A lot has been stated about Ethereum flipping Bitcoin prior to now, significantly through the 2017 bull cycle when the ETH/BTC ratio peaked at 0.157.

Nonetheless, quick ahead to now, spurred by the continuing banking disaster narrative, Glassnode knowledge analyzed by CryptoSlate suggests a interval of Ethereum underperformance forward – placing paid to the thought of a “flippening.”

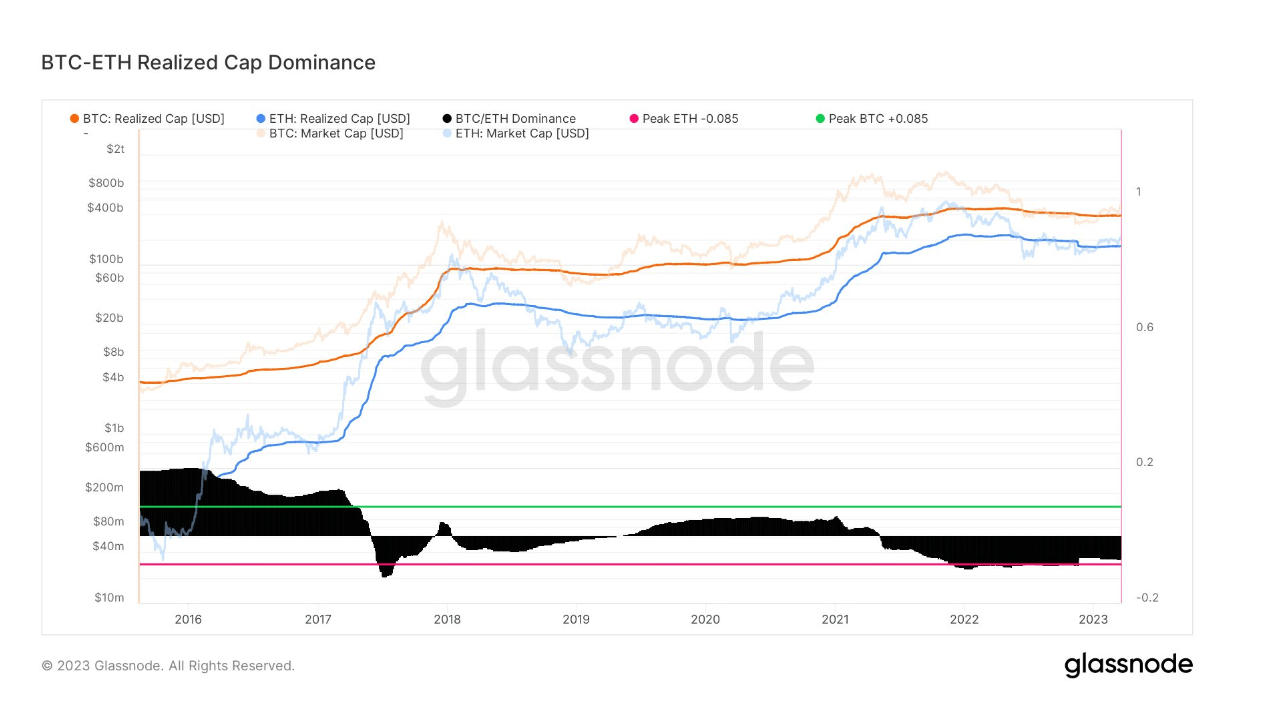

Bitcoin – Ethereum realized cap dominance

Market cap is the preferred method to worth and examine cryptocurrencies. It’s calculated by multiplying the present worth by the circulating provide.

A variation available on the market cap technique is realized cap, which substitutes the present worth within the above calculation with the value when the cash final moved. Proponents argue that this offers a extra correct valuation on account of minimizing the results of misplaced and irretrievable cash.

The chart under paperwork the Bitcoin and Ethereum market and realized caps since 2016. It reveals a tightening between BTC and ETH in June 2017, particularly when viewing the realized cap strains.

Round April 2019, the 2 started to diverge. However by Might 2021, an additional narrowing of the 2 bands occurred. Nonetheless, Ethereum’s realized cap has began to dip in current weeks, with Bitcoin’s holding comparatively regular.

The chart additionally plots BTC/ETH dominance, calculated by taking the BTC market cap and dividing by [(BTC market cap + ETH market cap) – 0.765]. The 0.765 determine visualizes the oscillator round a long-term imply worth. It reveals the market is starting to depart a two-year-long interval of ETH dominance.

Based mostly on the present scenario, markets are bracing for increased charges and banks persevering with to tighten credit score availability – a state of affairs typically favorable to risk-off property.

Ethereum is taken into account a extra risk-on, increased beta than Bitcoin, suggesting it’s going to underperform versus the main cryptocurrency going right into a risk-off setting.

Ethereum fundamentals

Evaluation of Ethereum fundamentals additionally suggests under-performance going ahead.

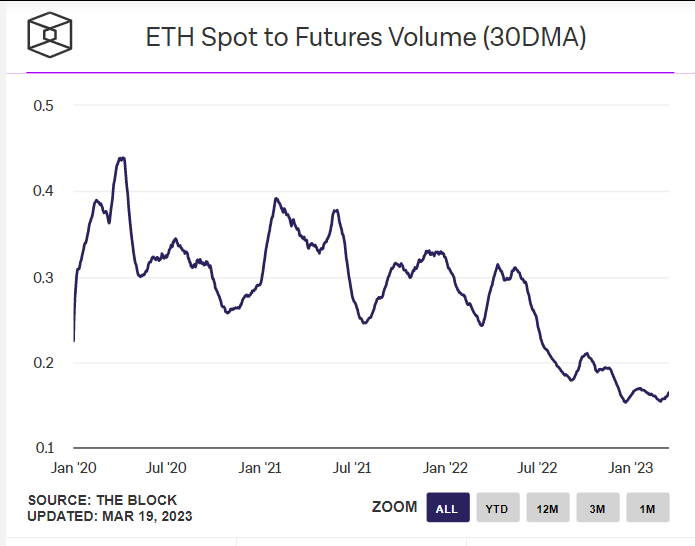

A common indicator of ecosystem well being is a excessive/rising Spot to Futures ratio – this means an ecosystem the place holders dominate merchants, whose intention is revenue quite than perception within the ecosystem.

Knowledge from the Block on ETH Spot to Futures quantity reveals a macro downtrend since April 2020. The downtrend accelerated round Might 2022 (Terra-LUNA implosion) and has since fallen to an all-time low.

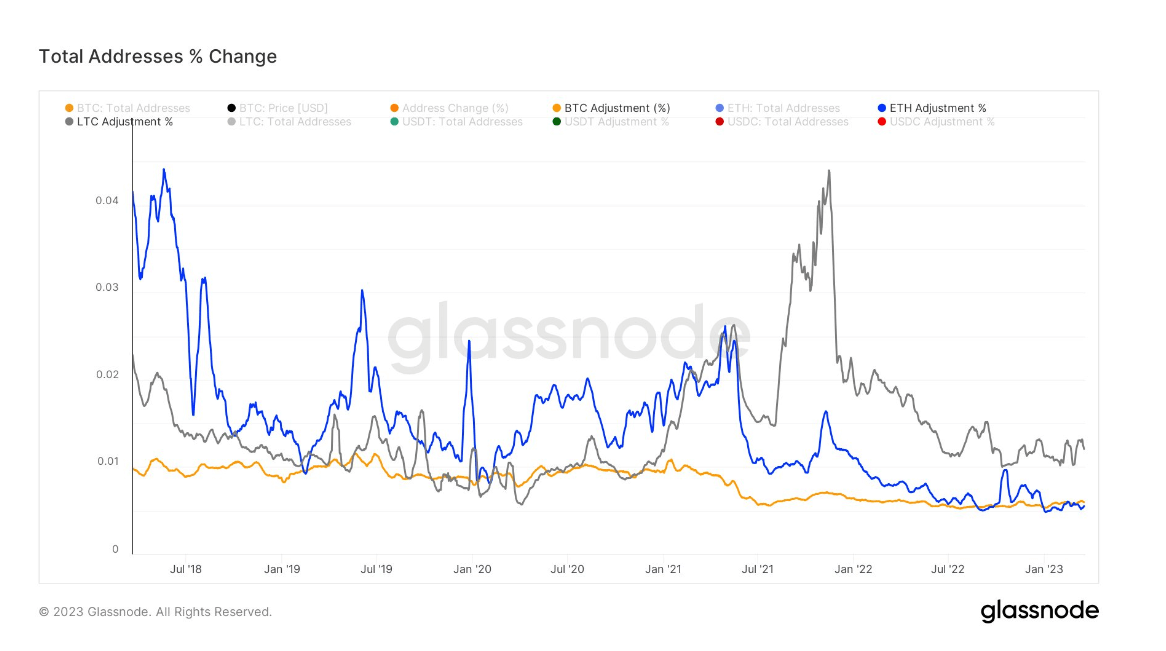

The share change in whole ETH addresses has decreased over the previous 5 years, dipping under BTC final month.

Likewise, the share change in whole LTC addresses started pulling away from ETH (and BTC) round June 2021, remaining persistently increased ever since, significantly shifting into the market prime round November 2021.

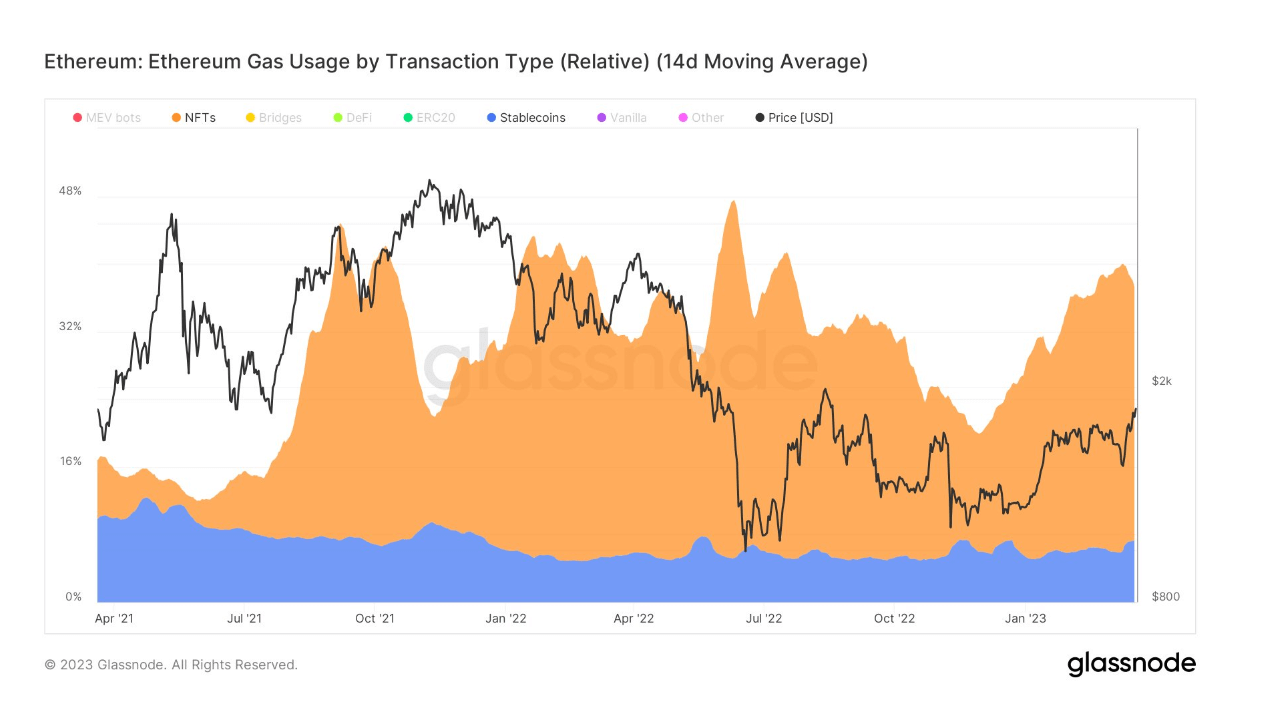

On-chain knowledge reveals that stablecoin and NFT transactions make up probably the most vital fuel utilization on ETH, with the previous spiking increased round December 2022. The latter has remained persistently, comparatively flat since April 2021.

In June 2022, stablecoin and NFT transactions comprised practically half of ETH’s fuel utilization. Now, the share is about 35%, indicating a common downturn in these functions on the ETH chain.

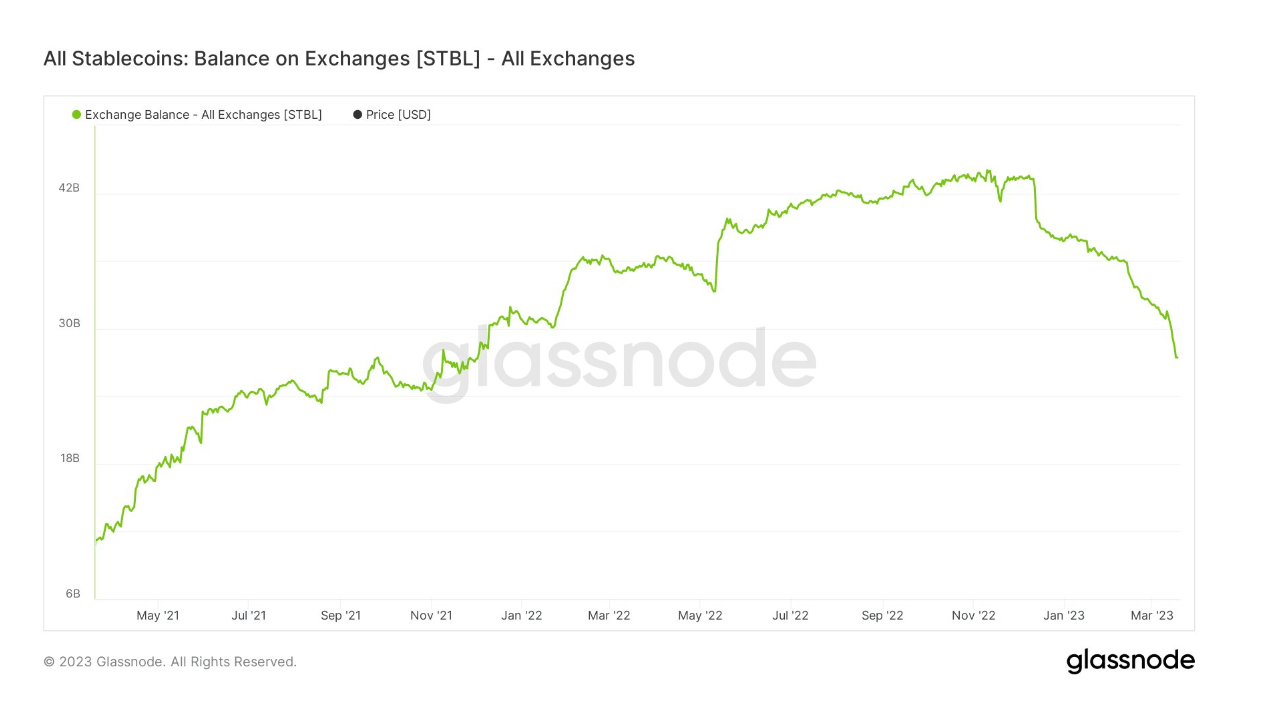

This may be defined by the rising recognition of Ordinals on BTC, which has considerably lessened ETH NFT demand. Equally, stablecoins on exchanges have sunk to a 17-month low – suggesting a common lower of their significance to crypto, seemingly on account of ongoing narratives round their security/redeemability.

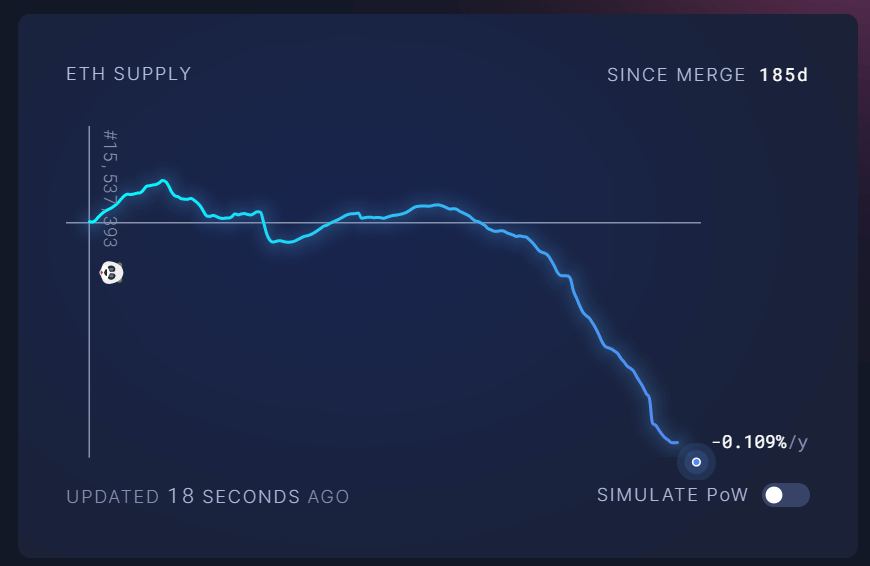

The Merge narrative led to bullish worth drivers within the swap to Proof-of-Stake and deflationary tokenomics. Nonetheless, greater than six months on, ETH continues to lose in opposition to Bitcoin. A number of causes could possibly be behind this.

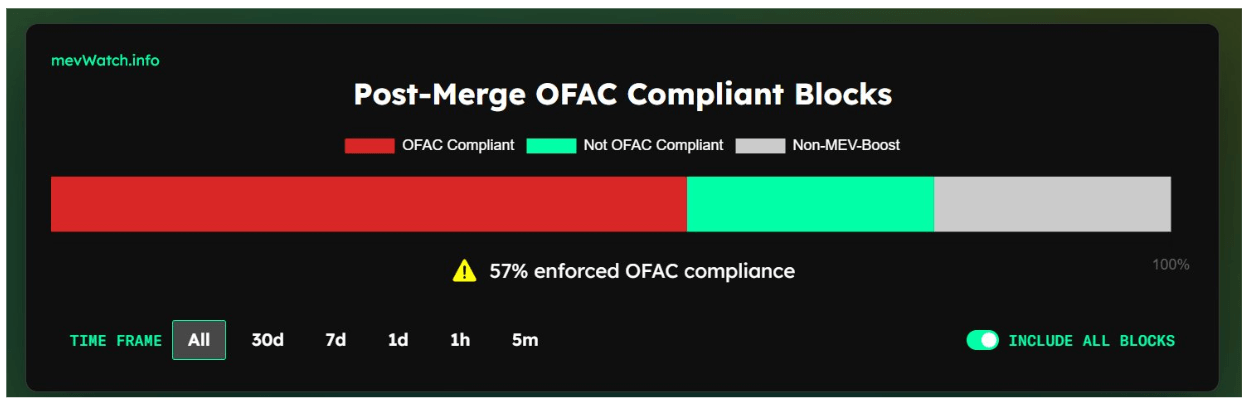

Because the Twister Money sanctions, Ethereum’s popularity as an uncensorable, decentralized chain has taken a big hit. Greater than half of the blocks are nonetheless Workplace of Overseas Asset Management (OFAC) compliant, that means greater than half of the community will exclude transactions on the behest of U.S. authorities.

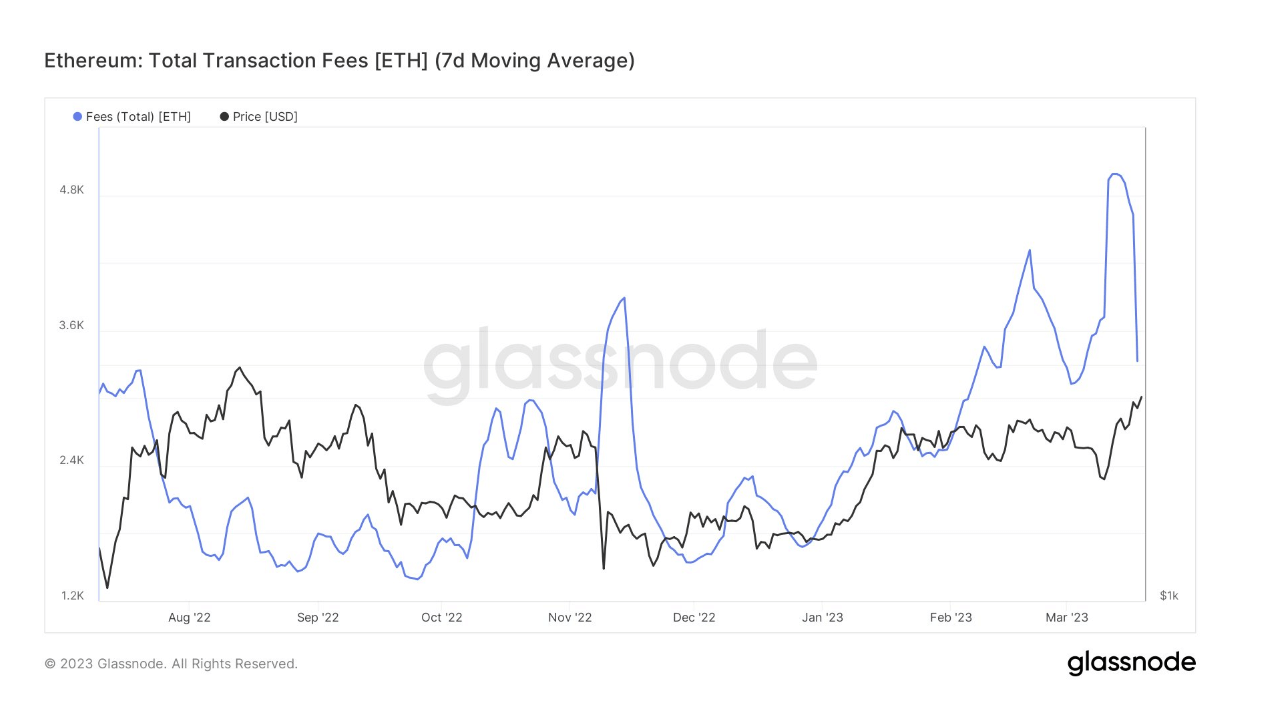

Additionally, whereas devs had been clear in stating the Merge wouldn’t decrease charges instantly, there stays an ongoing, unresolved concern with pricey transactions. The chart under reveals transaction charges not too long ago shot as much as roughly 5k ETH.

The ETH/BTC ratio is at present at 0.0635, lower than half that through the 2017 peak. Because the banking disaster, a notable drop off within the ratio occurred, suggesting the market overwhelmingly favors Bitcoin in these unsure instances.