Figuring out the market backside requires plenty of guesswork. Bitcoin’s latest volatility has resulted from numerous components starting from geopolitical uncertainty and native regulation to inside implosions of the crypto market.

Miners have traditionally been one of the vital dependable omens of Bitcoin’s efficiency.

Bitcoin miners make up the muse of the crypto market and create robust resistance ranges that scale back volatility. As one of many largest holders of BTC, miners can swing the market by holding their cash and liquidating them.

Analyzing the state of the market requires analyzing the state of Bitcoin miners.

As beforehand coated by CryptoSlate, among the most stable indicators of miner well being have been hash ribbons.

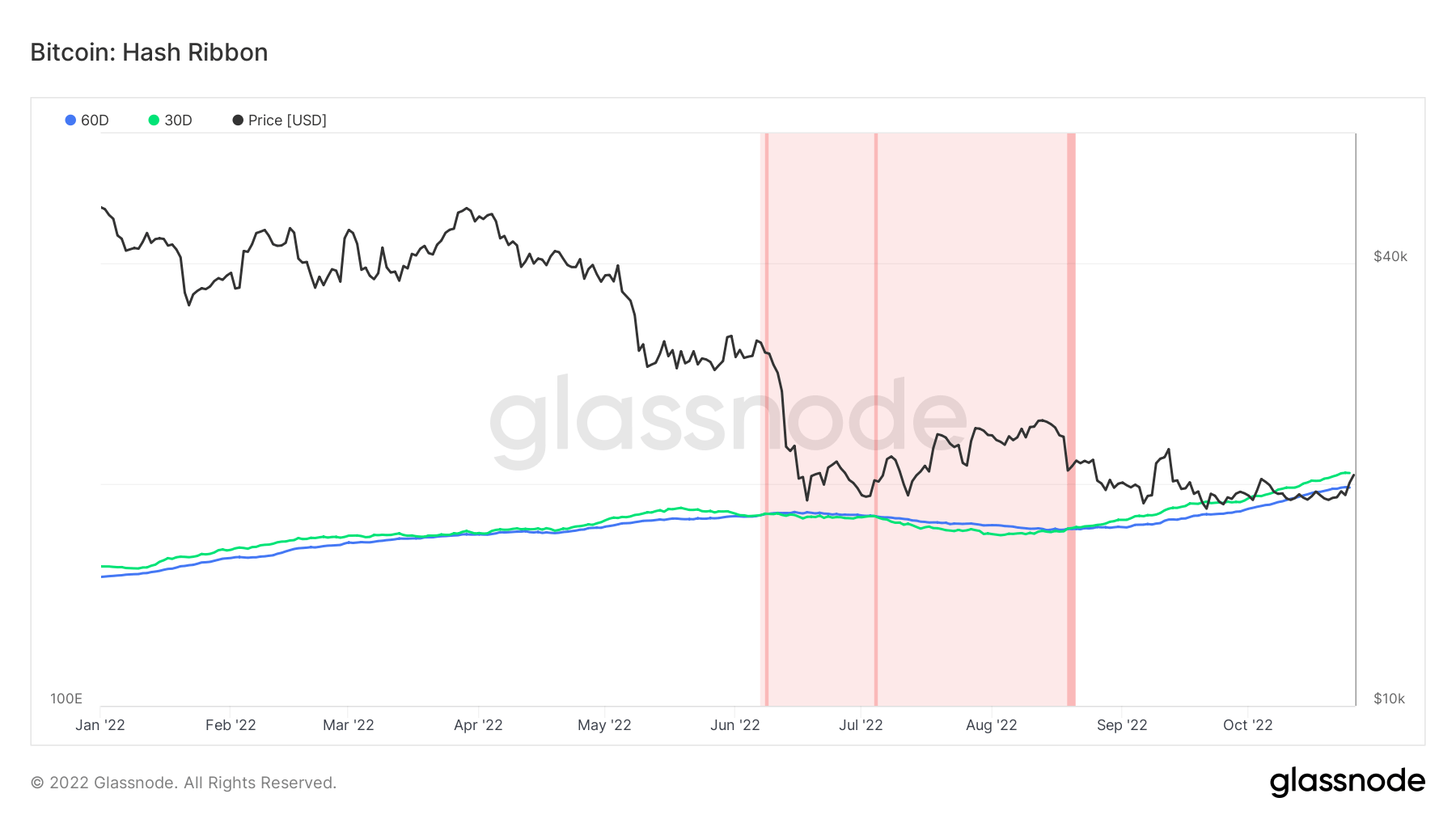

Hash ribbons point out when miners capitulate, exhibiting the divergence between the 30-day shifting common and the 60-day shifting common of the Bitcoin hash charge; having miners capitulate reveals that Bitcoin has grow to be too costly to mine — i.e., Bitcoin’s market worth is just too low to cowl the price of electrical energy required to supply it.

Based on hash ribbons, the worst of the miner capitulation is normally over when the 30-day MA of the Bitcoin hash charge crosses above the 60-day MA. For the reason that starting of the yr, we’ve seen three separate situations of this swap, proven in darkish crimson on the graph under.

Information analyzed by CryptoSlate confirmed that extreme miner capitulation started mid-June this yr and lasted till mid-August. The information is supported by crossing the hash ribbons illustrated within the graph above.

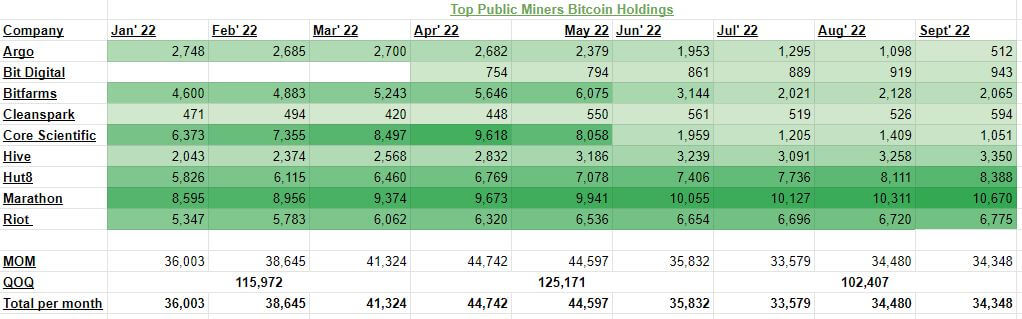

BTC holdings from the highest 9 largest publicly listed Bitcoin mining corporations additional helps this development. A number of massive miners created heavy promoting stress between Might and June, liquidating round 8,765 BTC.

And whereas the promoting stress appears to have steadied on a month-to-month foundation since June, quarterly knowledge paints a a lot totally different image.

The highest 9 public Bitcoin miners noticed their holdings lower from 125,171 BTC within the second quarter to 102,407 within the third quarter.

The numbers proven within the desk above decreased even additional in October. Earlier this month, Core Scientific liquidated over 1,000 BTC it held in September and reported holding simply 24 BTC on October 26.

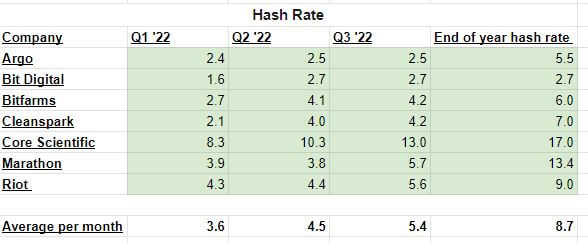

With mining issue and the hash charge at their all-time excessive, miners are getting squeezed when it comes to their income and assets. The typical hash charge has been rising every quarter in 2022 and is anticipated to extend at a fair larger charge because the fourth quarter ends.

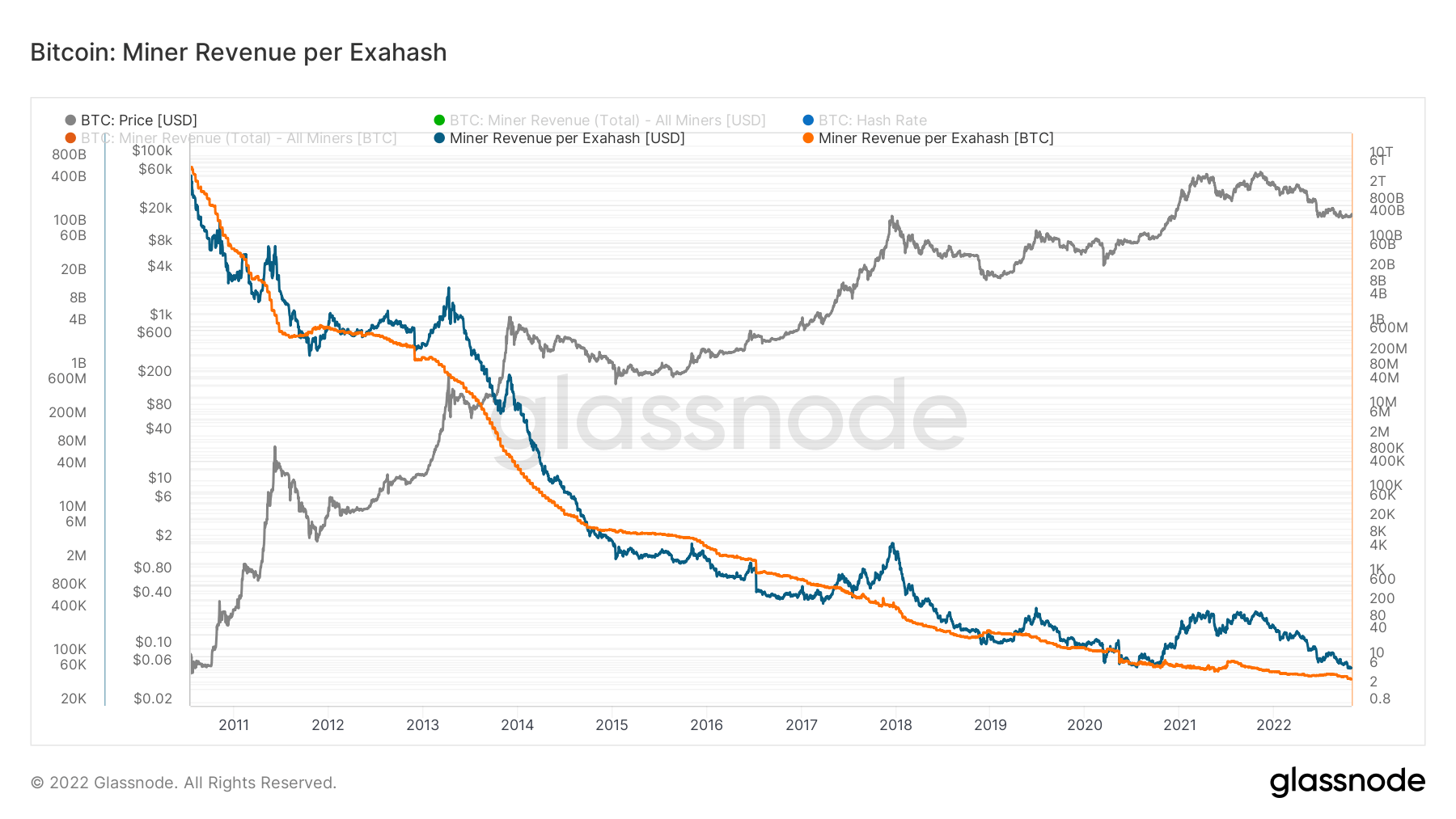

Information analyzed by CryptoSlate confirmed that Bitcoin’s drop within the yr’s second half brought about a notable discount in miner income.

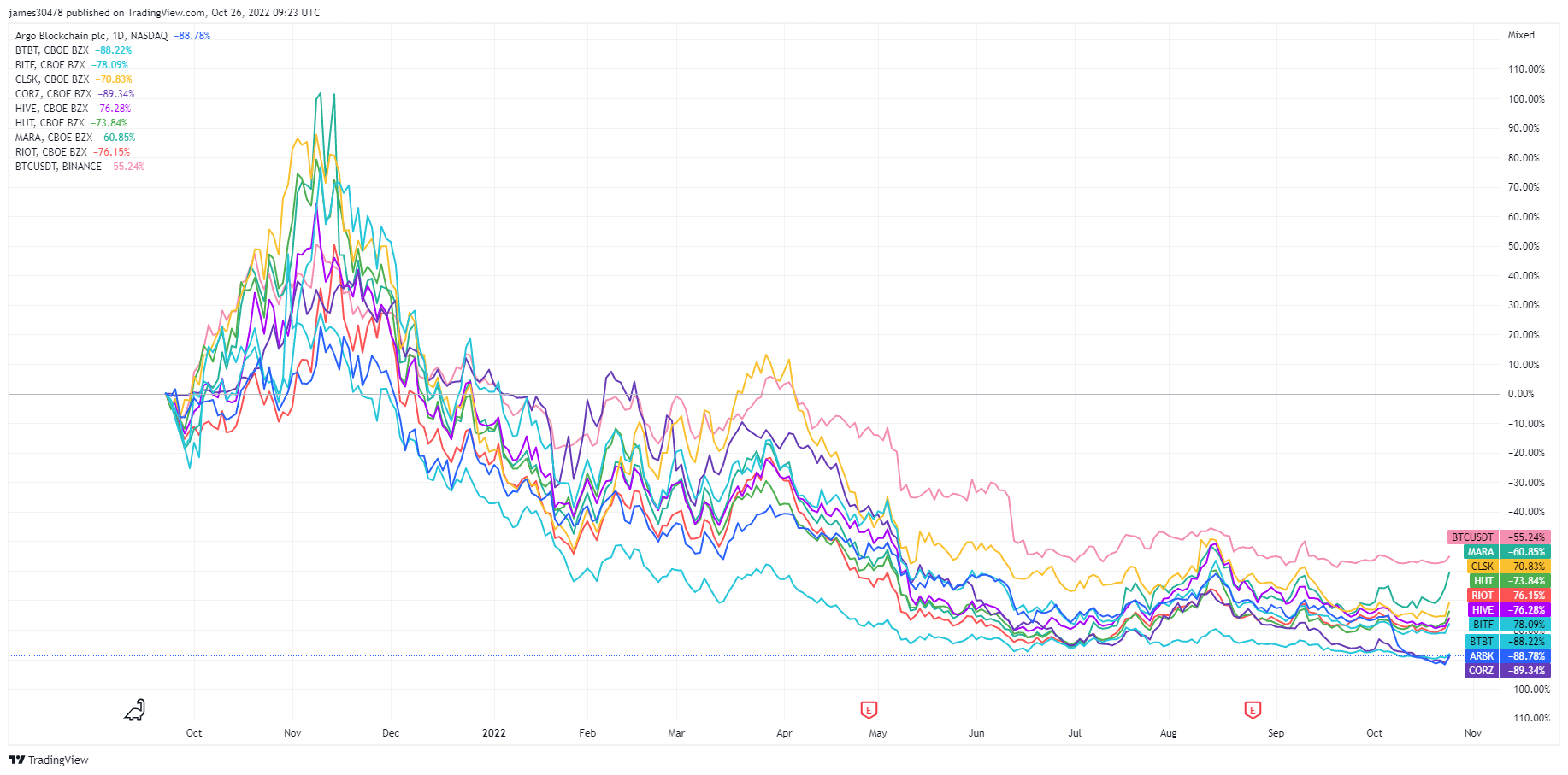

Bitcoin’s worth volatility, dropping income, and reducing BTC holdings have additionally affected the inventory market. The shares of all publicly listed Bitcoin mining corporations have been on a pointy drop since peaking in October 2021. Core Scientific leads the best way, with CORZ down nearly 90% previously yr, with Argo Blockchain and BitDigital shut behind with an 88% drop.

With the hash charge anticipated to develop even additional and no finish in sight to the bear market, we may see the continuing miner capitulation proceed till the top of the yr. And whereas knowledge reveals that miners have exited the darkish crimson zone and are both flatlining or consolidating, the more serious isn’t over. If present circumstances proceed, we may see one other miner capitulation earlier than the top of the yr, creating further promoting stress that would additional swing the delicate market.