Bitcoin (BTC) data the best weekly influx within the newest CoinShares report, as XRP and ADA path behind with zero.

Being the firstborn crypto, Bitcoin (BTC) has constantly maintained its dominance within the cryptocurrency house. Whereas the bear market has not proven any respect for the asset’s lofty standing, Bitcoin has persistently put up a good struggle in opposition to the bears.

Regardless of BTC’s constructive sentiments, the asset has seen inflows into funding funds up to now week regardless of worrisome market circumstances when most digital property are trailing behind.

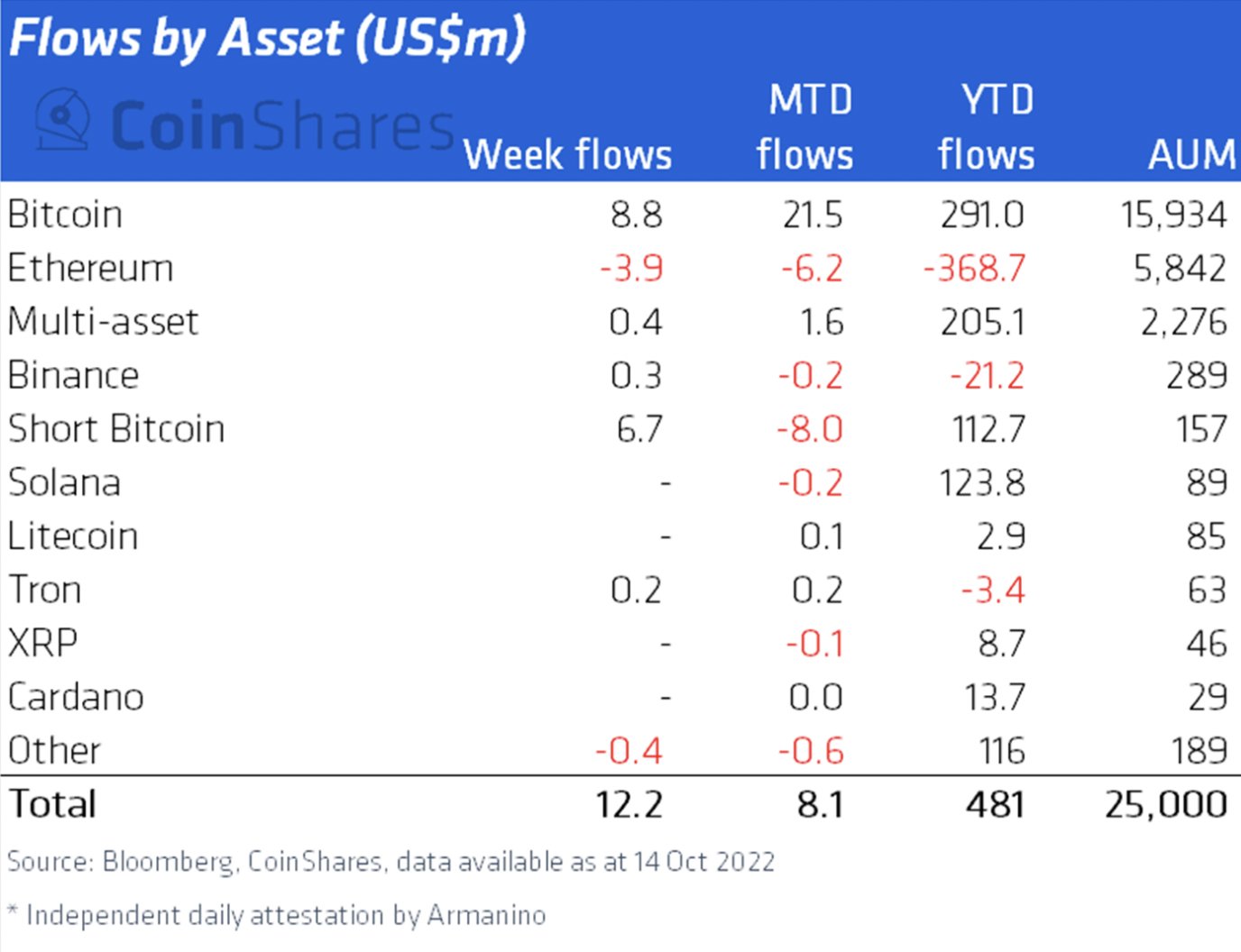

CoinShares not too long ago shared its Digital Asset Fund Flows Weekly Report for final week. The report revealed a cumulative influx of $12M into digital asset funds up to now week. Whereas this degree of influx is moderately low in comparison with earlier weeks, it beats different weeks that witnessed outflows from these funds.

Bitcoin reiterated its dominance within the digital asset house by taking the biggest chunk of the full inflows, reaching $8.8M – 73% of the cumulative worth of $12M. The current influx of $8.8M marked the fifth consecutive week of inflows BTC funds are seeing.

Alternatively, buyers appeared to have been much less inclined in the direction of pumping funds into XRP and Cardano (ADA), as each property noticed zero flows. XRP’s good run hit a roadblock in October, because the asset noticed outflows for the primary time on OCT third, earlier than that, XRP was recording inflows for seven consecutive weeks. Cardano additionally met the identical destiny after eight consecutive weeks of constructive flows.

Month-to-date (MTD) flows of Cardano stay flat at a worth of $0, whereas XRP has seen a slight MTD outflow of $0.1M. Bitcoin, nonetheless, continues to be trying good, with MTD inflows totaling $21.5M. The king altcoin, Ethereum, seems to be seeing much more bearish sentiments than XRP and ADA, because it recorded outflows of $3.9M up to now week, with MTD outflows of $6.2M.

– Commercial –