Crypto investor Ryan Sean Adams argued on December 4 that Ethereum’s (ETH) present valuation of round $2,200 is nearly “hilarious” given the strengthening on-chain exercise and the blockchain’s function within the sphere.

Enterprise Capitalist: Right here’s Why Ethereum Is Grossly Undervalued

Adams cited knowledge like the primary sensible contract platform producing billions yearly in “gasoline” charges, transitioning to turning into deflationary after merging in September 2021, and the over a million validators staking incomes over 5% as rewards. Furthermore, the enterprise capitalist identified the potential of the US Securities and Change Fee (SEC) approving spot Ethereum ETFs in the long term.

For now, BlackRock and Constancy, two of the world’s most distinguished conventional finance gamers, have utilized to subject these spinoff merchandise. Although the SEC has but to approve any spot crypto ETFs, the company will authorize one or a number of, seemingly in early Q1 2024.

Total, the crypto market expects any spot ETF, together with that of Ethereum, to draw billions in institutional capital. Past exterior components just like the SEC and ETFs discuss, Adams additionally identified the rising demand for mainnet block house from the a number of layer-2 options working off-chain rollups parallel to Ethereum.

ETH Worth Attracts From On-Chain Actions

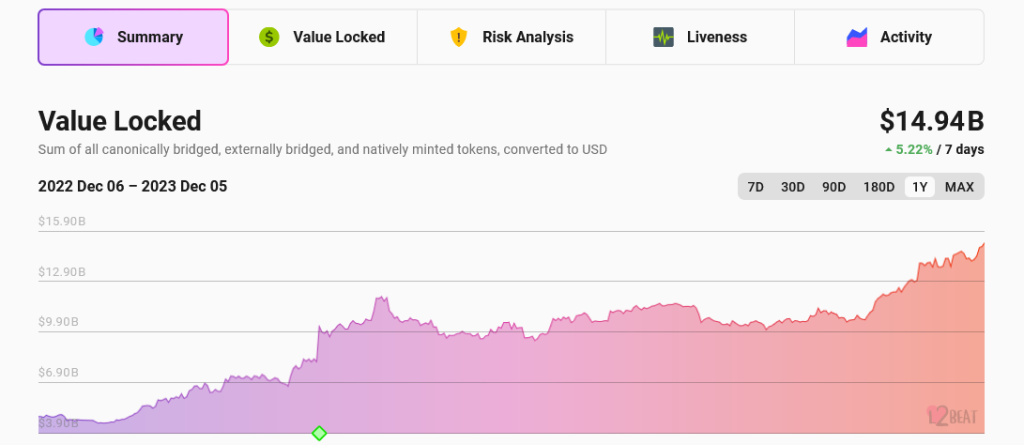

In line with L2Beat, Ethereum layer-2 options have over $14.9 billion as complete worth locked (TVL), with probably the most distinguished platforms, together with Arbitrum One, OP Mainnet, Starknet, and Base, commanding billions and processing tens of hundreds of transactions each day. Prior to now week, Adams noticed that main layer-2 rollups had been the highest 10 customers of Ethereum block house.

Evaluating Ethereum utilizing conventional metrics like price-earnings (P/E) ratios that examine favorably to know-how firms like Amazon and Zoom, Adams urged that Ethereum’s upside is nearly mathematically unavoidable this cycle.

The enterprise capitalist, primarily based on the above components, thinks Ethereum might seemingly be 10x, pushing the coin to over $22,000 per coin. Even so, the investor can’t exactly gauge how lengthy the markets will “keep irrational,” grossly undervaluing the second most dear coin.

In response, Uniswap founder Hayden Adams agreed Ethereum fundamentals would gasoline appreciation. Even so, the founder thinks Ethereum derives energy not from hypothesis attributes, as Ryan Sean Adams laid out. The Uniswap founder is assured that demand from lively protocols launching on the mainnet and competing for scarce block house will immediately pump costs.

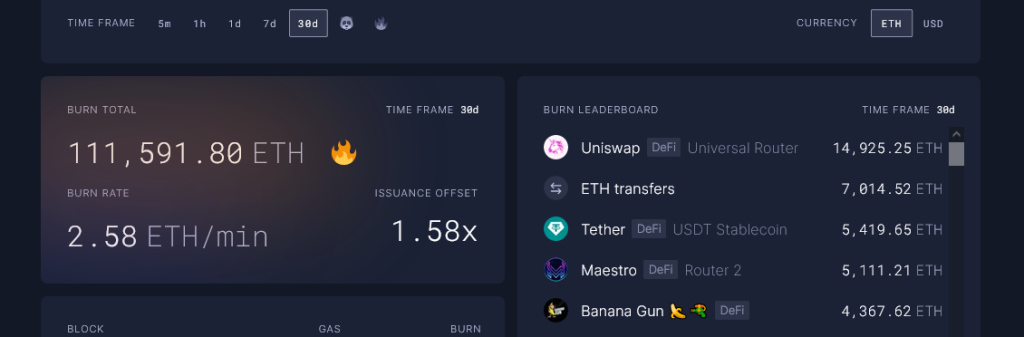

In line with Extremely Sound Cash, Uniswap helps Ethereum burn probably the most cash. Within the final month alone, Uniswap took over 14,900 ETH out of circulation, serving to the community grow to be extra deflationary.

Function picture from Canva, chart from TradingView