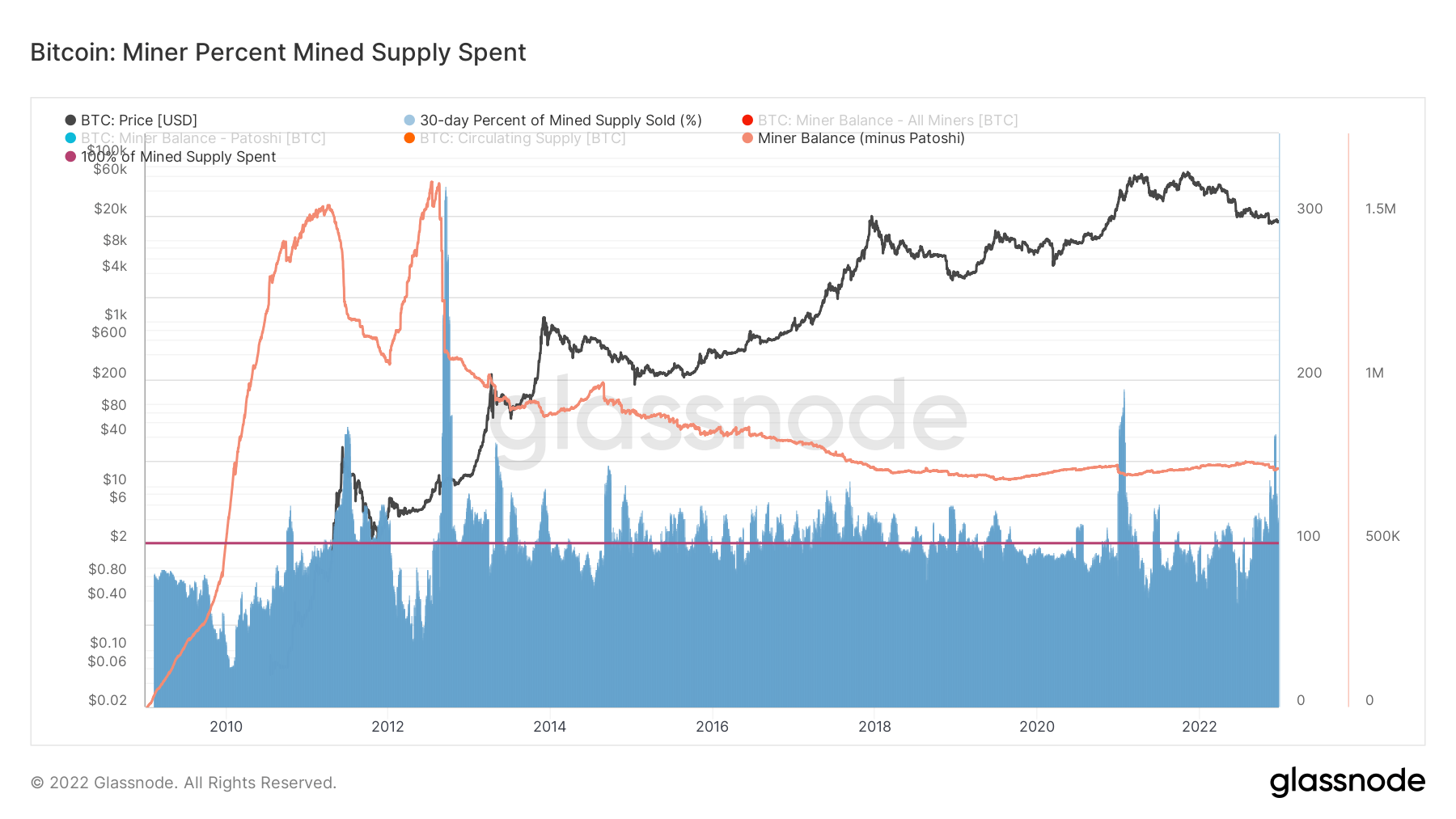

Bitcoin (BTC) miner balances began at 1.82 million BTC at the start of the 12 months. Regardless of peaks of capitulation and important selloff quantity, BTC miner wallets nonetheless sit at a flat 1.8 million BTC.

Mining rewards held in BTC miners’ wallets noticed a pointy decline beginning in August, doubtless because of the Poolin exodus. This 12 months noticed the third-largest BTC selloff by miners over a 30-day interval, with 112% of mined provide plus treasury being spent. In distinction, the primary and second-largest selloffs occurred throughout the 2013 and 2021 bull runs, as miners bought their BTC at a revenue somewhat than a loss.

The invasion of Ukraine in February 2022 precipitated a worldwide vitality disaster, leading to excessive prices for BTC miners and wiping out potential earnings.

The miner stability at the moment stands at 1.8 million BTC and has remained flat over the previous 5 years, excluding Patoshis cash. This implies important promote strain if miners proceed to battle into 2023.

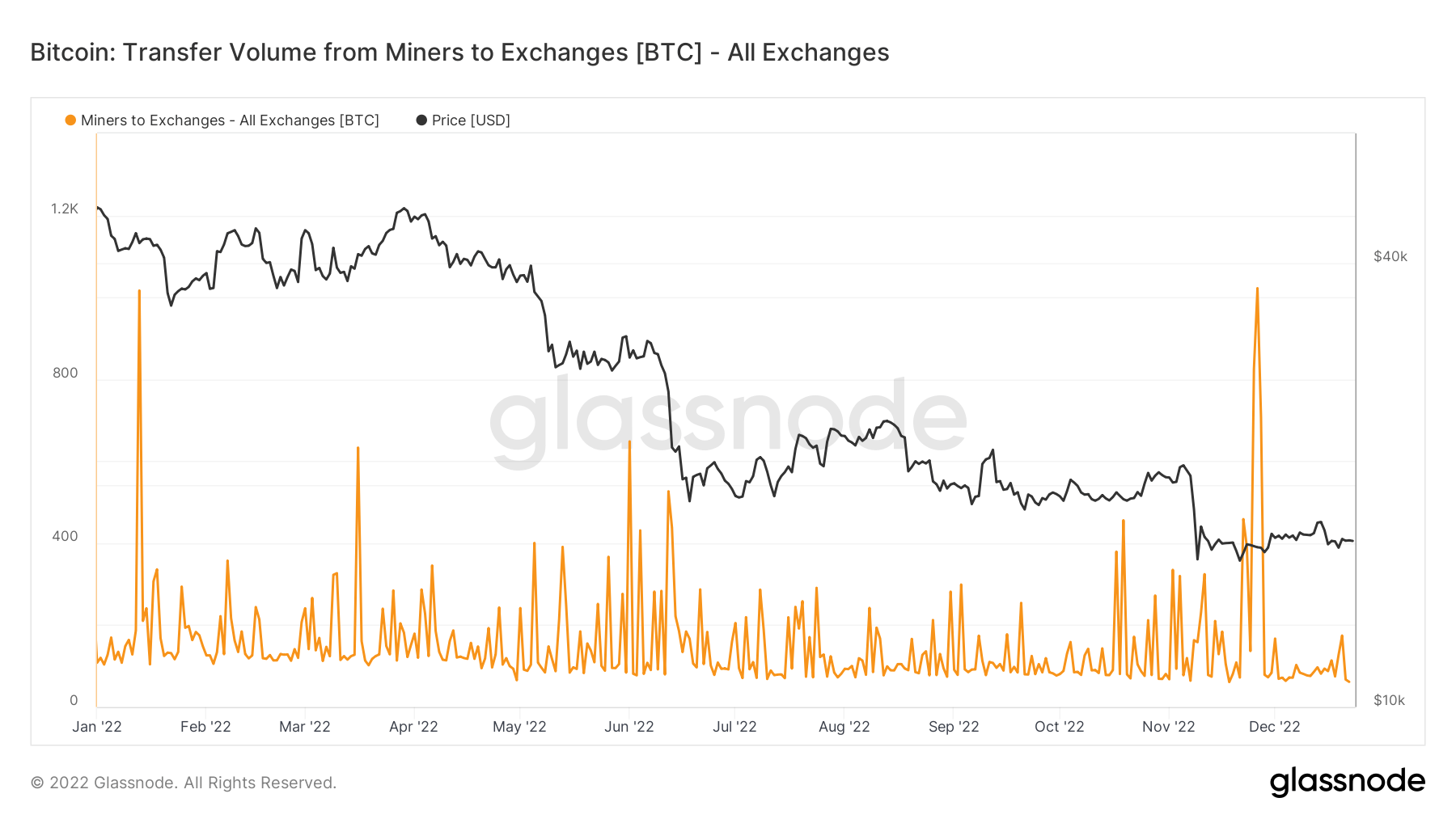

Whereas BTC miners have been offloading their holdings, that is merely miners transferring to totally different wallets somewhat than sending the BTC to exchanges to be bought.

Roughly 200 BTC has been spent day by day since 1000 BTC was bought in late November.

By 2022, miners promoting to exchanges has remained minimal, with roughly 57,000 BTC bought via the 12 months.

With solely 57,000 BTC being bought out of a complete of 1.8 million BTC and rising promote strain, it’s value contemplating whether or not BTC miners are making ready to promote in 2023.

Amid BTC mining firm chapter, record-breaking whale BTC selloffs and miner profitability disaster — 2023 miner capitulation is geared in direction of main selloffs if promote strain continues to mount.