Latest information point out that the present bear market has fared higher than in 2018 however worse than in 2014 by way of ROI.

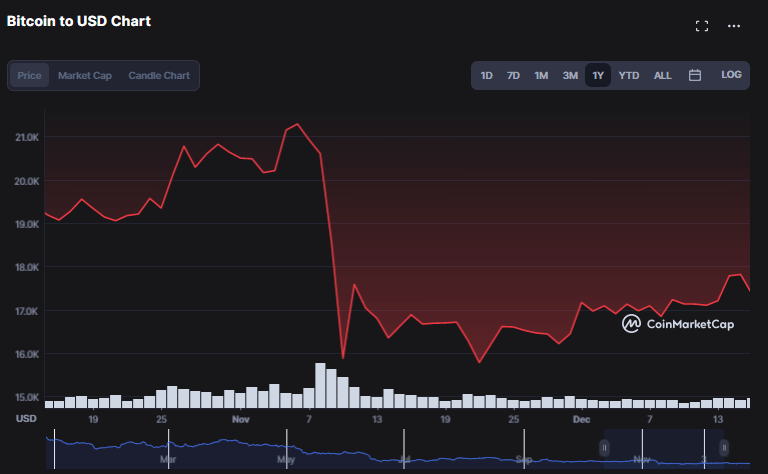

The worth of bitcoin, which began the 12 months at $50,700, has declined by greater than 66% to $16,847.51 at press time, in keeping with CoinMarketCap.

It was the Russia-Ukraine warfare that triggered the crypto bear market in 2022. Additional, within the aftermath of Terra-Luna’s collapse, it turned worse for your entire crypto market, together with Bitcoin.

The market skilled new lows following the crash of FTX on Nov. 7, with Bitcoin buying and selling between $15k and $17k in a brand new sideways vary.

Within the wake of the FTX contagion, a number of corporations filed for chapter, together with BlockFi and Genesis. The Fed’s rising rates of interest to struggle inflation didn’t assist the state of affairs for Bitcoin both.

A modest rally on Dec. 27 lifted Bitcoin just under the $17k vary earlier than it fell by 1.5%.

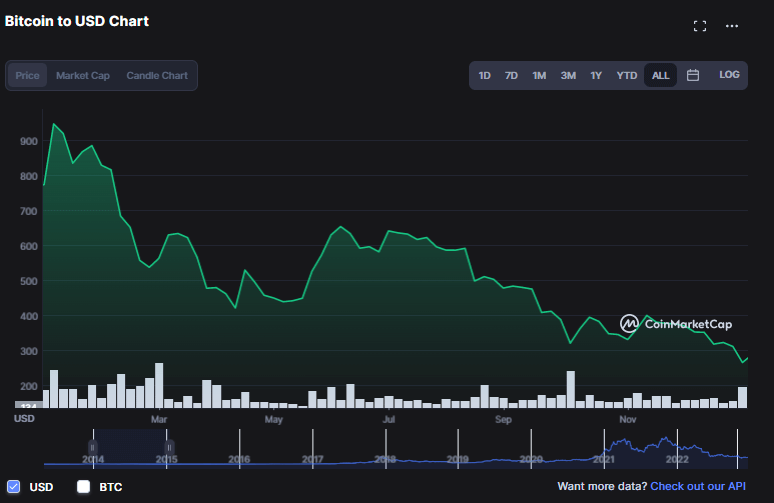

Bear Cycles of 2014-2015

After reaching $1,000 in December 2013 for the primary time, Bitcoin’s value tumbled to $601.78 inside a month, coming into a chronic bear market. Over the following two years, the cryptocurrency continued to say no, reaching a low of $320 in June 2014 earlier than bottoming out at round $170 in January 2015.

An extended cryptocurrency winter of 2014 was attributed to Mt. Gox’s hack, which halted Bitcoin withdrawals in early February. Ultimately, the platform halted all buying and selling and filed for chapter in Japan and america.

A number of main monetary authorities have additionally expressed issues about Bitcoin. Consequently, the common sentiment round Bitcoin remained unfavorable till August 2015, when the development started to shift.

The worth of Bitcoin, which started 2014 at $773.44, dropped by greater than 59% to $462.53 by the tip of the 12 months.

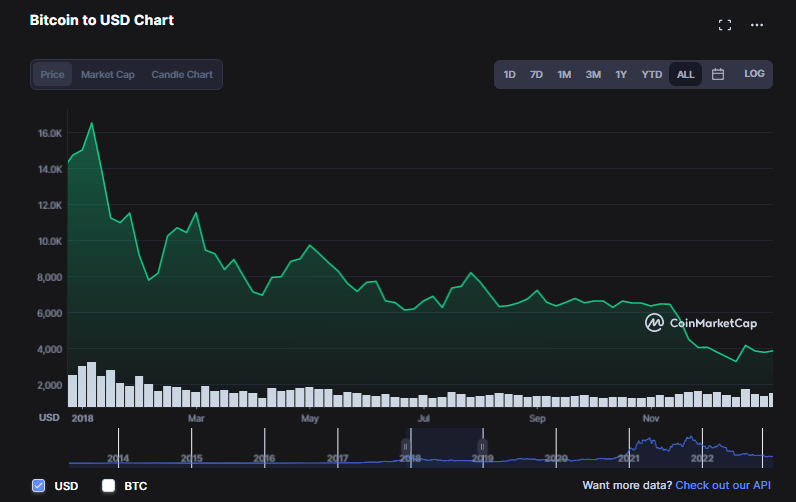

Bear Cycles of 2018

After recovering to $1,000 in January 2017, Bitcoin continued to rally to as excessive as $20,000 by the tip of that 12 months. Nonetheless, Bitcoin’s peak of $20,000 was short-lived, because it subsequently misplaced greater than 81% of its worth inside a 12 months to $3200.

An enormous hack of Coincheck, a Japanese cryptocurrency alternate, started the crypto winter of 2018, which resulted within the lack of about $530 million in NEM (XEM).

An extra blow got here in March and June when Fb and Google banned advertisements for ICOs and token gross sales. Additionally contributing to the bear market had been regulatory efforts to control the crypto market, with the US Securities and Change Fee rejecting functions for BTC exchange-traded funds.

Bitcoin’s value, which started 2018 at $14,978, fell by greater than 74% to $3746.71 on the finish of the 12 months.