Bitcoin mining agency Bitfarms’ third-quarter report exhibits that the miner offered extra BTC than it made within the quarter -the miner offered 2,595 BTC whereas mining 1,515 BTC.

The miner targeted on strengthening its place to outlive the bear market by chopping prices and decreasing its debt obligations considerably through the quarter.

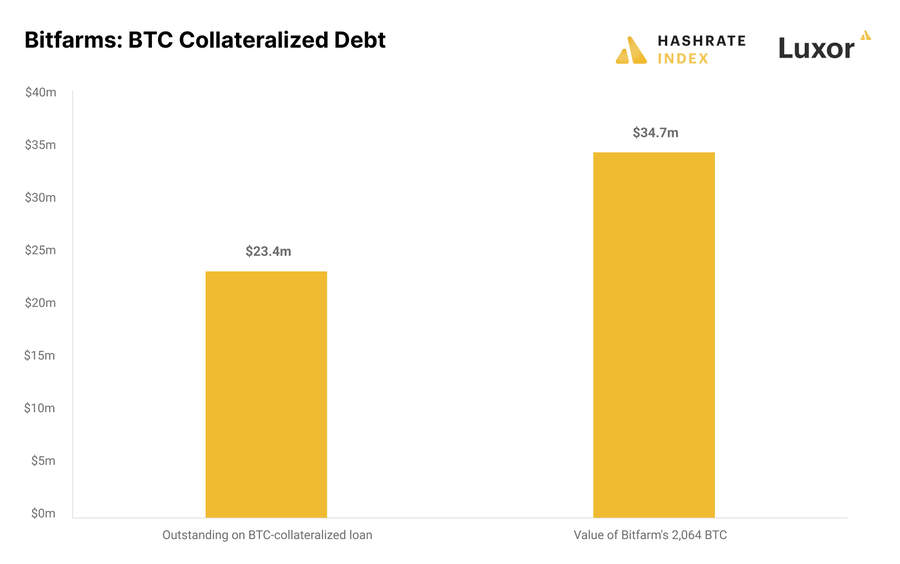

Nevertheless, the miner nonetheless holds $55 million in machine-collateralized debt and $23 million in Bitcoin-collateralized debt.

Bitfarms’ liquidity underneath highlight

Bitcoin mining analyst Jaran Mellerud stated that whereas Bitfarms’ Bitcoin gross sales helped it to cut back its debt burden, the miner doesn’t have a lot Bitcoin left.

Mellerud stated:

“(Bitfarms) holds $38 million of money and a pair of,064 bitcoin. The issue is that 1,724 of those Bitcoin are pledged as collateral, giving the corporate a complete unpledged liquidity of solely $44 million.”

The value of the flagship digital asset poses one other main problem for the agency because it should keep a collateral worth of 125% to the mortgage.

Mellerud stated the miner’s total Bitcoin stack of two,064 equals 141% of the mortgage. So, if BTC’s value fell to round $14,200, the corporate’s mortgage could possibly be liquidated.

Following this, analyst Mellerud concluded that “the corporate’s liquidity is inadequate to fund its deliberate expansions.”

Bitfarms retains prices down

Bitfarms’ third-quarter report revealed that the agency’s common and administrative bills have been down 15% to $6 million, excluding non-cash share-based compensation.

Talking on this, Mellerud praised the agency for minimizing its manufacturing prices whereas retaining its administrative prices comparatively low in comparison with rivals.

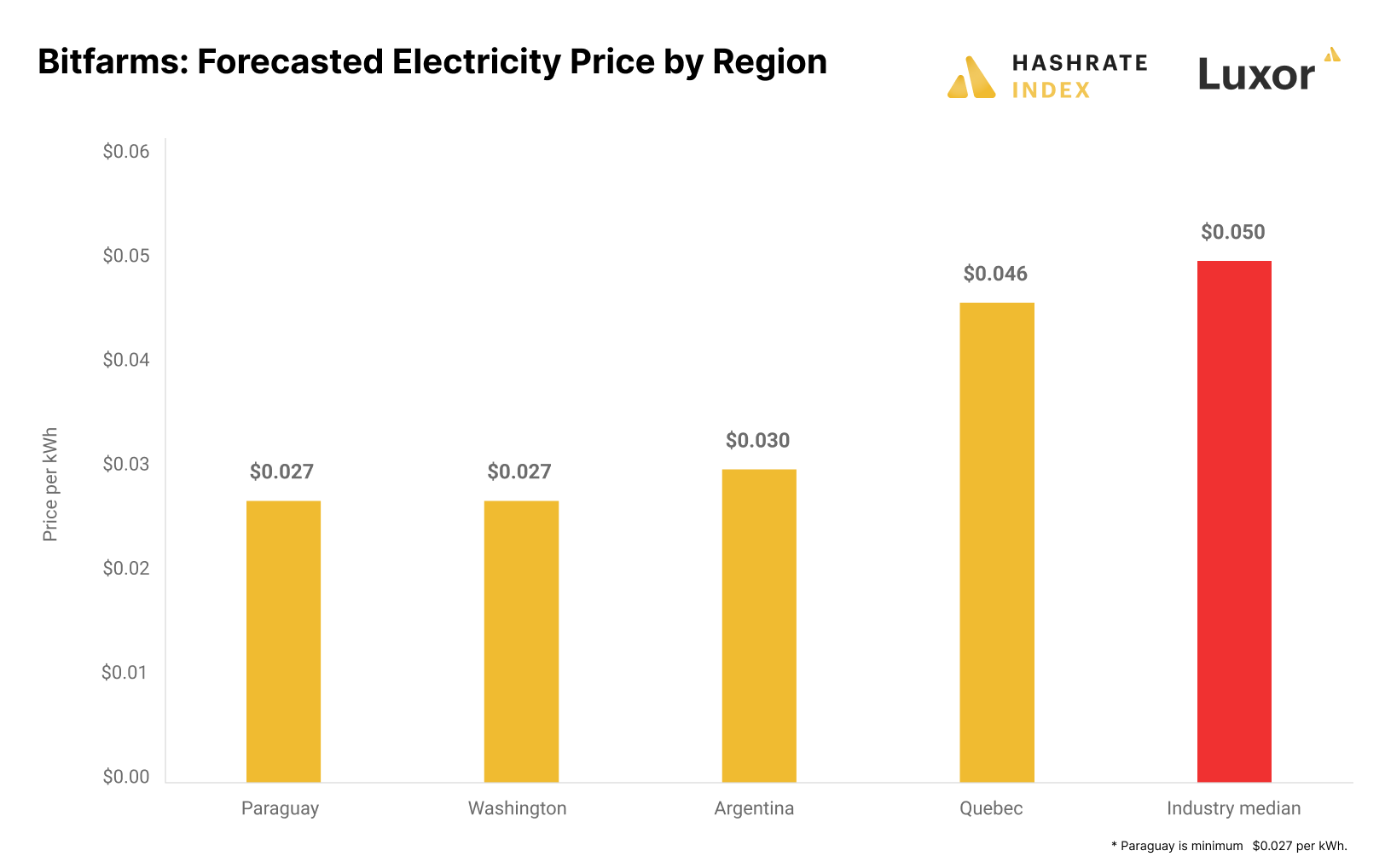

In accordance with Mellerud, Bitfarm has entry to cheaper electrical energy as its charges are considerably decrease than the business median of round $0.05 per kWh. Bitfarms’ expects to pay $0.027 per kWh in Washington, $0.03 per kWh in Argentina, and $0.046 per kWh in Quebec.

In the meantime, a lot of the firm’s income comes from its Quebec services which account for over 80% of its income.

Nevertheless, the Bitcoin mining agency’s plan to broaden into South America is stalling as a consequence of forms. Mellerud famous that the corporate may want exterior financing or reduce on its enlargement plans.