Knowledge exhibits whereas Bitcoin has been correlated with the US inventory marketplace for a while now, the 2 haven’t moved in tandem not too long ago.

Bitcoin Correlation With US Shares Might Be Weakening As BTC Has Been Transferring In another way

As identified by an analyst in a CryptoQuant put up, BTC has gone down previously week whereas shares have made some beneficial properties.

A “correlation” between two property (or markets) exists when each their costs observe the identical basic pattern over a time frame.

For Bitcoin, there was a robust correlation with the US inventory market over the past couple of years or so. The explanation behind the markets changing into so tied is the rise of institutional traders within the crypto.

Such traders view BTC as a threat asset and pull out of the coin as quickly as there’s macro uncertainty looming over the market (therefore driving the crypto’s worth down together with the shares).

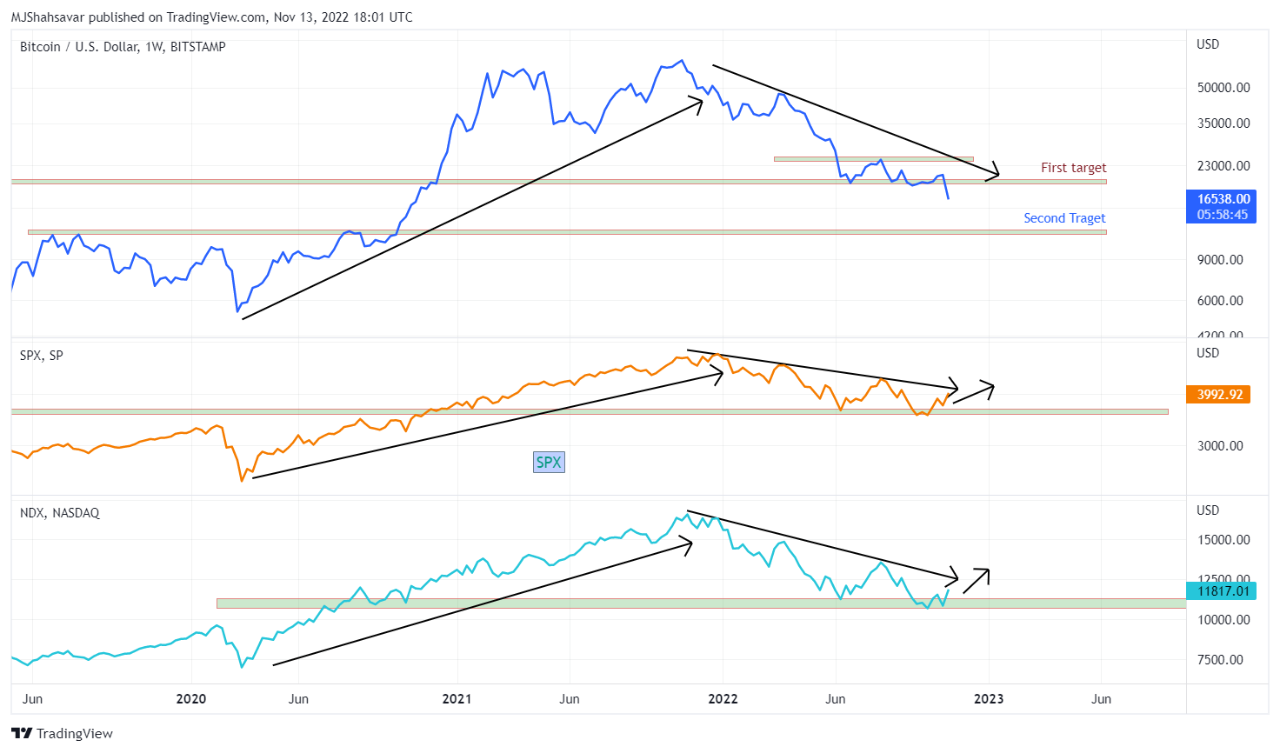

Here’s a chart that exhibits the costs of Bitcoin, S&P 500, and NASDAQ over the previous couple of years:

Seems to be just like the property have adopted related tendencies in current instances | Supply: CryptoQuant

As you may see within the above graph, Bitcoin wasn’t correlated with the inventory market in 2019 and early 2020, but it surely all modified when COVID struck.

After the black swan crash that occurred in March 2020, the worth of BTC began following S&P 500 and NASDAQ.

Although, whereas BTC confirmed a similar basic long-term pattern, the crypto continued to be far more extremely risky than the shares.

The correlation has continued by means of the bear market, however the final week or so has turned out completely different.

Whereas the US inventory market has seen some uplift previously 7 days, Bitcoin has as an alternative taken a pointy plummet.

These markets displaying completely different conduct not too long ago might counsel the correlation between them could also be decreasing.

With the newest plunge, BTC has additionally misplaced the assist line of the earlier all-time excessive, one thing that has by no means occurred within the earlier cycles.

The quant within the put up notes that this current pattern is an indication of weak point within the crypto market, which might result in additional downtrend within the close to future.

BTC Worth

On the time of writing, Bitcoin’s worth floats round $16.5k, down 20% within the final week. Over the previous month, the crypto has misplaced 15% in worth.

The beneath chart exhibits the pattern within the worth of the coin during the last 5 days.

The worth of the crypto appears to have remained beneath $17k in current days | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com