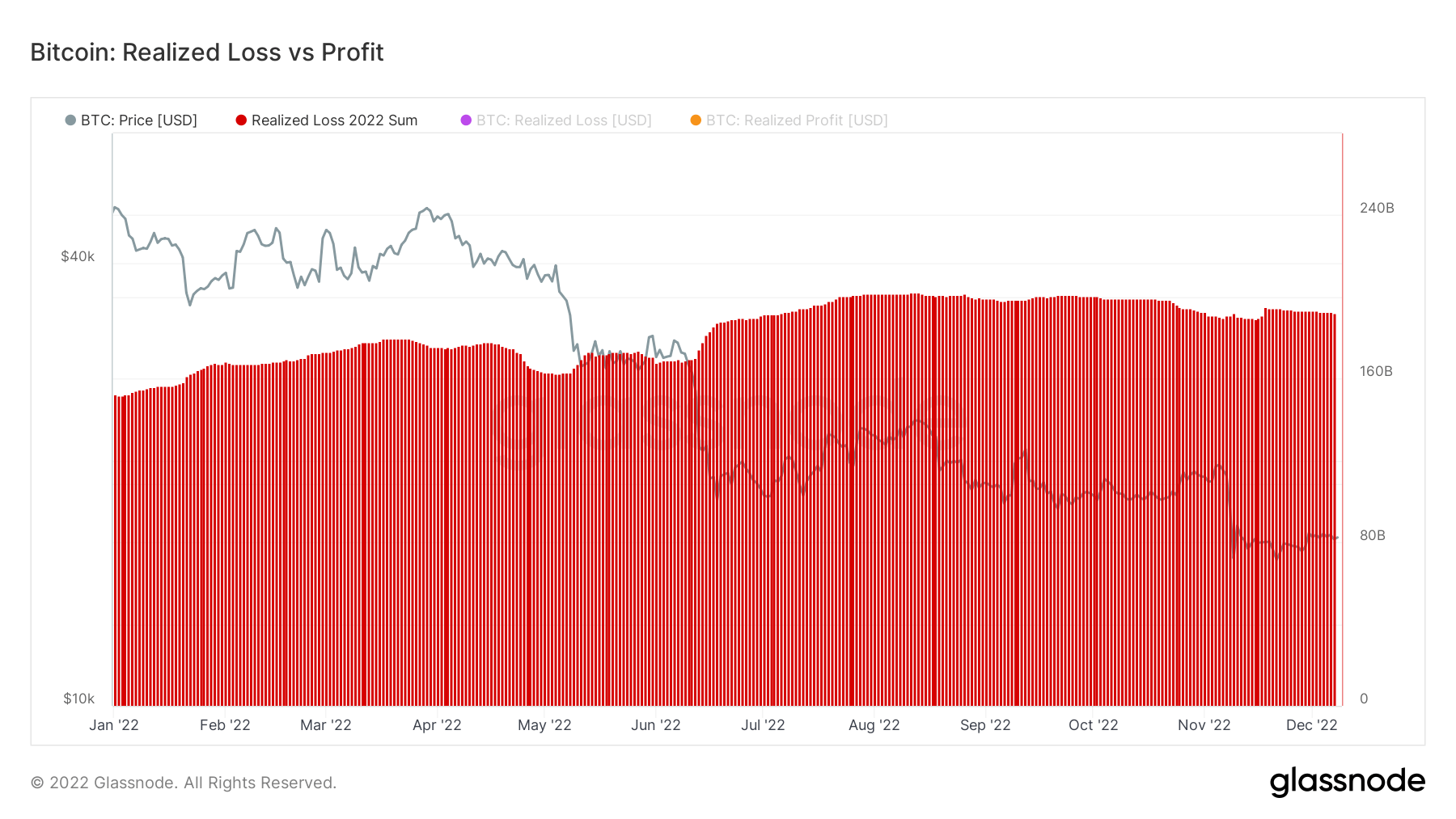

CryptoSlate’s evaluation of Glassnode charts confirmed that Bitcoin’s (BTC) realized losses in 2022 have been virtually twice the dimensions of realized revenue.

Bitcoin realized losses high $195 billion

In response to the chart, Bitcoin had a realized lack of $195 billion in 2022. Because of this a number of holders offered their BTCs for lower than they purchased them. Most of those losses occurred in February, Might, June, and November.

These durations are vital as varied occasions starting from the Russian-Ukraine warfare to the failure of crypto initiatives like Terra’s UST, led to large sell-offs leading to these losses.

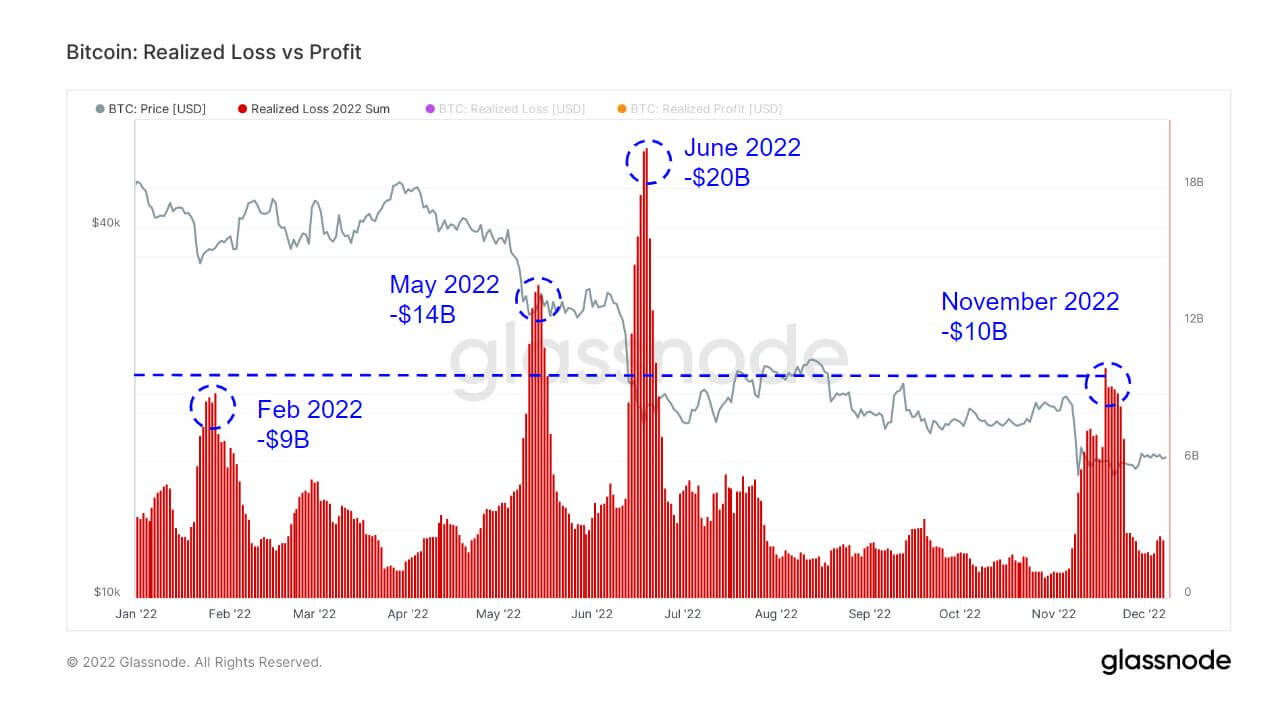

The 2 highest capitulations in 2022 occurred throughout Terra’s implosion in Might and June. Traders misplaced over $14 billion and $20 billion, respectively.

Terra ecosystem’s collapse birthed a contagion that resulted within the eventual collapse of crypto companies like Celsius, Voyager DIgital, Three Arrows Capital, and a number of other others. Additionally, the worldwide economic system confronted record-high inflation, forcing the Fed to extend rates of interest considerably.

Bitcoin skilled its worst month throughout this era, because it shed round 40% of its worth inside 30 days.

In the meantime, the FTX collapse in November additionally led to a document lack of over $10 billion in seven days for BTC holders -this was the third-largest capitulation within the 12 months. This occasion led to an enormous withdrawal of the flagship digital asset from centralized exchanges as buyers started to favor self-custodial providers.

CryptoSlate reported that buyers suffered extra realized losses from the FTX fallout than they did from the collapse of Luna.

The fourth main capitulation occurred in February after Russia invaded Ukraine. Promote-offs on the time resulted in over $9 billion in losses. Experiences emerged that Bitcoin traded at a premium as excessive as $20,000 on Russian exchanges.

In abstract, BTC buyers’ capitulation in 2022 resulted from macroeconomic and industry-specific components that don’t precisely converse to the worth of Bitcoin.

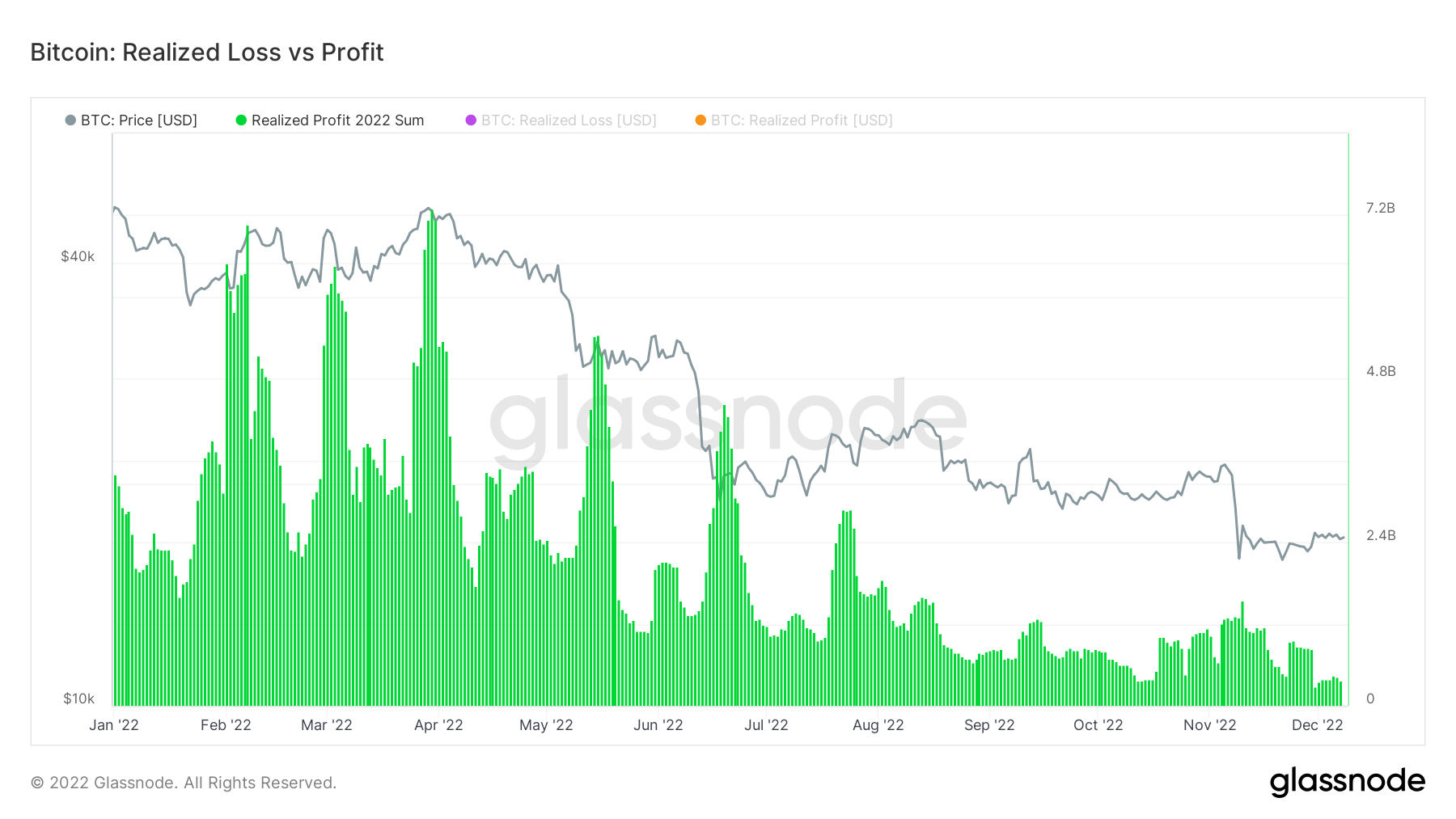

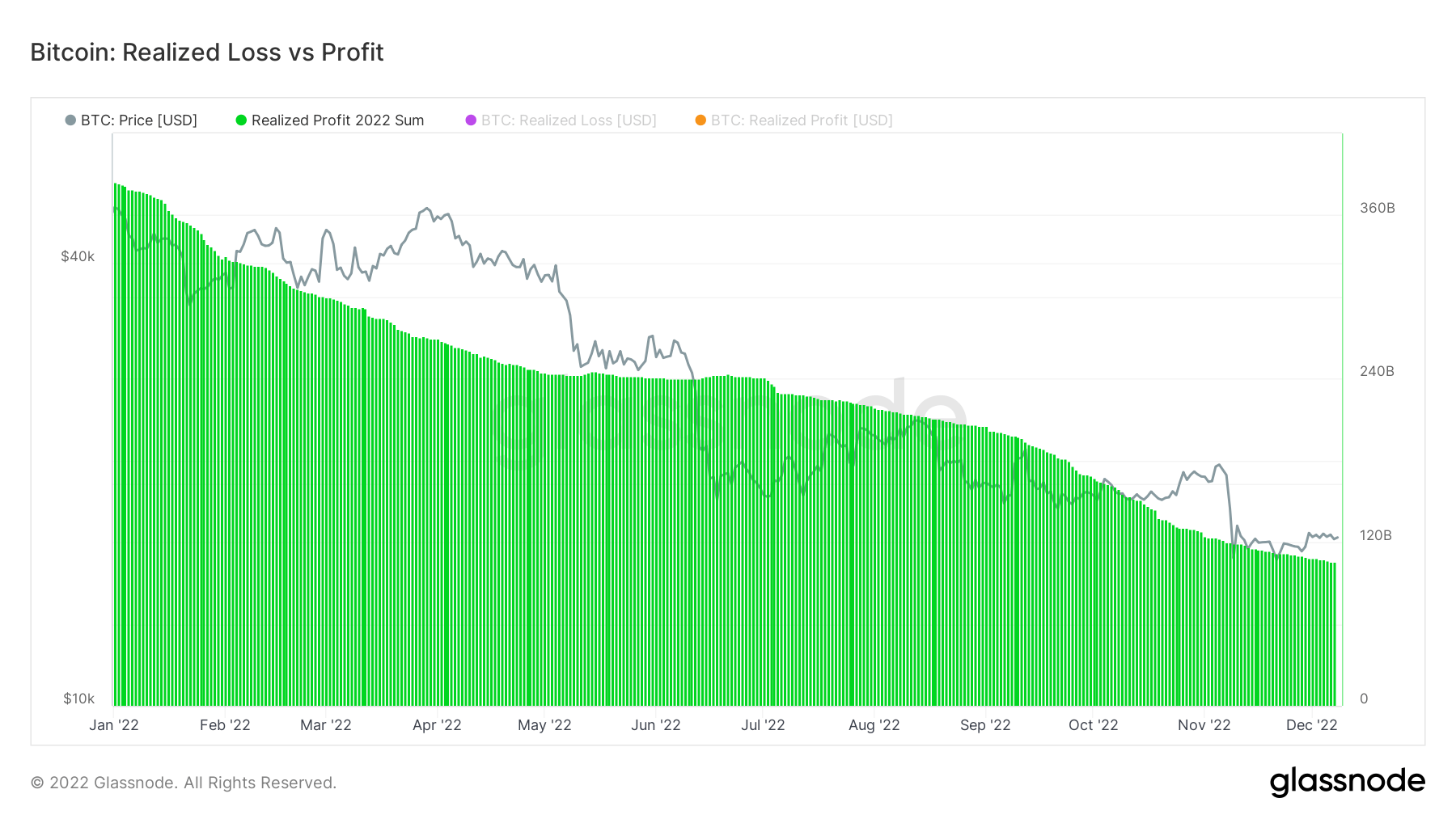

Bitcoin realized revenue is $105 billion

In the meantime, buyers nonetheless realized earnings of $105 billion in 2022, most of which got here from long-term holders holding BTC for over 18 months.

Notably, the realized earnings decreased because the 12 months progressed on account of declining costs. BTC’s realized good points peaked in February and April when buyers that offered revamped $7 billion in earnings. Bitcoin traded round $40,000 in each months.

With the worth declining in subsequent months, earnings for buyers that have been promoting additionally lowered. The bottom realized good points in 2022 was $500 million recorded in December 2022, when BTC largely traded beneath $17,000.