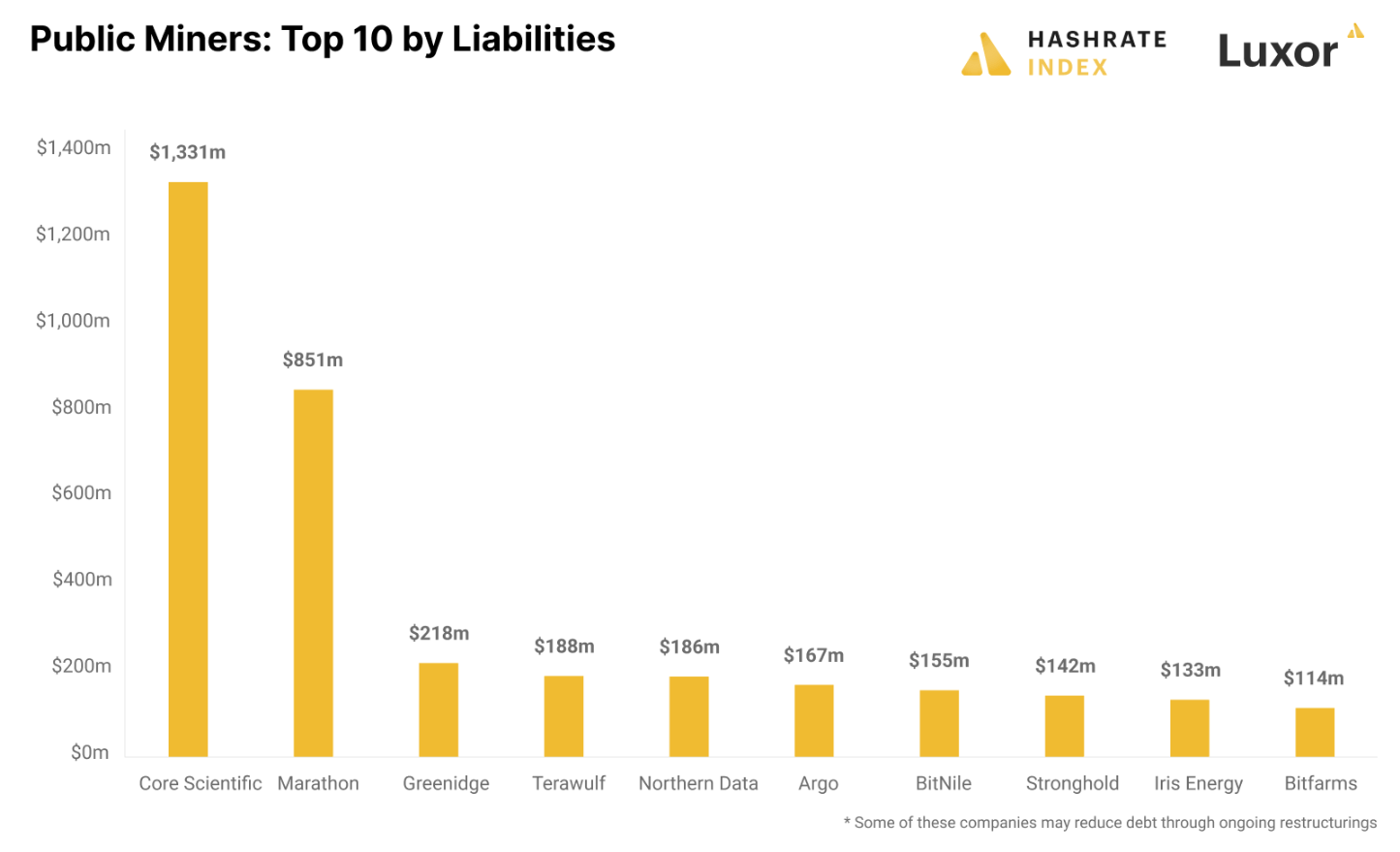

Public Bitcoin (BTC) mining corporations collectively have liabilities that amass to over $4 billion, in line with Hashrate Index.

Owing probably the most in liabilities, Core Scientific debt sat at roughly $1.3 billion on Sept. 30, in line with an organization assertion.

The BTC mining trade has seen important fluctuations throughout this bear market — the current chapter of Core Scientific stands as a testomony to volatility of the sector.

Although it’s the largest public BTC miner by hashrate, Core Scientific has struggled beneath debt for a lot of months — unable to repay month-to-month debt service funds, in line with Hashrate Index.

Warning: Laborious Hats have to be worn

Core Scientific is just not the one public miner combating debt. Marathon, the second-largest debtor, owes $851 million, largely within the type of convertible notes that give holders the choice to transform them to inventory.

Greenidge, the third-biggest debtor, owes $218 million and is present process a restructuring course of to cut back its debt.

Deep in Debt

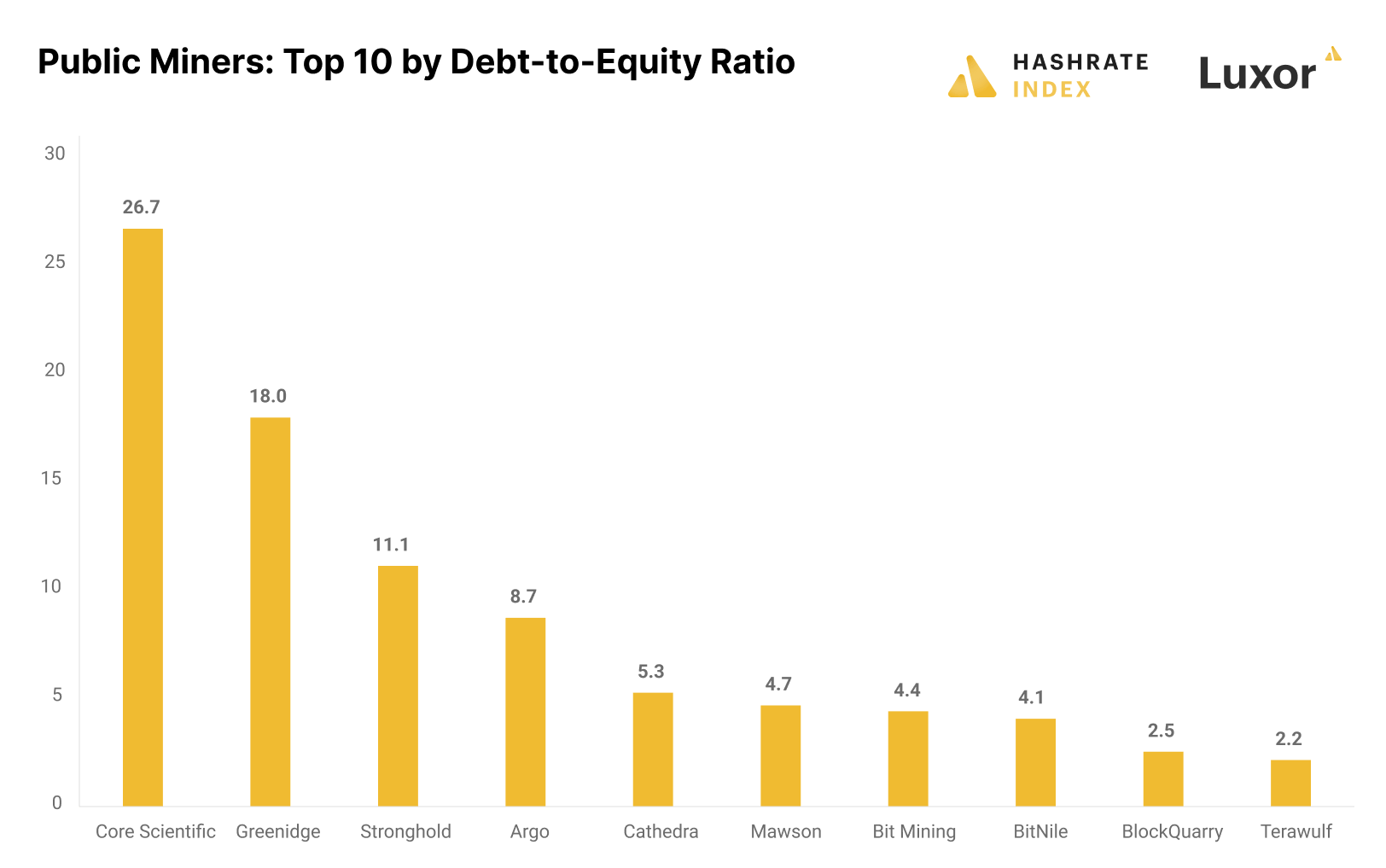

When wanting on the debt-to-equity ratio, a measure of how a lot an organization owes relative to its fairness, it turns into clear that many public miners have considerably excessive ranges of debt.

Luxor analyst, Jaran Mellerud, acknowledged that, usually:

“A debt-to-equity ratio of two or increased is taken into account dangerous, however in a unstable Bitcoin mining trade, it ought to be considerably decrease. Within the chart under, we are able to see that there are a lot of public miners with extraordinarily excessive debt-to-equity ratios.”

Core Scientific has the very best ratio at 26.7, adopted by Greenidge at 18 and Stronghold at 11.1.

Argo are In fourth place with a ratio of 5.3 — having by accident revealed plans for chapter — acknowledged that it’s “negotiating to promote a few of its belongings and perform an gear financing transaction to cut back its debt and enhance liquidity,” in line with Mellerud.

“As a result of unsustainably excessive debt ranges within the trade, we are going to probably proceed to see extra restructurings and doubtlessly some bankruptcies. We’ve began to enter the a part of the cycle the place the weak gamers are flushed out.”