FTX collapse has birthed renewed curiosity in self-custody amongst retail customers, as many are actually shifting their Bitcoin (BTC) to chilly wallets.

Glassnode information, as analyzed by CryptoSlate, confirmed that retailers are taking out their cash from exchanges on the most aggressive fee, with the withdrawals coming principally from Crypto.com.

Crypto.com is at the moment confronted with growing FUD following revelations that the trade mistakenly despatched 320,000 ETH to rival trade Gate.io.

Whereas CEO Kris Marszalek has addressed these considerations and revealed that the trade was working as normal, customers stay apprehensive as they’ve been massively withdrawing their property from the firm-Etherscan information exhibits that one of many trade’s public ETH pockets processed almost 90,000 transactions on Nov. 13.

BTC withdrawals throughout exchanges at document excessive

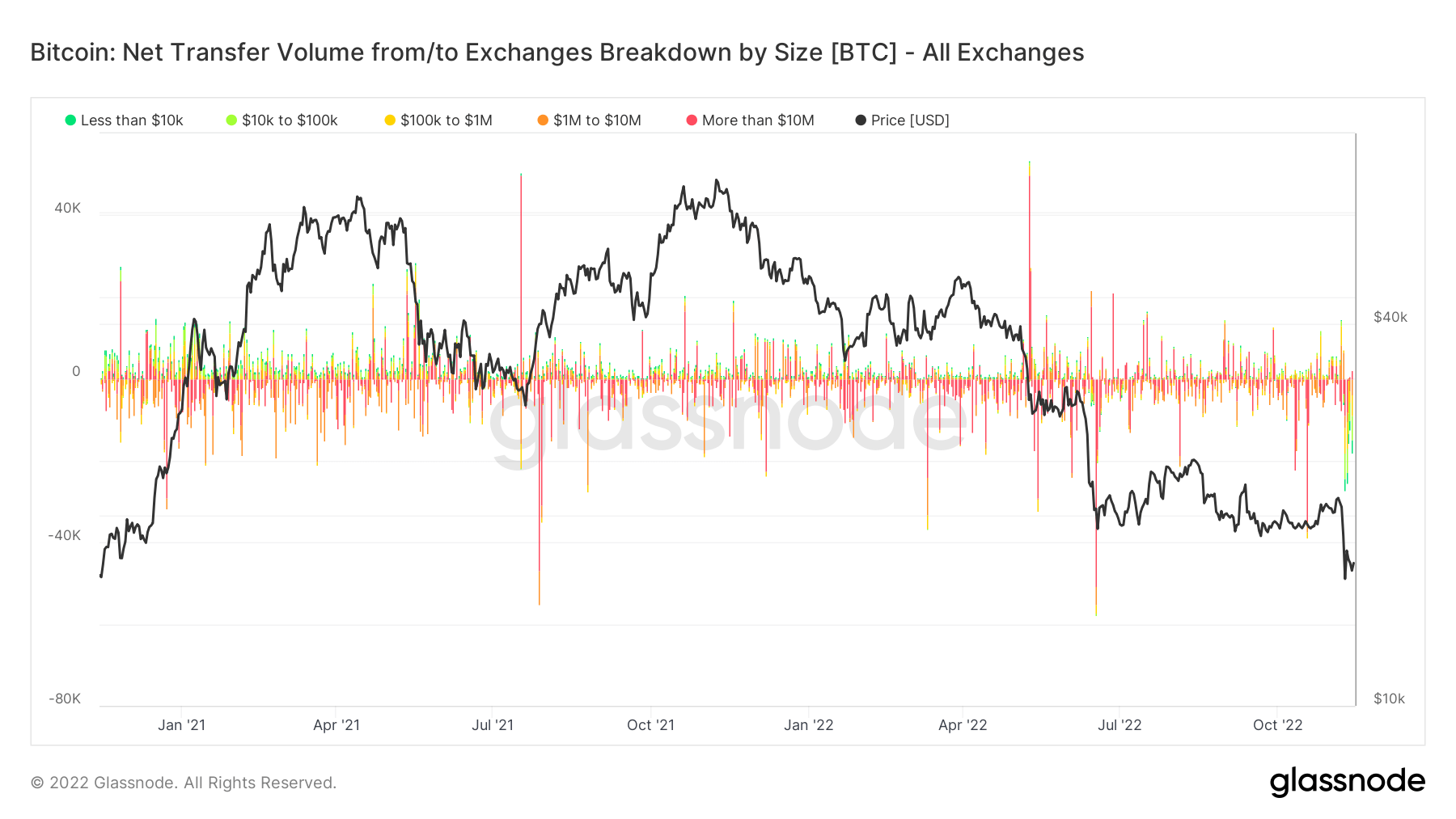

Glassnode Insights additional revealed that the mixture BTC stability throughout exchanges fell by 72,900 BTC over the previous seven days –one of many largest internet declines within the historical past of the market. The earlier instances the crypto business witnessed this stage of withdrawals have been through the 2020 bear market and 2022’s Terra LUNA-influenced crash.

Moreover, over 1 million ETH left exchanges over the past seven days. Glassnode famous that this was the biggest 30-day decline because the DeFi summer season of September 2020, when demand for ETH as collateral in good contracts was at its peak.

Group stakeholders push for self-custody

A number of crypto stakeholders have urged the neighborhood to self-custody their property following FTX’s implosion.

Binance CEO Changpeng Zhao said self-custody was a elementary human proper. CZ suggested his followers to start out with smaller quantities with a view to study the ropes, as errors right here could be pricey.

“Self custody is a elementary human proper. You’re free to do it anytime. Simply be sure to do do it proper.”

Ethereum educator Anthony Sassano additionally shared the identical view, saying solely these actively buying and selling giant sizes ought to have their property on centralized platforms. He added, “(I) use a choose few CEXs as fiat on/off ramps and use Ethereum DeFi for every thing else (with self-custody of all of my property).”

In the meantime, the brand new wave of curiosity in self-custody has despatched the worth of the Belief Pockets token up by 113% in a single week to a brand new all-time excessive of $2.48 on Nov. 14. The pockets turned extra common after CZ tweeted about it whereas talking concerning the significance of self-custody.