Crypto analyst and long-term crypto investor Jelle has highlighted an fascinating historic sample that implies that February may very well be bullish for Bitcoin. This could little question be a reduction for BTC buyers who need to take care of a bearish January for the flagship crypto token.

Why February Might Be Bullish For Bitcoin

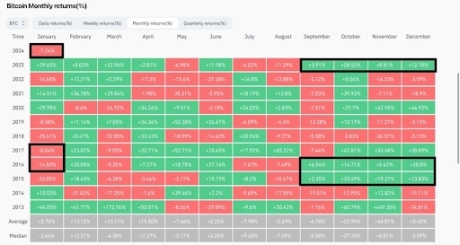

Jelle acknowledged in an X (previously Twitter) put up that “February ought to be sturdy” for Bitcoin “if historical past retains repeating itself.” The historical past which he alludes to is the sample the place February seems to be a inexperienced month for Bitcoin after it has seen a bearish January and had closed within the inexperienced for the final 4 months of the earlier 12 months.

Information from Coinglass exhibits that the one different occasions (2015 and 2016) BTC closed the final 4 months of the 12 months within the inexperienced, it went on to document a bearish January and a bullish February after that. Final 12 months, Bitcoin closed September, October, November, and December within the inexperienced, thanks largely to the frenzy across the Spot Bitcoin ETFs.

Supply: X

Bearing the historic sample in thoughts, Jelle expects that February will as soon as once more be a inexperienced month for Bitcoin. Curiously, Bitcoin’s good points in February 2016 and 2017 have been vital, recording 20% and 23%. As such, there isn’t solely the potential for this February being inexperienced for Bitcoin but in addition coming with big good points for the crypto token.

The Bull Market Stays On

In a more moderen X put up, Jelle highlighted how Bitcoin was again above the $42,000 degree and hinted that there may very well be extra transfer to the upside as he acknowledged that the “bull market stays on.” The crypto analyst is thought to be a good dealer, as he had beforehand talked about how his methods helped him catch the BTC backside and promote the highest.

From his X put up, one might see that Jelle was predicting that the subsequent vital upward motion from Bitcoin might see it rise to as excessive as $53,000. Curiously, from the accompanying chart, there was a probability of this taking place someday in February. Such a transfer will as soon as once more set up that historic sample which Jelle had earlier highlighted.

No matter occurs in February, Bitcoin buyers can nonetheless take consolation in the truth that Bitcoin nonetheless has over 500 days of bullish momentum, in response to crypto analyst Ali Martinez. Bitcoin whales have to date remained steadfast, with a rise in these holding 1,000 BTC or extra regardless of the flagship crypto token’s current value decline.

On the time of writing, BTC is buying and selling simply above $42,000, down over 1% within the final 24 hours, in response to information from CoinMarketCap.

Featured picture from The Monetary Fee, chart from Tradingview.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site totally at your individual danger.