This 12 months hasn’t been form to Bitcoin miners because the invasion of Ukraine in February 2022 triggered a worldwide vitality disaster, pushing mining prices by the roof.

As well as, the collapse of Luna in June tanked Bitcoin’s worth to a two-year low, wiping out the little profitability miners had left.

After a difficult summer season with skyrocketing electrical energy costs, miners welcomed winter scarred by the FTX fallout and much more unsure costs.

The 2022 disaster hit each giant and small mining operations. Massive, publicly-listed mining corporations had been those hit the worst, as a massively worthwhile 2021 led many to tackle debt and embark on costly growth tasks.

The battle miners have been by isn’t anecdotal – on-chain information reveals an extremely traumatic 12 months, based on CryptoSlate’s evaluation.

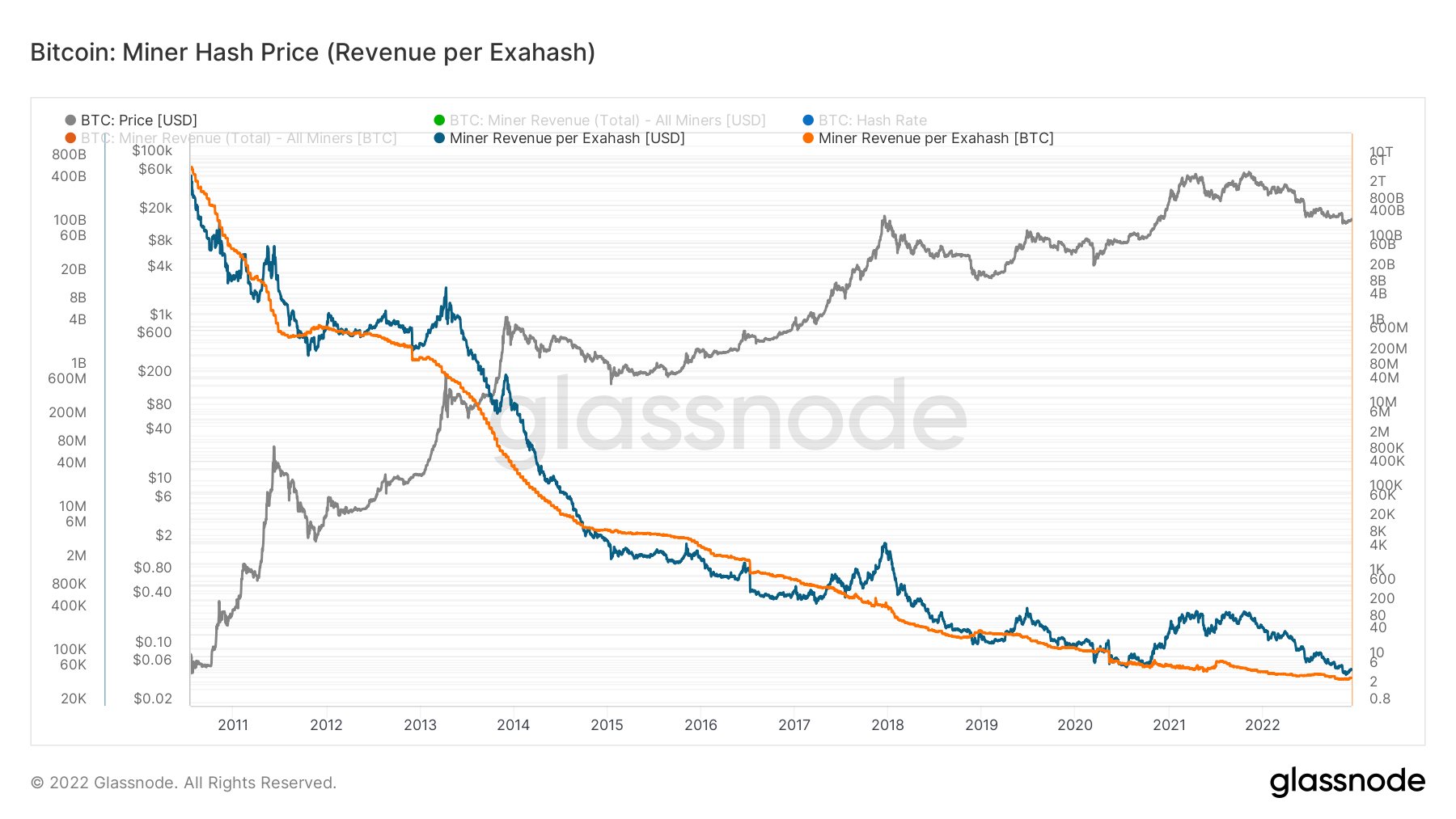

Miner income per Exahash has been dropping sharply for the reason that starting of the 12 months. Income denominated in USD has seen considerably extra volatility, spelling bother for people who determined to promote their BTC holdings.

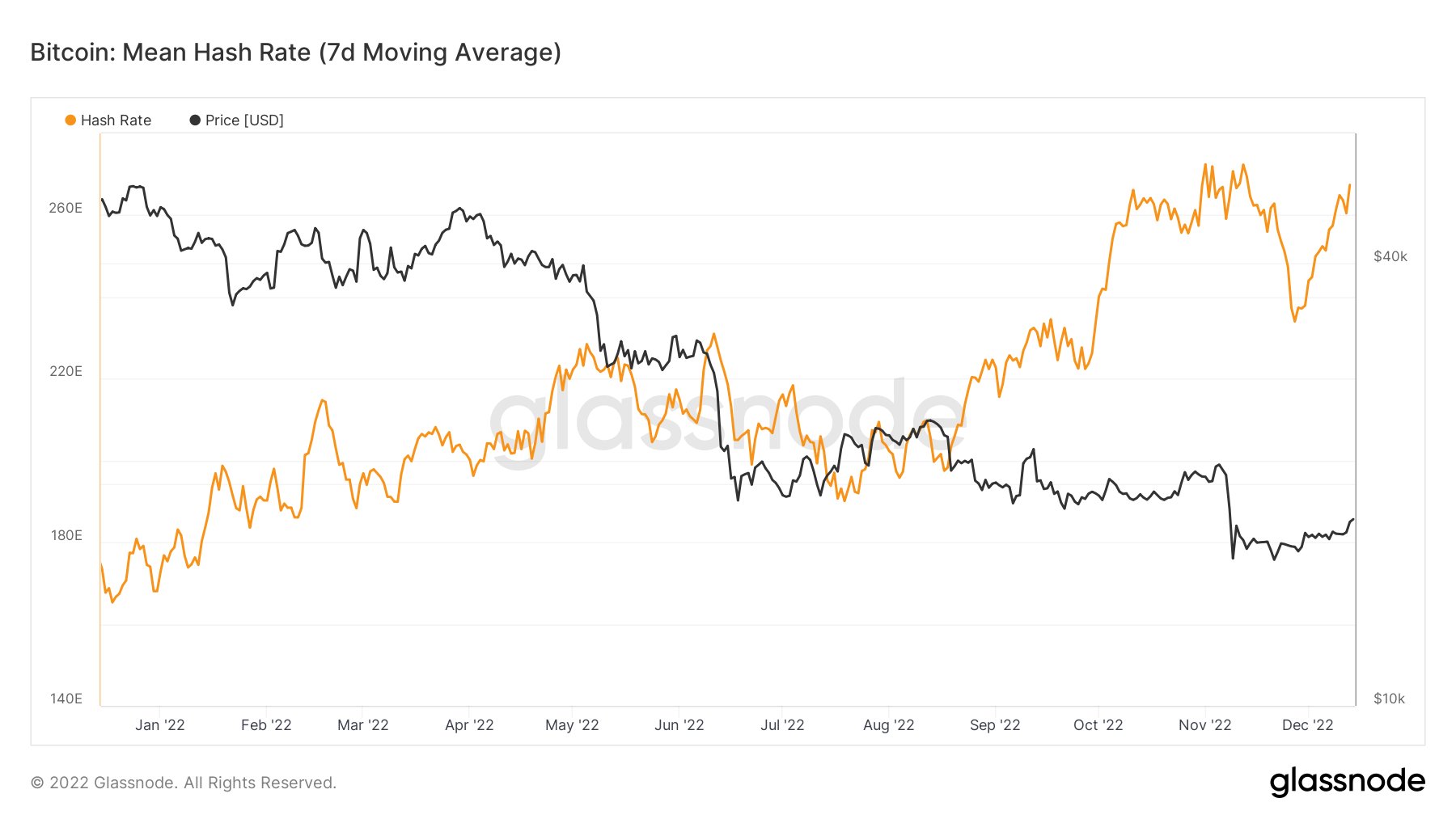

hash ribbons additional confirms this pattern. The metric analyzes the 30-day shifting common and the 60-day shifting common of the Bitcoin hash fee to find out when miners capitulate. When the 30-day MA drops under the 60-day MA, capitulation begins as Bitcoin turns into too costly to mine. When the pattern reverses, Bitcoin mining returns to being worthwhile.

Because the starting of the 12 months, the market has seen three cases of those shifting averages crossing — in June, July, and August. And now, the start of December noticed the fourth reversal of shifting averages, indicating one other capitulation has begun.

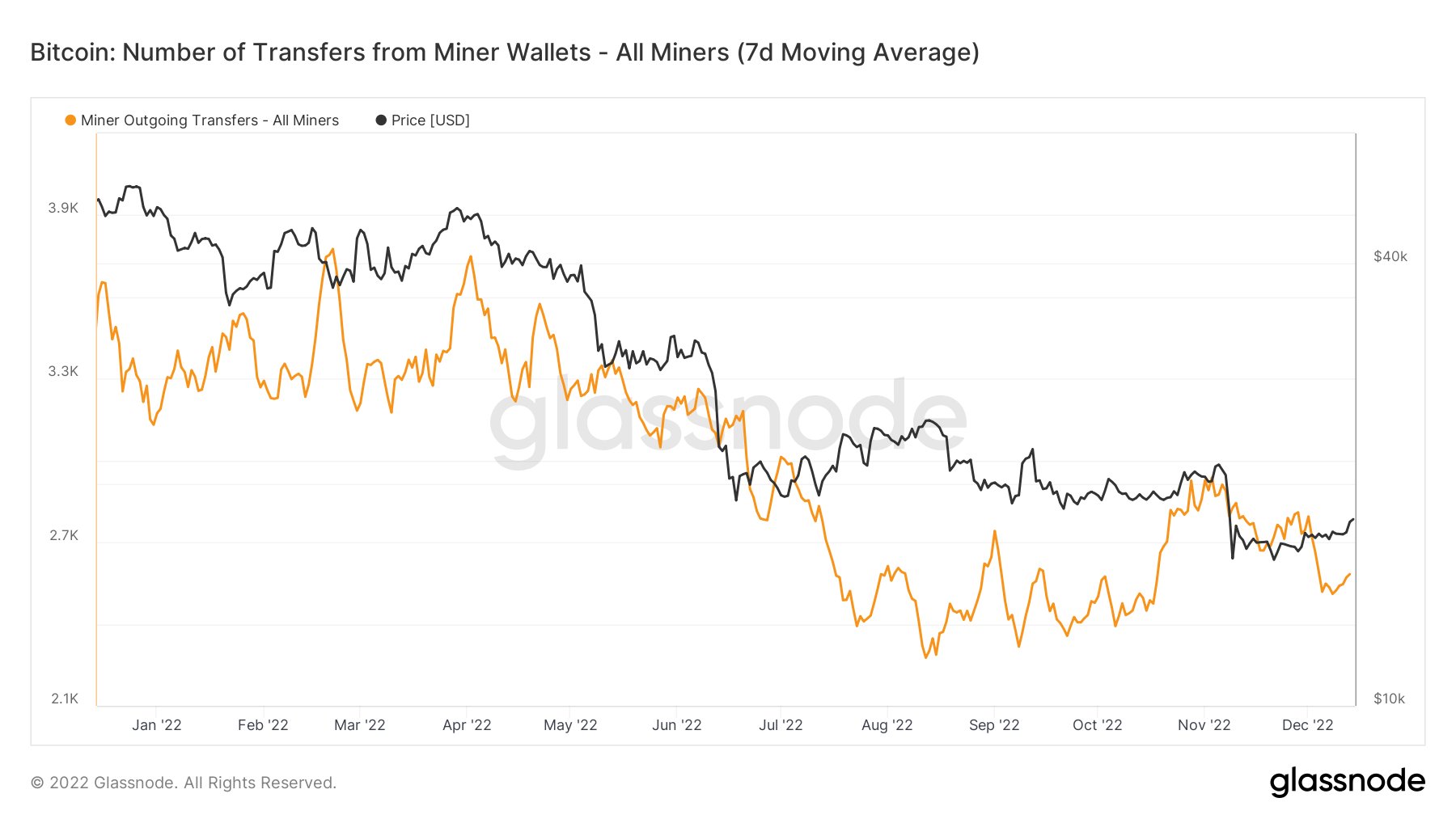

On-chain information clearly reveals miners have been capitulating en masse all year long. Nonetheless, this doesn’t imply that they’ve been promoting all their BTC.

Knowledge analyzed by CryptoSlate reveals that there has truly been a notable lower within the quantity of BTC miners have been promoting for the reason that starting of the 12 months.

Trying on the variety of outgoing transactions from miner wallets in 2022 reveals a lowering promoting strain. Outdoors of a short-lived spike in outgoing transfers in mid-November, the pattern has been steadily declining.

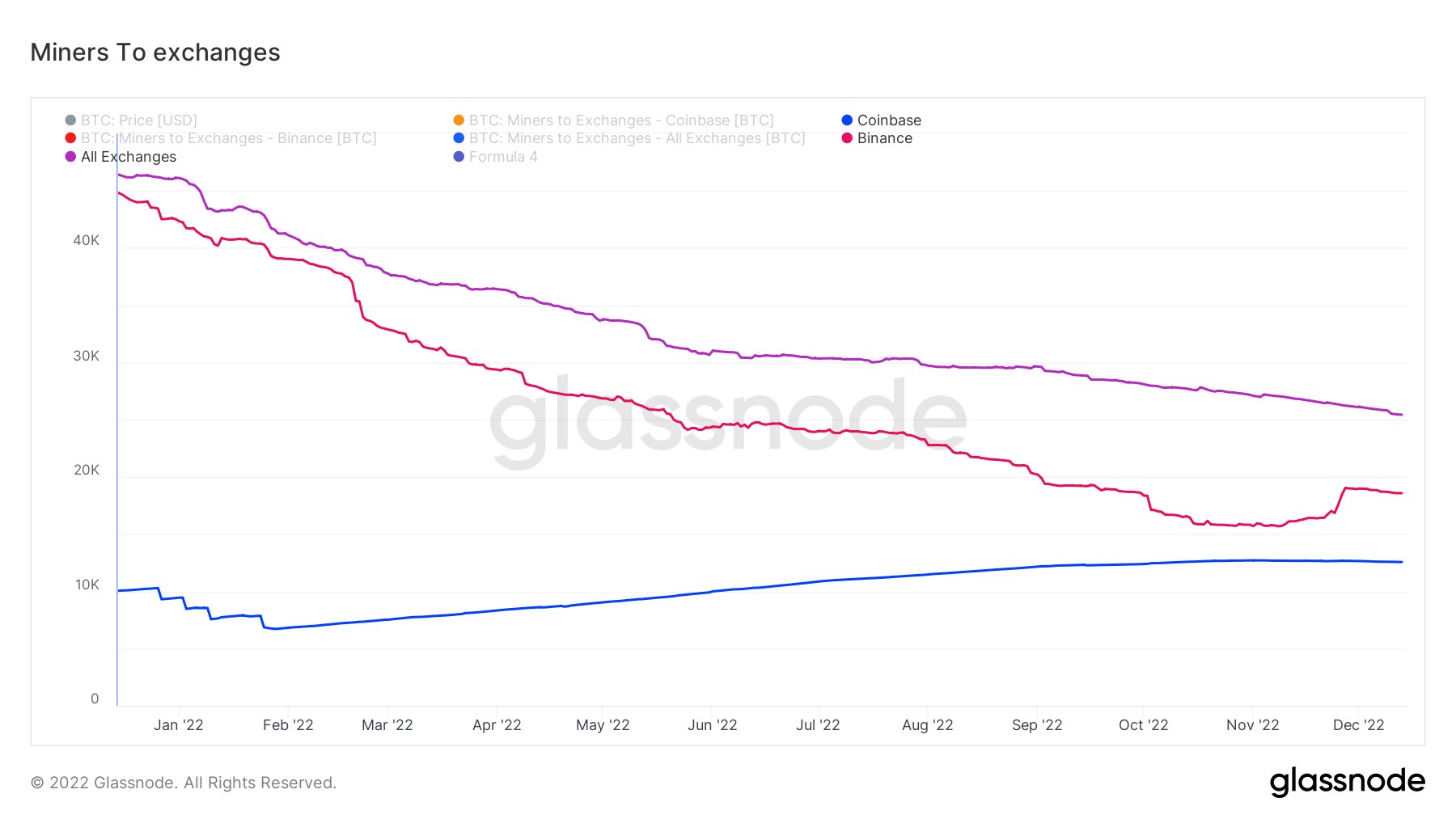

Transfers from miner wallets to exchanges additional verify this pattern.

Because the starting of the 12 months, miner transfers to all exchanges have been lowering. Miners despatched a complete of round 57,000 BTC to exchanges in 2022, with 18,500 going to Binance and round 12,500 going to Coinbase.

Diving deeper into Bitcoin’s hash fee reveals that the power of the community hasn’t been compromised. The promoting strain pushed up by rising electrical energy costs and skyrocketing {hardware} prices hasn’t affected the hash fee. In truth, Bitcoin’s hash fee is at the moment climbing again to the yearly excessive it recorded in mid-November — despite Bitcoin’s dropping worth.