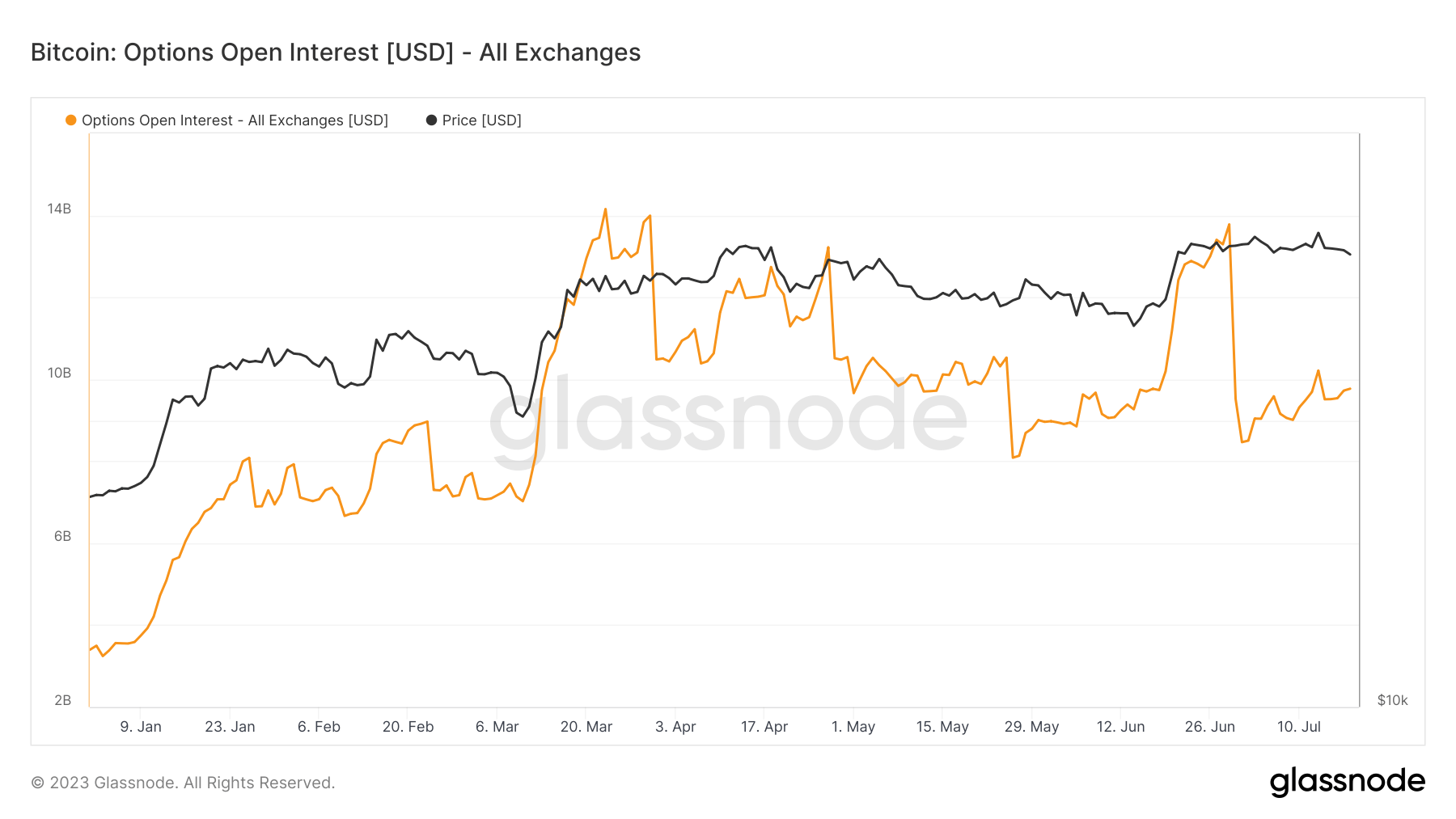

This divided sentiment contrasts with the construction of the overall open curiosity for Bitcoin name choices, which stands at $9.7 billion. Open curiosity refers back to the complete variety of excellent choices contracts that haven’t been settled. It’s a essential metric that displays cash movement into the derivatives market.

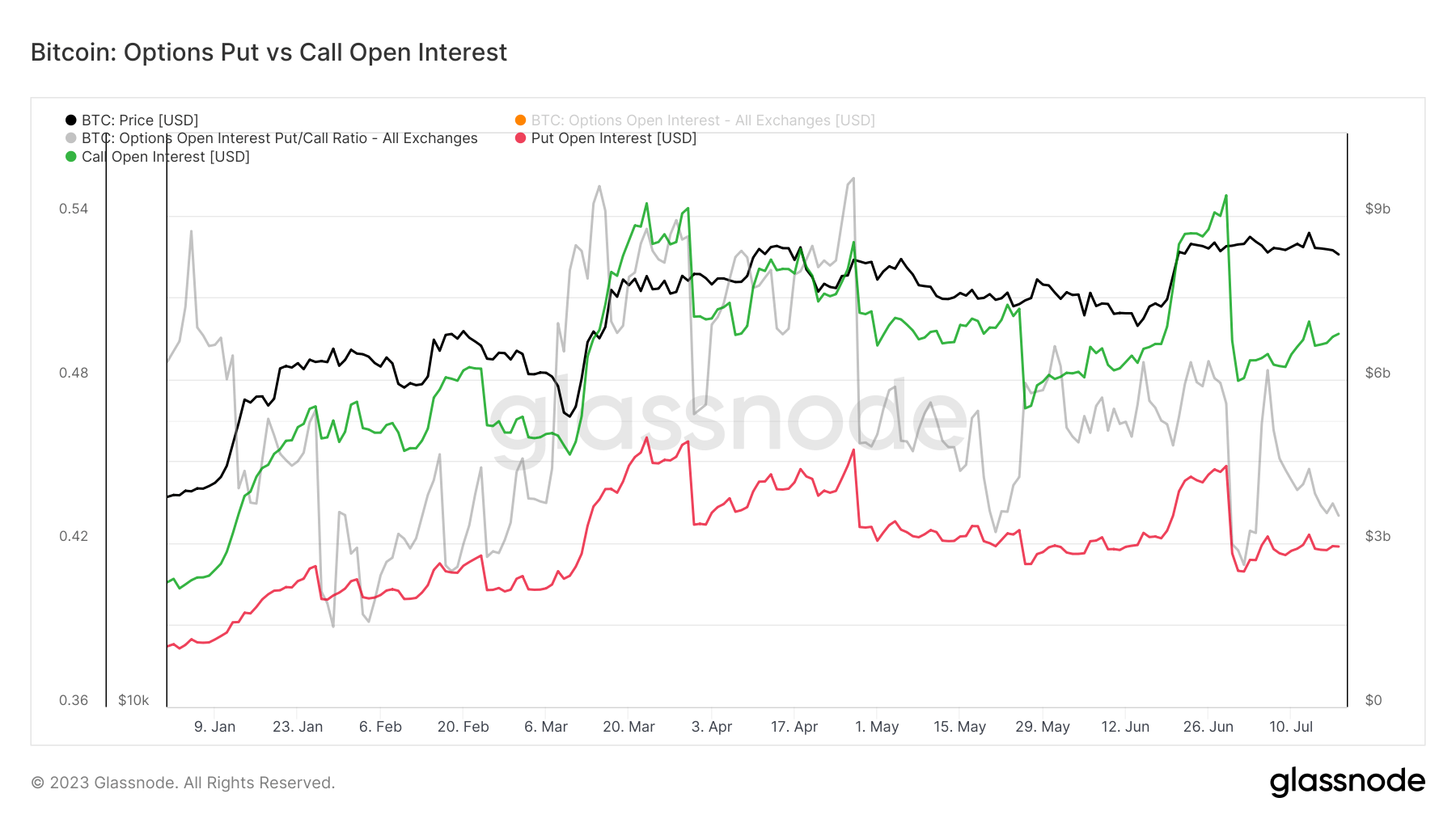

The overall open curiosity for Bitcoin calls is $6.93 billion, considerably increased than the open curiosity for places, which is $2.83 billion. This discrepancy might recommend that merchants are usually extra bullish on Bitcoin, anticipating the worth to extend, therefore the upper variety of name choices.

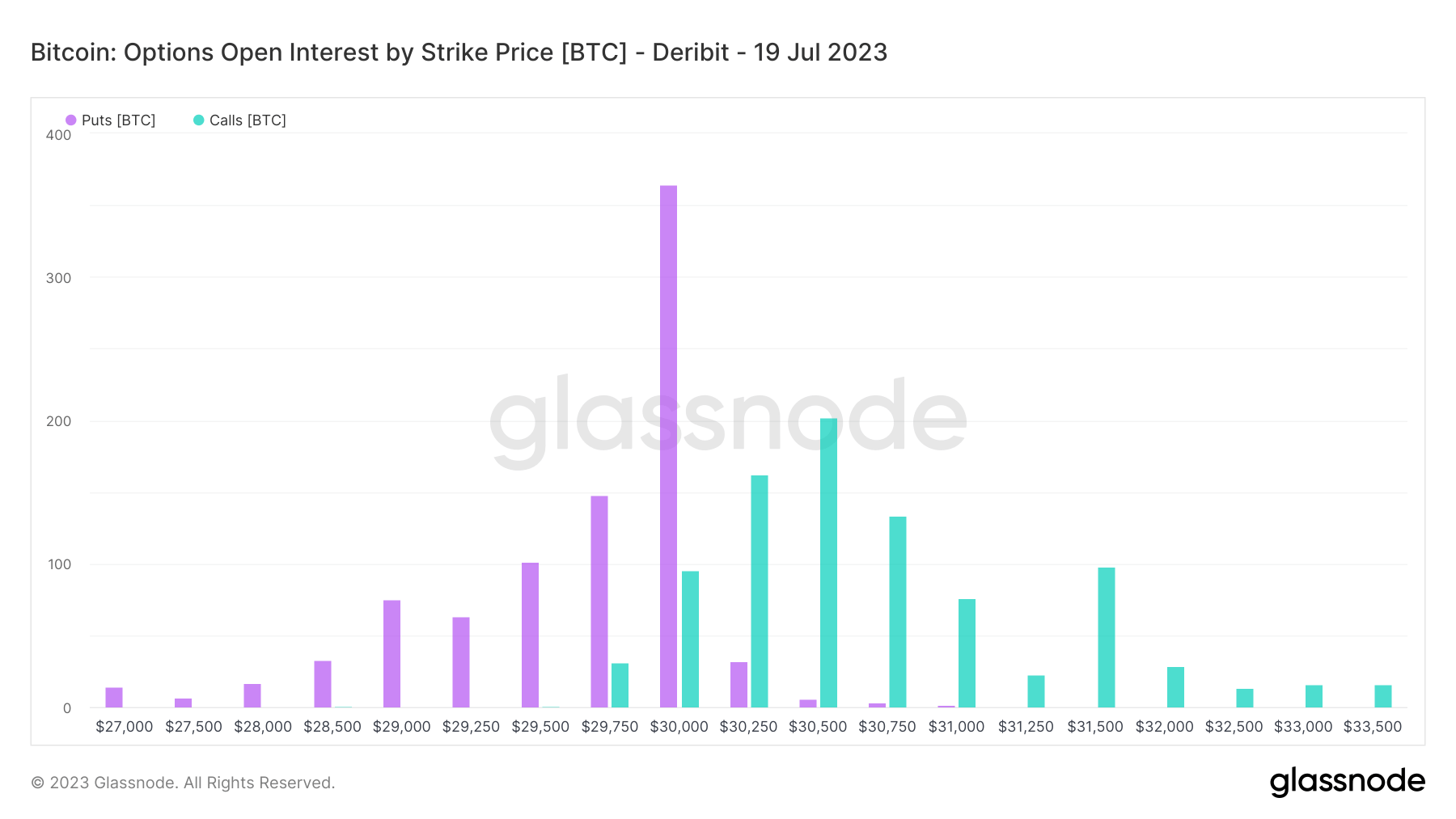

Nonetheless, the open curiosity of name and put choices by strike value for choices contracts expiring on July 19 exhibits a special story. An equal quantity of open curiosity, 365.4 BTC, is betting that BTC will fall beneath $30,000 and rise above $30,250-$30,500. This stability of curiosity signifies a market at a standstill, reflecting Bitcoin’s present value degree.

In conclusion, the indecisive derivatives market is conserving Bitcoin flat. Whereas some merchants are bullish, anticipating a value improve, an equal quantity are bearish, betting on a value lower. This division helps Bitcoin in a decent buying and selling vary, with little indication of a big shift within the coming days.

Opposite to the bearish sentiment mirrored within the choices market, long-term forecasts by some specialists recommend a extra bullish viewpoint, with merchants seemingly able to experience out the present flat market in anticipation of future value rises.

The submit An indecisive choices market retains Bitcoin flat appeared first on CryptoSlate.