Whereas many of the market focuses on Bitcoin’s worth volatility, a a lot larger downside appears to go unnoticed.

The centralization of Ethereum has been one of many hottest subjects within the crypto business because the community’s change to Proof-of-Stake, with many critics warning in regards to the risks of such a excessive market cap cryptocurrency counting on solely a handful of centralized validators.

Because the coveted mining ban in China, the centralization of the Bitcoin community largely disappeared from mainstream discussions and have become the main target of a distinct segment group within the mining sphere.

Nevertheless, Bitcoin’s centralization is an issue that considerations your complete market, particularly now when solely two mining swimming pools produce nearly all of its blocks.

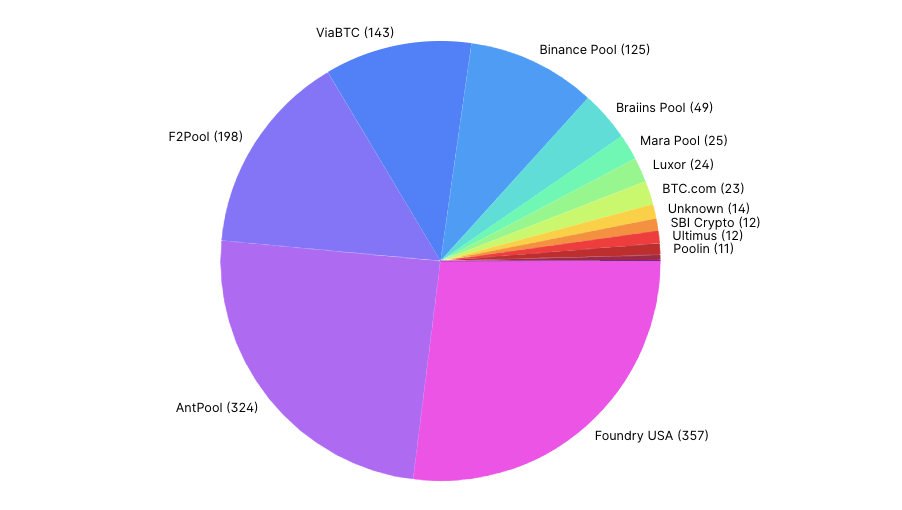

CryptoSlate checked out Bitcoin’s world hash fee distribution and located that greater than half of it got here from Foundry USA and Antpool.

The 2 swimming pools mined over 1 / 4 of Bitcoin blocks up to now ten days every. Since mid-December, Foundry USA mined 357 blocks, whereas Antpool mined 325. Foundry’s block manufacturing accounted for 26.98% of the community, whereas Antpool was answerable for slightly below 24.5% of the whole block manufacturing.

Antpool has been on the forefront of Bitcoin mining for years and produced virtually 14% of the blocks mined up to now three years. However, Foundry is a comparatively new title within the mining house. Nevertheless, it rapidly rose to change into one of many high ten swimming pools by hash fee, accounting for 3.2% of the blocks mined up to now yr.

A deeper have a look at Antpool and Foundry USA exhibits an alarming degree of centralization — and an online of interconnected firms that successfully personal half of the community.

Foundry — DCG’s mining behemoth

It took lower than two years for Foundry USA to change into a power to be reckoned with within the Bitcoin mining house. The mining pool is owned and operated by the eponymous Foundry, an organization Digital Forex Group (DCG) created in 2019.

By late summer time 2020, Foundry was already among the many largest Bitcoin miners in North America. Other than mining, the corporate supplied tools financing and procurement. By the top of 2020, Foundry helped procure half of all of the Bitcoin mining {hardware} delivered to North America.

Foundry’s large success as an tools procurer and miner immediately outcomes from DCG’s affect within the crypto business.

The enterprise capital agency is among the house’s largest and most lively buyers, backing greater than 160 crypto firms in over 30 international locations. DCG’s portfolio is a registry of the business’s largest gamers — Blockchain.com, Blockstream, Chainalysis, Circle, Coinbase, CoinDesk, Genesis, Grayscale, Kraken, Ledger, Lightning Community, Ripple, Silvergate, and dozens extra.

Foundry is its wholly-owned subsidiary that acts as a one-stop store for all of those firms’ mining wants. The fast development in Foundry USA’s hash fee led some to take a position that DCG’s firms had been contractually obligated to do all of their mining via Foundry’s pool. Nevertheless, it’s necessary to notice that neither DCG nor any firms in its portfolio confirmed this.

The mining ban instated in China final yr helped as nicely.

Pressured to depart China’s plentiful and low cost hydropower, miners had been on the lookout for different areas providing not less than a fraction of their revenue and a extra welcoming regulatory surroundings.

The U.S. introduced as an ideal relocation spot, providing miners a wide array of areas and energy sources. And having a mining pool as giant as Foundry USA at their doorstep definitely didn’t damage.

Antpool — Bitmain’s monopoly

Based in 2014, Antpool is among the oldest working mining swimming pools in the marketplace. Steadily accounting for over 1 / 4 of the worldwide hash fee, Antpool has virtually by no means left the highest ten largest mining swimming pools.

The pool’s success is its excellent vertical integration — it’s owned and operated by Bitmain, the world’s largest mining {hardware} producer. The corporate behind the Antminer sequence has equipped its pool with the most recent and most effective Bitcoin hashers, serving to it keep worthwhile even within the coldest crypto winters.

Bitmain’s affect over the worldwide crypto market has led many to take a position that the corporate was obligating its giant consumers to mine with Antpool. With each Bitmain and Antpool having headquarters in China, many additionally fear in regards to the nation’s affect over such a big portion of Bitcoin’s hash fee.

The corporatization of crypto mining

It’s necessary to notice {that a} mining pool differs from a personal mining operation. Not like a personal miner, a pool represents the joint hash fee of many machines owned by varied entities.

Homeowners of mining machines, or hashers, break up the earnings generated by the mining pool in line with the scale of their contribution.

That Foundry USA accounts for 1 / 4 of the Bitcoin hash fee doesn’t imply that DCG owns each machine that produced it.

Nevertheless, Foundry gives the muse and the roof for its shoppers’ mining operations. The corporate’s weaknesses might shake up a good portion of the Bitcoin community and go away hundreds of smaller miners and machines fending for themselves if it had been to close down.

The identical will be utilized to Antpool.

The speed of centralization these two entities imposed on the business turns into even larger when trying past simply Bitcoin. Antpool has swimming pools for different cryptocurrencies as nicely — Litecoin (LTC), ZCash (ZEC), Bitcoin Money (BCH), Ethereum Traditional (ETC), and Sprint (DASH), simply to call a couple of.

Foundry gives enterprise staking help for Ethereum (ETH), Solana (SOL), Polkadot (DOT), Avalanche (AVAX), and Cosmos (ATOM). The corporate doesn’t disclose the variety of belongings it manages.