On Dec. 13., an additional decline of CPI to 7.1% was met by an anticipated rally in equities and a drop within the U.S. greenback and treasury yields. On Dec. 14., Powell elevated rates of interest by 50bps to a brand new federal funds price goal of 4.25%-4.5%.

Encouraging CPI

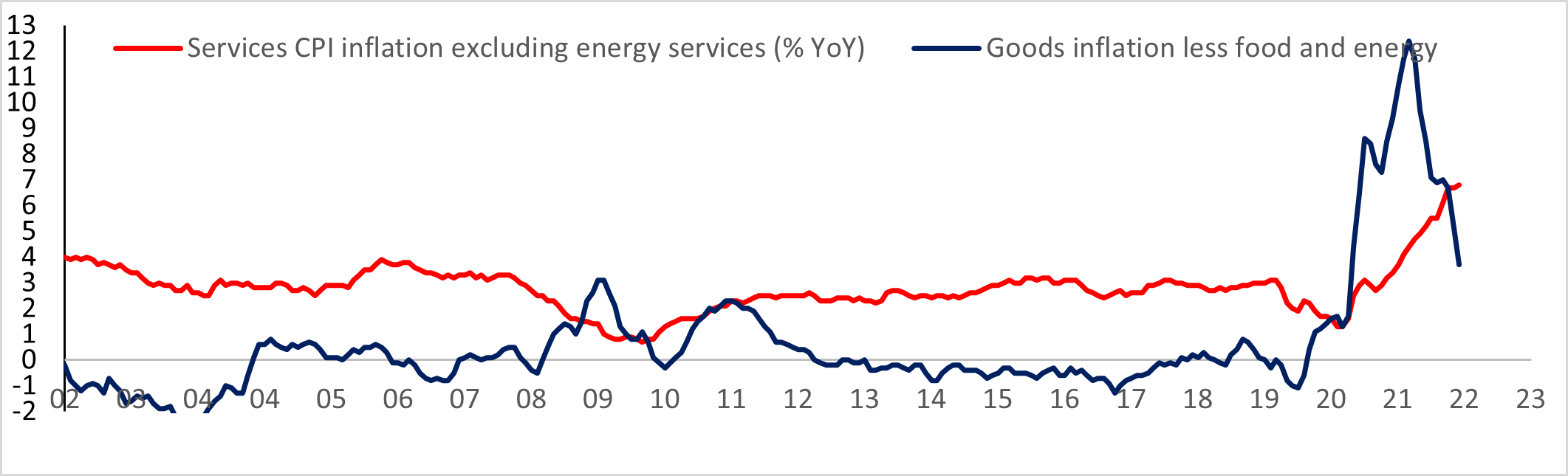

Headline inflation slowed from 7.7% to 7.1%, offset by a decline in core good costs by 0.5% and a 1.6% decline in power costs.

Core items inflation continued to lower to simply beneath 4% from its peak in February, above 12%. Nevertheless, companies inflation which excludes power rose to six.8%. Providers inflation will keep elevated because the job market continues to be resilient within the U.S.; nevertheless, that might change in 2023.

Powell stays hawkish

The fed raised charges by an anticipated 50bps to set the brand new fed funds goal of 4.25%-4.5%, and the tone from Powell stays unchanged “ongoing” price hikes and “we are going to keep the course till the job is finished”. Powell expects inflation to proceed declining slowly because the labor market stays tight. 55% of core CPI continues to be rising quickly though home and items costs are dropping quickly.

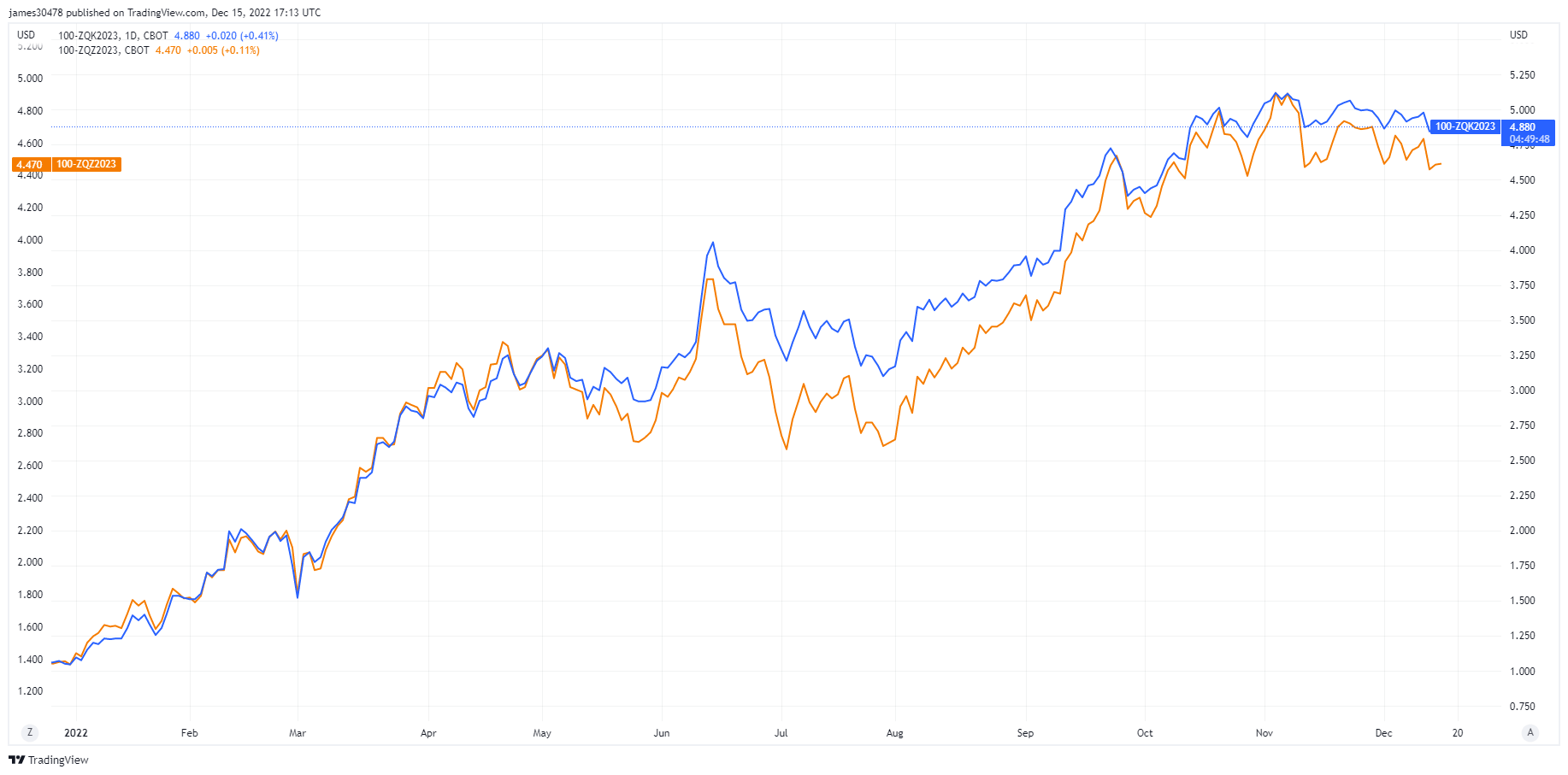

The market continues to struggle the fed and disagree on futures feds funds charges. The market is projecting a peak within the fed funds price of 4.8% in Might 2023, with a decline to 4.5% by December 2023.

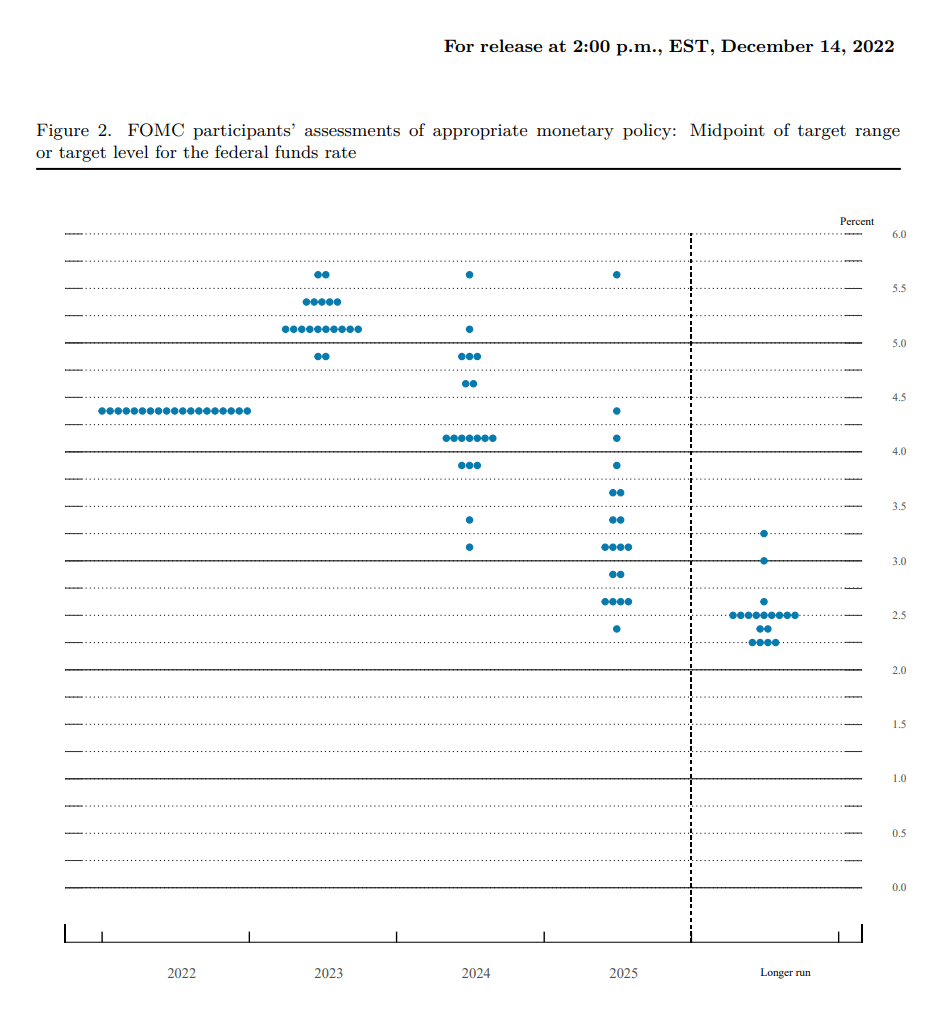

Based on the DOT plot, which exhibits the projections for the federal funds price, every dot represents the view of a Fed policymaker. The fed has a better projected funds price than the market on the finish of 2023, revised from 4.6% to five.1%; seven fed officers mission a price above 5.1% and ten above 5%.

Different notable price hikes

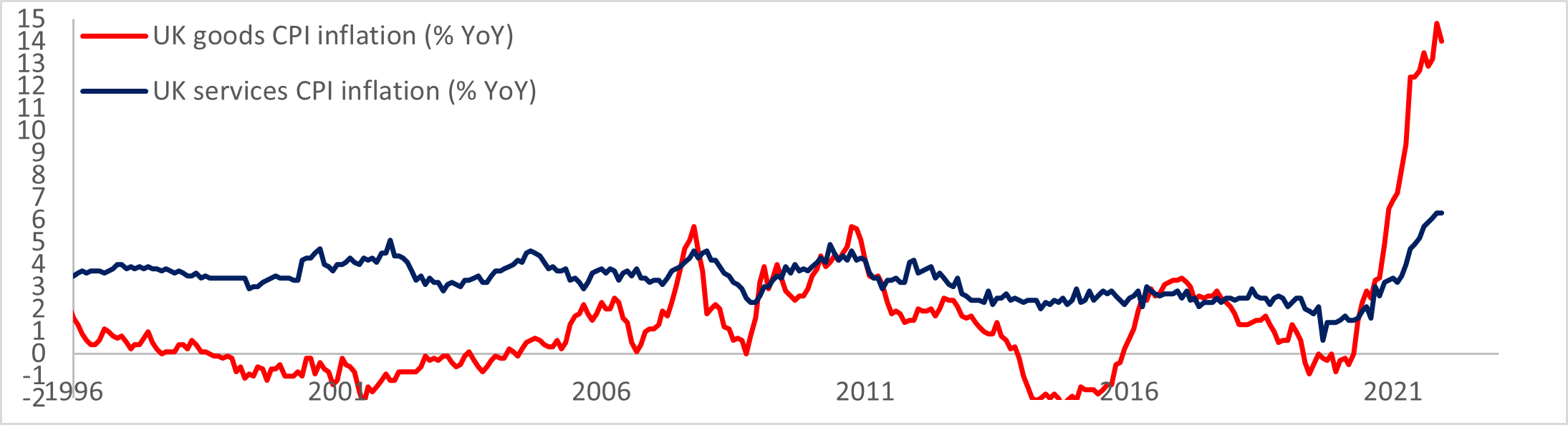

The Financial institution of England delivered a 50bps price hike on Dec.15 to boost the financial institution price to three.5%. This was the ninth consecutive rate of interest hike from the BOE. As well as, inflation might have peaked within the U.Ok. as inflation expectations beat market estimates as inflation dropped from 11.1% to 10.7%, with the core price falling to six.3% from 6.5%.

As well as, the ECB elevated rates of interest from 1.5% to 2% and introduced a plan to shrink its steadiness sheet.

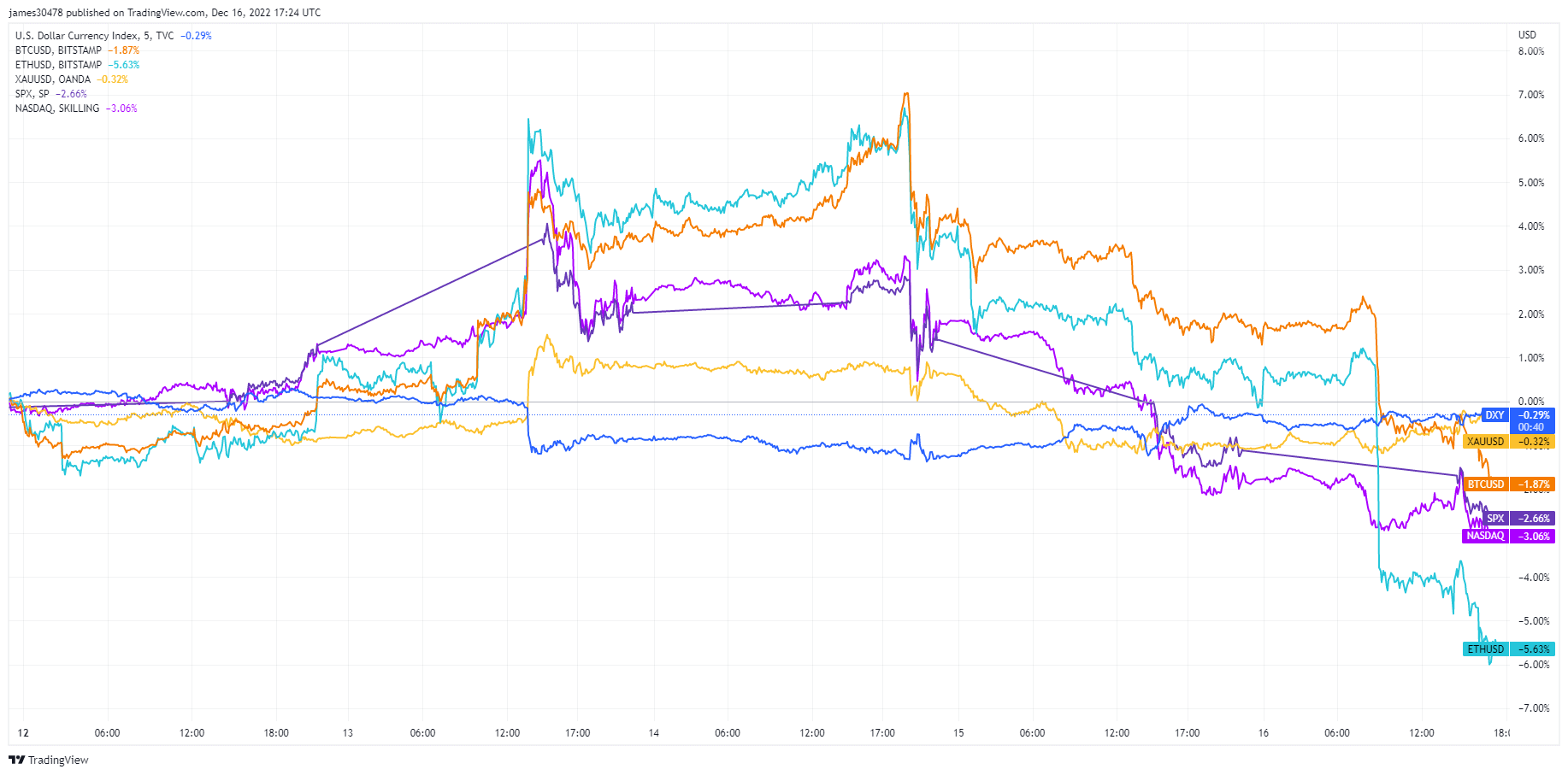

Asset overview: week commencing Dec. 12

From Dec. 12 to Dec. 15, BTC had been the best-performing asset in comparison with its friends, nevertheless, BTC and ETH made new lows for the week on Dec. 16.

- BTC: -1.85%

- ETH: -5.60%

- Gold: -0.33%

- DXY: -0.39%

- SPX: -2.0%

- Nasdaq: -2.76%