Unspent Transaction Outputs (UTXOs) are sometimes called the basic constructing block of Bitcoin. Because the Bitcoin community is constructed on an accounting mannequin based mostly on unspent outputs, they can be utilized to measure the general state and progress of the community.

Adjustments within the cumulative worth settled by means of UTXOs, their quantity, and the proportion of them in revenue or loss can point out the place the community stands and the place it’s heading.

What are UTXOs?

Put bluntly, an unspent transaction output is the quantity of BTC that is still after each transaction. Each time a Bitcoin transaction takes place, current inputs are deleted and new outputs are created. Outputs that aren’t spent instantly grow to be UTXOs tied to the sender.

For instance, if an tackle with a steadiness of 1 BTC desires to ship a transaction of 0.4 BTC, the transaction will break up the steadiness into two separate outputs: the 0.4 BTC paid to the receiver, and the 0.6 BTC that’s left behind. The 0.6 BTC is “unspent,” returned to the sender, and turns into a UTXO that can be utilized as an enter in later transactions.

Nearly all Bitcoin transactions find yourself utilizing unspent transaction outputs. Solely transactions utilizing a single unified knowledge byte — i.e. transactions in increments of entire numbers — don’t generate UTXOs. Nonetheless, these transactions are uncommon sufficient that they are often ignored when unspent output knowledge.

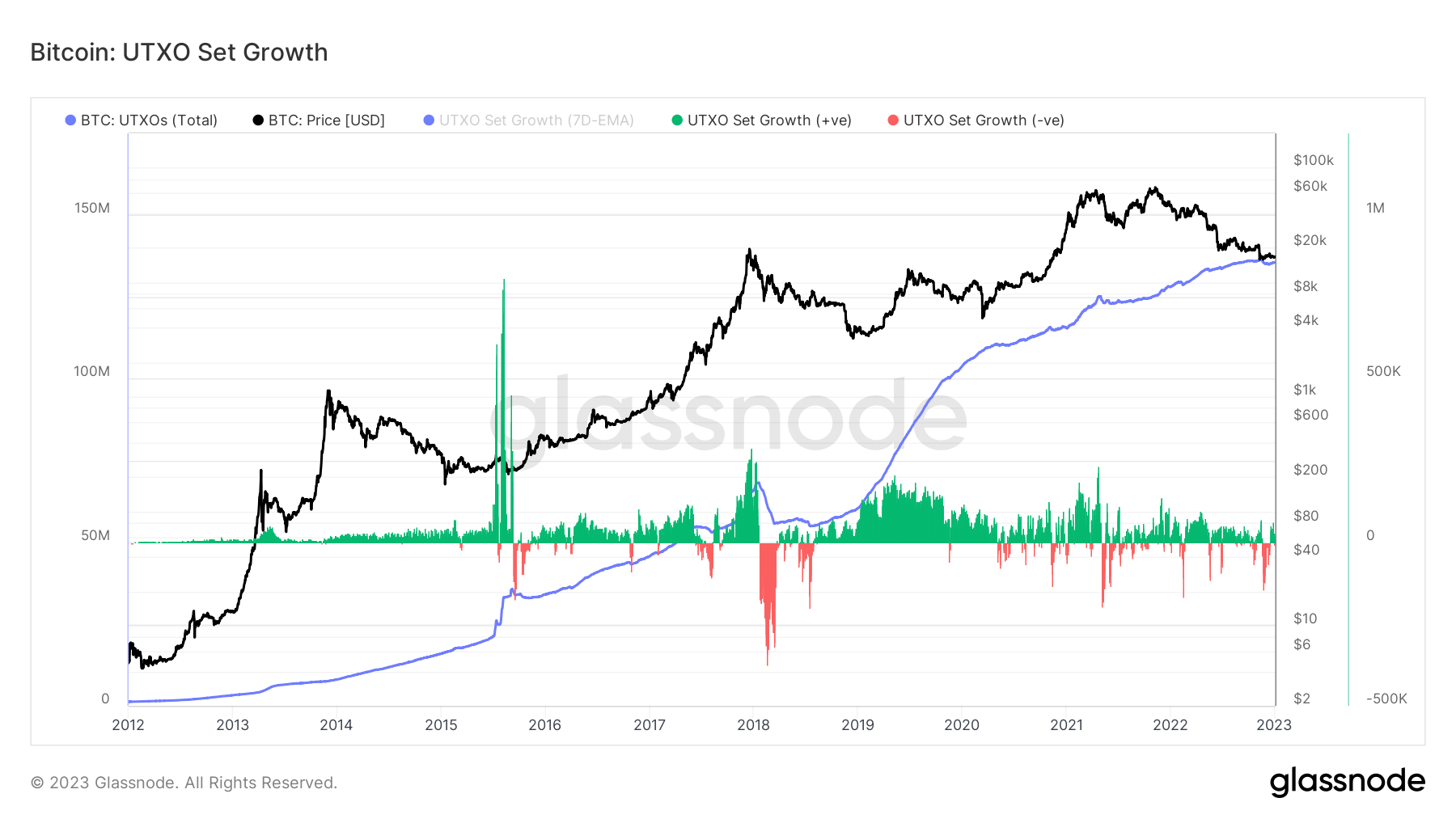

CryptoSlate’s evaluation of Bitcoin UTXOs confirmed that there was steady progress within the complete variety of UTXOs since 2018. The rising variety of unspent outputs defied each occasion of value volatility and continues to develop by means of the continued bear market. Optimistic progress within the UTXO set signifies elevated community utilization, whereas detrimental values present a contraction in community utilization.

Information from Glassnode confirmed that the overall set of Bitcoin UTXOs reached its all-time excessive within the first days of January, counting over 136 million UTXOs.

The persistent progress within the UTXO set exhibits that the community has been rising regardless of the bear market. Crypto winters have traditionally been durations of stagnating community progress, as low costs and uncertainty push many customers out of the community. Then again, bull markets have traditionally triggered durations of quick community progress, as a rise in speculators drives the general community utilization up.

UTXOs may also assist decide future market momentum.

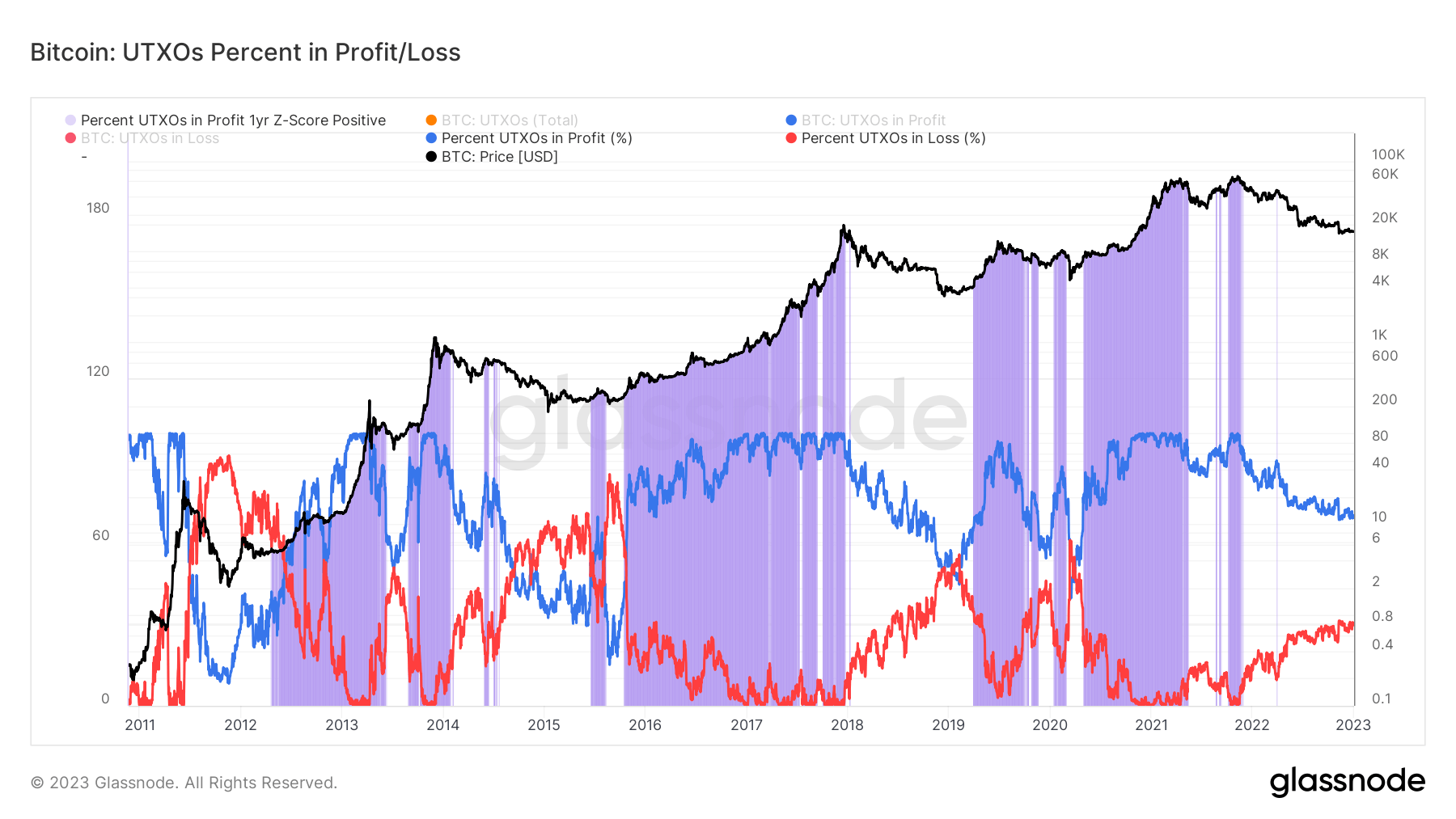

Wanting on the value stamp assigned on the time of the creation of every UTXO and evaluating it to BTC’s present value exhibits which outputs are in revenue and that are in loss.

As of Jan. 3, round 100 million of UTXOs are in revenue. Which means 70% of all unspent transaction outputs ever created have transacted with BTC beneath its present value. An above-average depend of in-profit outputs has traditionally been related to constructive market momentum.

Nonetheless, it’s nonetheless too early to inform when the constructive value motion may happen. The 1-year rolling Z-Rating of UTXOs in revenue has final been constructive on the finish of 2021, suggesting that the bear market may proceed nicely into 2023.